Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

If you live in Arkansas and have been in a car accident, you may be wondering if the state follows a no-fault system. No-fault insurance is a type of car insurance where your own insurance covers your damages, regardless of who caused the accident.

However, the answer is not so simple. While Arkansas does require drivers to carry certain types of insurance, it is not considered a pure no-fault state. In this article, we will explore what this means for drivers in Arkansas and how it affects car accident claims.

Arkansas is not a no-fault state for car accidents. Instead, Arkansas follows a traditional fault-based system in which the driver who caused the accident is responsible for paying for damages and injuries. However, Arkansas drivers must carry liability insurance to cover their potential costs in the event of an accident.

H2: Is Arkansas a No Fault State for Car Accidents?

If you live in Arkansas and are involved in a car accident, you may be wondering if your state is a no-fault state. No-fault insurance means that each driver’s insurance company pays for their own injuries and damages, regardless of who was at fault for the accident. In this article, we will explore whether or not Arkansas is a no-fault state for car accidents.

H3: No-Fault vs. At-Fault States

Before we dive into whether Arkansas is a no-fault state, let’s first understand the difference between no-fault and at-fault states. In at-fault states, the driver who is determined to be at fault for the accident is responsible for paying for the damages and injuries of the other driver. In no-fault states, each driver’s insurance company pays for their own damages and injuries, regardless of who caused the accident.

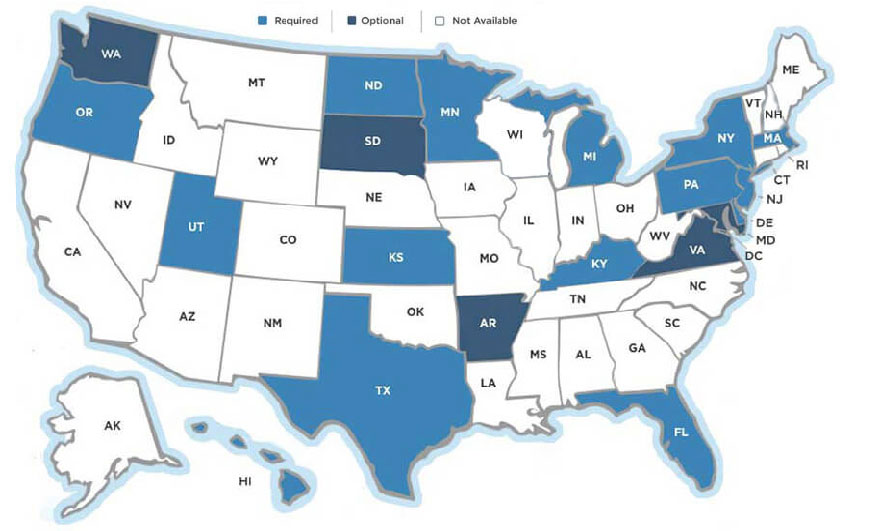

There are currently 12 states that are considered no-fault states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, and Utah. The remaining 38 states, including Arkansas, are considered at-fault states.

H3: How Arkansas Handles Car Accident Claims

In Arkansas, car accident claims are handled using a fault-based system. This means that the driver who is found to be at fault for the accident is responsible for paying for the damages and injuries of the other driver. In order to determine fault, the insurance companies and/or the courts will investigate the accident and gather evidence to determine who was responsible.

It is important to note that Arkansas does require all drivers to carry minimum liability insurance coverage, which includes $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. This insurance is meant to protect drivers from having to pay out of pocket for damages and injuries they cause in an accident.

H3: Benefits of No-Fault Insurance

While Arkansas is not a no-fault state, there are some benefits to having no-fault insurance. One of the main benefits is that it can help streamline the claims process and reduce the amount of time it takes to process a claim. With no-fault insurance, each driver’s insurance company pays for their own damages and injuries, which can reduce the need for lengthy investigations to determine fault.

Another benefit of no-fault insurance is that it can help reduce the number of lawsuits related to car accidents. Without no-fault insurance, drivers may be more likely to sue each other in order to recover damages and injuries, which can lead to lengthy and expensive legal battles.

H3: Downsides of No-Fault Insurance

While there are some benefits to no-fault insurance, there are also some downsides. One of the main downsides is that it can lead to higher insurance premiums. Because each driver’s insurance company is responsible for paying for their own damages and injuries, insurance companies may need to raise their premiums in order to cover the costs of claims.

Another downside of no-fault insurance is that it can be difficult to determine fault in certain situations. For example, if one driver is clearly at fault for an accident, but the other driver’s injuries exceed their insurance coverage, it may be difficult to determine who should be responsible for paying for the additional damages and injuries.

H3: Conclusion

In conclusion, Arkansas is not a no-fault state for car accidents. Instead, car accident claims in Arkansas are handled using a fault-based system, where the driver who is found to be at fault is responsible for paying for the damages and injuries of the other driver. While there are some benefits to no-fault insurance, such as streamlining the claims process and reducing the number of lawsuits, there are also some downsides, such as higher insurance premiums and difficulties in determining fault in certain situations.

Contents

- Frequently Asked Questions

- What is a no-fault state for car accidents?

- What are the minimum car insurance requirements in Arkansas?

- Does Arkansas follow a no-fault system for car accidents?

- Can I sue the at-fault driver for damages and injuries in Arkansas?

- Should I contact a lawyer if I am involved in a car accident in Arkansas?

Frequently Asked Questions

What is a no-fault state for car accidents?

In a no-fault state, drivers involved in a car accident are required to turn to their own insurance company to cover their medical expenses and other financial losses, regardless of who was at fault for the accident. This is different from a fault-based system where the driver who caused the accident is responsible for paying for the damages.

What are the minimum car insurance requirements in Arkansas?

In Arkansas, drivers are required to carry liability insurance coverage of at least $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. These are the minimum requirements, and drivers may choose to purchase additional coverage for added protection.

Does Arkansas follow a no-fault system for car accidents?

No, Arkansas is not a no-fault state for car accidents. Instead, Arkansas follows a fault-based system where the driver who is found to be at fault for the accident is responsible for paying for the damages and injuries sustained by the other parties involved in the accident.

Can I sue the at-fault driver for damages and injuries in Arkansas?

Yes, if you are involved in a car accident in Arkansas, you have the right to sue the at-fault driver for damages and injuries sustained in the accident. However, Arkansas follows a modified comparative negligence rule, which means that if you are found to be partly at fault for the accident, your damages may be reduced proportionally to your degree of fault.

Should I contact a lawyer if I am involved in a car accident in Arkansas?

It is advisable to contact a lawyer if you are involved in a car accident in Arkansas, especially if you have sustained injuries or damages. A lawyer can guide you through the legal process, help you understand your rights and options, and work to ensure that you receive fair compensation for your losses.

In conclusion, Arkansas is not a pure no-fault state for car accidents. Although the state has a modified no-fault system, it still allows drivers to pursue a claim against the at-fault party in certain situations. This means that if you are involved in a car accident in Arkansas, you may be able to recover damages from the other driver’s insurance company if the accident meets the state’s criteria for fault-based claims.

While understanding the laws and regulations surrounding car accidents in Arkansas can be complex, it is important to know your rights as a driver. If you have been involved in a car accident and are unsure of how to proceed, seeking the advice of an experienced personal injury lawyer can help you navigate the legal system and ensure that you receive the compensation you deserve.

Ultimately, whether you are a resident of Arkansas or just passing through, it is crucial to drive safely and responsibly on the state’s roads. By following traffic laws and avoiding dangerous behaviors such as distracted driving and speeding, you can help prevent accidents and keep yourself and others safe on the road.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts