Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

When you’re looking to protect yourself and those around you from unexpected accidents and injuries, it’s important to understand the difference between personal injury and bodily injury insurance. Both types of insurance can provide much needed financial protection, but there are distinct differences between them. In this article, we’ll explore the differences between personal injury and bodily injury insurance, and how each can provide coverage for medical and legal costs.

| Personal Injury Insurance | Bodily Injury Insurance | |

|---|---|---|

| Definition | Insurance that covers costs related to damages caused to another person’s body, such as medical bills and legal fees. | Insurance that covers costs of damages caused to other people, such as legal fees and medical bills. |

| Coverage | Includes coverage for damages caused to another person’s body, as well as legal fees. | Includes coverage for damages caused to another person’s property, as well as legal fees. |

| Limitations | Does not cover damages caused to another person’s property. | Does not cover damages caused to another person’s body. |

Personal Injury Vs Bodily Injury Insurance: In-Depth Comparison Chart

| Personal Injury Insurance | Bodily Injury Insurance | |

|---|---|---|

| Definition | Personal Injury Insurance is a type of insurance that covers the costs of an individual’s medical expenses, lost wages, and other damages when they are injured due to the negligence or fault of another person or company. | Bodily Injury Insurance is a type of insurance that covers the medical expenses, lost wages, and other damages of an injured third-party when the policyholder is found to be at fault for the accident. |

| Coverage Types | Personal Injury Insurance covers the costs of the policyholder’s medical expenses, lost wages, and other damages. | Bodily Injury Insurance covers the medical expenses, lost wages, and other damages of an injured third-party. |

| Eligibility | Personal Injury Insurance can be purchased by individuals and businesses. | Bodily Injury Insurance is typically required by law for businesses and individuals who own vehicles. |

| Benefits | Personal Injury Insurance can cover the costs of medical expenses, lost wages, and other damages in the event of an accident. | Bodily Injury Insurance can help protect businesses and individuals from financial liability in the event of an accident. |

Contents

Personal Injury vs Bodily Injury Insurance

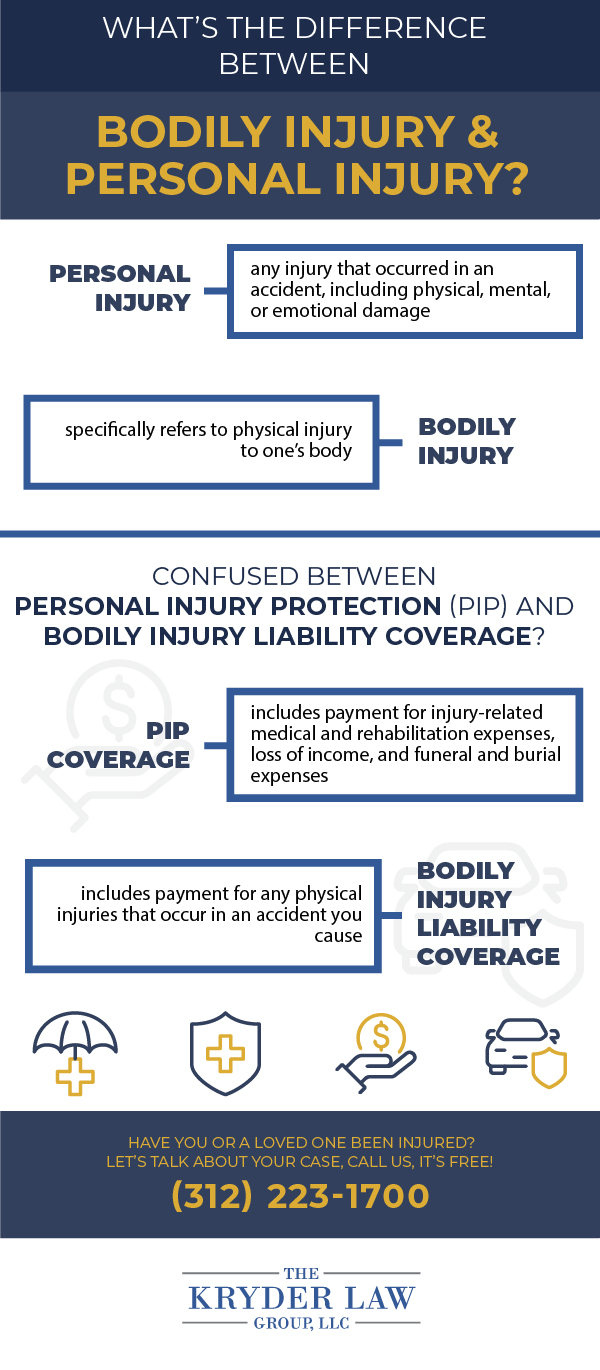

Personal injury and bodily injury insurance can both provide valuable coverage for individuals in the event of an accident. However, it’s important to understand the key differences between the two types of insurance and how they can affect your personal liability.

What is Personal Injury Insurance?

Personal injury insurance is designed to provide coverage for you or your family in the event of an accident that causes physical injury to you or someone else. This type of insurance typically covers medical expenses, lost wages, and pain and suffering resulting from the injury. It also covers legal fees if you are sued for damages due to the injury.

Personal injury insurance usually has a maximum coverage limit, which is the maximum amount that the insurer will pay out in the event of a claim. The coverage limit can vary greatly depending on the type of policy, the insurer, and the state in which you live.

Personal injury insurance can also provide coverage for property damage caused by an accident. This coverage may include damage to your home, car, or other items. However, it is important to note that the coverage limit for property damage may be lower than the coverage limit for personal injury.

What is Bodily Injury Insurance?

Bodily injury insurance is designed to provide coverage for damages caused by an accident that results in physical injury to someone else. It covers medical expenses, lost wages, and pain and suffering resulting from the injury. It also covers legal fees if you are sued for damages due to the injury.

Bodily injury insurance typically has a higher coverage limit than personal injury insurance. This is because it is designed to provide coverage for damages that may be incurred by someone else, rather than just yourself or your family. It also typically covers any property damage that may be caused by the accident.

Bodily injury insurance is often required by law in certain states. In most cases, it must be purchased as part of a car insurance policy. It is important to make sure that you have the proper coverage limit for your state in order to protect yourself from potential liability.

Differences Between Personal Injury and Bodily Injury Insurance

The main difference between personal injury and bodily injury insurance is the coverage limit. Personal injury insurance typically has a lower coverage limit than bodily injury insurance. This is because it is designed to provide coverage for damages that may be incurred by yourself or your family, rather than by someone else.

Bodily injury insurance also typically covers any property damage that may be caused by the accident, whereas personal injury insurance typically does not. It is important to make sure that you have the right coverage limit for your state in order to protect yourself from potential liability.

It is also important to note that personal injury insurance and bodily injury insurance are two separate types of coverage. While they may both provide coverage for physical injury, they are not interchangeable and should not be confused with one another.

What Should You Do?

Before purchasing insurance, it is important to understand the differences between personal injury and bodily injury insurance. Be sure to read the policy carefully to ensure that you have the right coverage limit for your state and to make sure that you are covered in the event of an accident.

It is also important to shop around for the best rates and coverage. Different insurers offer different coverage limits and rates, so it is important to compare different policies to make sure that you are getting the best value for your money.

Finally, it is important to speak with a qualified insurance agent to ensure that you have the right coverage for your needs. An agent can help you understand the differences between personal injury and bodily injury insurance and make sure that you have the right coverage for your situation.

Personal Injury Vs Bodily Injury Insurance Pros & Cons

Pros:

- Personal injury insurance covers medical expenses and lost wages for the injured party.

- Bodily injury insurance covers the costs of damages to the other party’s vehicle, medical expenses, and legal fees if they sue.

- Bodily injury insurance is required in most states to cover the costs of an accident.

Cons:

- Personal injury insurance can be expensive and may have a high deductible.

- Bodily injury insurance can also be expensive and may have a high deductible.

- Both forms of insurance may not cover all damages, depending on the state’s laws.

Which is Better – Personal Injury Vs Bodily Injury Insurance?

Personal Injury and Bodily Injury Insurance both offer coverage for medical expenses, lost wages, pain and suffering, and other damages that can be caused by an accident. However, each type of insurance has its own unique features, advantages, and disadvantages. To decide which type of insurance is best for a particular situation, it helps to understand the differences between the two.

Personal Injury Insurance covers expenses related to an injury that was caused by another person. This type of insurance is designed for those who may have suffered an injury due to negligence or recklessness of another person. It pays for medical expenses, lost wages, and other costs associated with the injury.

Bodily Injury Insurance is designed to cover expenses related to an injury sustained by the insured person or another person. This type of insurance covers medical expenses, lost wages, and other costs associated with the injury. Additionally, Bodily Injury Insurance may also pay for legal costs incurred if a lawsuit is filed against the insured.

When deciding which type of insurance is better between Personal Injury vs Bodily Injury Insurance, there are several factors to consider. Here are three reasons why Bodily Injury Insurance may be the best choice:

- Bodily Injury Insurance covers medical expenses, lost wages, and other costs associated with the injury, as well as legal costs if a lawsuit is filed.

- Bodily Injury Insurance offers more flexibility when it comes to choosing coverage levels and deductibles.

- Bodily Injury Insurance may provide more comprehensive coverage than Personal Injury Insurance.

For these reasons, Bodily Injury Insurance is often the superior choice between Personal Injury vs Bodily Injury Insurance. It offers more comprehensive coverage and greater flexibility in terms of coverage levels and deductibles.

Frequently Asked Questions

Personal injury and bodily injury insurance are two different types of coverage that one can purchase for protection from liability in the event of an accident. Both coverages provide financial protection for medical expenses, but there are key differences between the two. Below are some commonly asked questions about personal injury and bodily injury insurance.

What is Personal Injury Insurance?

Personal injury insurance is a type of liability coverage that helps to protect individuals and businesses from financial loss in the event that they are found to be legally responsible for another person’s injury or property damage. It provides coverage for medical expenses, lost wages, and legal fees if an individual or business is sued for negligence. Personal injury insurance is typically purchased as part of a business insurance policy or a homeowners insurance policy, but can also be purchased separately.

What is Bodily Injury Insurance?

Bodily injury insurance is a type of liability coverage that helps to protect individuals and businesses from financial loss in the event that they are found to be legally responsible for another person’s bodily injury. This type of coverage provides protection for medical expenses, lost wages, and legal fees if an individual or business is sued for negligence. Bodily injury insurance is typically included as part of an auto insurance policy, but can also be purchased separately.

What is the Difference Between Personal Injury and Bodily Injury Insurance?

The primary difference between personal injury and bodily injury insurance is the types of injuries that are covered. Personal injury insurance provides coverage for injuries to a person’s reputation, while bodily injury insurance provides coverage for physical injuries to a person’s body. Bodily injury insurance also typically provides coverage for pain and suffering, while personal injury insurance does not.

Do I Need Both Personal Injury and Bodily Injury Insurance?

The need for both personal injury and bodily injury insurance depends on the type of activities that you or your business are engaging in. If you are a business owner, you may need to have both types of coverage to protect yourself from legal liability. If you are an individual, you may only need bodily injury insurance if you are driving a vehicle or engaging in activities that could potentially cause bodily harm to another person.

Who Should I Contact For More Information?

If you have questions about personal injury and bodily injury insurance, it is best to contact a local insurance agent or broker. They will be able to provide you with information about the different types of coverage that are available and help you to determine which type of coverage best suits your needs. Additionally, they can provide you with personalized advice and assistance in finding the best policy for your situation.

Personal Injury and Bodily Injury insurance are two distinct forms of insurance that provide financial protection in the event of a lawsuit or settlement. While they are similar in their purpose, the differences between the two forms of insurance are important to understand when making a decision on which type of coverage to purchase. Personal Injury insurance can provide protection for the costs associated with emotional distress, while Bodily Injury coverage provides financial protection in the event of a lawsuit or settlement resulting from an injury or accident. Ultimately, the decision on which type of coverage to purchase depends on the individual’s personal needs and the risks associated with them. With the right coverage in place, individuals can rest assured that they are financially protected in the event of an accident or incident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts