Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Car accidents can be a traumatic and stressful experience, leaving you with a damaged vehicle and mounting expenses. But what about the depreciation of your car? Can you claim it on your insurance after an accident? This is a common question that many drivers ask themselves, and the answer can vary depending on several factors. In this article, we’ll explore the concept of car depreciation and whether or not you can claim it after an accident. So, buckle up and let’s get started!

If your car was involved in an accident and you use it for business purposes, you may be able to claim depreciation on it. However, the amount you can claim depends on various factors, such as the extent of the damage and whether your insurance covers it. It’s best to consult with a tax professional to determine if you’re eligible for depreciation and how much you can claim.

Can I Claim Depreciation on My Car After an Accident?

What is Depreciation and How Does it Affect Your Car Value?

Depreciation refers to the decrease in value of an asset over time due to wear and tear, age, or obsolescence. In the case of a car, depreciation is a natural occurrence that starts the moment you drive it off the lot. The value of your car will continue to decrease over time, with some models losing as much as 20% of their value in the first year alone.

Depreciation can be a key factor in determining how much your car is worth after an accident. If your car has been in an accident, it will likely have lost some of its value. When you make a claim with your insurance company, they will assess the value of your car before the accident and the value of your car after the accident to determine how much compensation you are entitled to.

Can You Claim Depreciation on Your Car After an Accident?

The short answer is, it depends on your insurance policy. Some insurance policies will cover depreciation as part of their comprehensive coverage, while others will not. If your policy does not cover depreciation, you may still be able to claim it as part of your settlement if you can prove that your car has lost value as a result of the accident.

To claim depreciation, you will need to provide evidence of the value of your car before and after the accident. This can be done by obtaining an appraisal from a qualified appraiser or by using online tools that provide estimates of your car’s value based on its make, model, and year. You will also need to provide evidence of the repairs that have been made to your car, as well as any other costs that you have incurred as a result of the accident.

The Benefits of Claiming Depreciation on Your Car After an Accident

Claiming depreciation can help you receive a fair settlement for your car after an accident. By taking into account the loss in value that your car has suffered as a result of the accident, you will be able to receive compensation that reflects the true value of your car. This can help you to replace your car with a similar make and model, or to put the money towards other expenses that you may have incurred as a result of the accident.

Depreciation vs. Diminished Value: What’s the Difference?

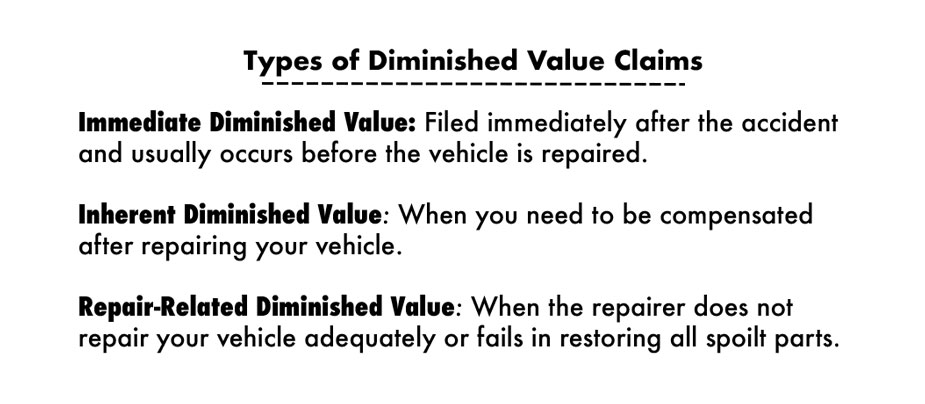

Depreciation and diminished value are often used interchangeably, but they are not the same thing. Depreciation is the natural decrease in value that occurs over time, while diminished value is the decrease in value that occurs as a result of an accident.

Diminished value takes into account the fact that even if your car has been repaired, it will still have a history of damage that can affect its value in the future. For example, if you try to sell your car after an accident, potential buyers may be hesitant to pay the full value of the car because of its accident history.

How to Calculate Depreciation on Your Car After an Accident

Calculating the depreciation on your car after an accident can be a complex process that requires the expertise of a qualified appraiser. The appraiser will take into account a number of factors such as the make, model, and year of your car, as well as its condition before and after the accident.

Using online tools to estimate the value of your car after an accident can be a good starting point, but it is important to remember that these tools are not always accurate and may not take into account all of the factors that can affect the value of your car.

The Role of Your Insurance Company in Claiming Depreciation

Your insurance company plays a key role in determining whether or not you can claim depreciation on your car after an accident. If your policy includes comprehensive coverage that covers depreciation, you will be able to claim it as part of your settlement.

If your policy does not cover depreciation, you may still be able to claim it as part of your settlement if you can provide evidence that your car has lost value as a result of the accident. Your insurance company will need to assess the value of your car before and after the accident to determine how much compensation you are entitled to.

Conclusion

In conclusion, claiming depreciation on your car after an accident can help you receive a fair settlement that reflects the true value of your car. While not all insurance policies cover depreciation, you may still be able to claim it as part of your settlement if you can provide evidence that your car has lost value as a result of the accident. Working with a qualified appraiser and providing documentation of repairs and costs can help you to make a strong case for claiming depreciation.

Contents

Frequently Asked Questions

Here are some frequently asked questions about claiming depreciation on your car after an accident.

How does car depreciation work?

Depreciation is the loss in value of an asset over time. In the case of a car, it starts to depreciate as soon as you drive it off the lot. The rate of depreciation depends on factors such as the make and model of the car, its age, and its condition.

After an accident, your car may have lost even more value due to damage, which means you may be able to claim a higher amount of depreciation.

Can I claim depreciation on my car after a minor accident?

Yes, you can claim depreciation on your car after a minor accident. Even if the damage is minor, it can still affect the value of your car. It’s important to have your car appraised by a professional to determine the extent of the damage and the resulting depreciation.

Keep in mind that the insurance company may only cover a portion of the depreciation, so it’s important to understand your policy and negotiate with the insurer if necessary.

What if my car was totaled in the accident?

If your car was totaled in the accident, you may be able to claim the full amount of depreciation. Total loss means that the cost of repairing the car is more than its current value. In this case, the insurance company will usually pay you the actual cash value of the car, which includes the amount of depreciation.

However, if you have gap insurance, it may cover the difference between the actual cash value and the amount you owe on the car loan or lease.

Can I claim depreciation on a leased car?

If you’ve leased a car and it’s been damaged in an accident, you may be able to claim depreciation. However, the process may be different than if you owned the car outright.

You’ll need to review your lease agreement and insurance policy to determine what you’re entitled to. In some cases, the leasing company may be responsible for the depreciation, while in other cases, you may be able to claim it through your insurance.

How do I calculate the depreciation on my car after an accident?

Calculating the depreciation on your car after an accident can be complex and may require the help of a professional appraiser. The appraiser will consider factors such as the make and model of the car, its age, its condition before the accident, and the extent of the damage.

Once the appraiser has determined the amount of depreciation, you can use this information to negotiate with your insurance company and determine the amount of compensation you’re entitled to.

In conclusion, claiming depreciation on your car after an accident can be a complicated process. However, it is possible if you meet certain criteria. Firstly, the accident must be caused by someone else’s fault, and you must not have received a full compensation for the loss of your car’s value. Secondly, you need to have proper documentation to prove the extent of the damage and the depreciation value of your vehicle. Lastly, it is recommended to seek help from a professional, such as an accountant or a lawyer, to ensure that you receive the maximum compensation you are entitled to.

Although it may be tempting to try and handle the process on your own, it is important to remember that a small mistake can lead to a significant loss of compensation. Therefore, it is important to approach the process with caution and seek advice from appropriate professionals. Ultimately, if you meet the requirements and have the necessary documentation, you may be able to claim depreciation on your car after an accident and receive the compensation you deserve.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts