Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

When it comes to protecting yourself from the financial costs associated with being injured in an accident, you are likely familiar with the term “personal injury protection.” But what is the difference between full and limited personal injury protection? In this article, we will discuss the finer points of full and limited personal injury protection, including how they differ and the advantages and disadvantages of each. Get ready to gain a better understanding of this important topic and make an informed decision for your own protection.

| Full Personal Injury Protection | Limited Personal Injury Protection |

|---|---|

| Provides an unlimited amount of coverage for medical expenses and lost wages. | Provides a limited amount of coverage for medical expenses and lost wages. |

| May cover funeral expenses, survivor benefits, and other costs. | May not cover funeral expenses, survivor benefits, and other costs. |

| May cover some non-medical care, such as housekeeping or childcare. | May not cover non-medical care, such as housekeeping or childcare. |

| May be more expensive than limited coverage. | May be less expensive than full coverage. |

Full Vs Limited Personal Injury Protection: In-Depth Comparison Chart

| Full Personal Injury Protection | Limited Personal Injury Protection |

|---|---|

| Medical Expenses | Medical Expenses |

| Lost Wages | Lost Wages |

| Death Benefits | Death Benefits |

| Rehabilitation Expenses | Rehabilitation Expenses |

| Ambulance Services | Ambulance Services |

| Funeral Expenses | Funeral Expenses |

| Long-Term Care | No Coverage |

| Home Health Care | No Coverage |

| Loss of Services | No Coverage |

| Replacement Services | No Coverage |

| Uninsured/Underinsured Motorist Coverage | No Coverage |

Contents

Full Vs Limited Personal Injury Protection

Personal injury protection (PIP) is an optional car insurance coverage that helps cover medical and other expenses for you and your passengers if you’re injured in a car accident, regardless of who’s at fault. When selecting car insurance coverage, it’s important to understand the difference between full and limited personal injury protection.

Full Personal Injury Protection

Full personal injury protection is the most comprehensive form of PIP coverage available. It covers any necessary medical expenses, such as hospital stays, ambulance rides, and doctor visits. It also covers lost wages, death benefits, and funeral expenses. It also covers any other expenses related to the accident that you may incur, such as childcare or home care. Finally, full PIP coverage typically includes a deductible, which is the amount of money you must pay out of pocket before insurance coverage kicks in.

Full personal injury protection can be expensive, but it offers more comprehensive coverage than limited PIP. If you have a larger budget and want more coverage for medical and other expenses, full PIP may be the right choice for you.

Full PIP coverage is also beneficial if you are in an accident that is not your fault. Because the coverage is not based on fault, you won’t have to worry about navigating the legal process to receive compensation for your expenses. This can save time and money, and can help ensure you get the coverage you need.

Limited Personal Injury Protection

Limited personal injury protection is a less comprehensive form of PIP coverage. It typically covers medical expenses, such as hospital stays, doctor visits, and ambulance rides. It may also cover lost wages, but typically does not cover death benefits, funeral expenses, or other expenses related to the accident.

Limited PIP coverage is usually more affordable than full PIP coverage, but it may not provide as much coverage if you are in an accident. If you’re on a tight budget and don’t need the extra coverage, limited PIP may be the right choice for you.

It’s important to note that limited PIP coverage is based on fault. This means that if you are in an accident and it is determined that you are at fault, you may not receive any coverage for your medical and other expenses. This can make it more difficult to receive compensation for your expenses, and may require you to navigate the legal process.

Factors to Consider

When deciding between full and limited personal injury protection, there are a few factors to consider. First, consider your budget. Full PIP coverage may be more expensive, but it offers more comprehensive coverage. Limited PIP coverage may be more affordable, but it may not provide as much coverage if you are in an accident.

You should also consider the potential for an accident. If you live in an area with a lot of traffic or have a high-risk driving style, full PIP coverage may be a better option. This is because full PIP coverage is not based on fault, so you won’t have to worry about navigating the legal process to receive compensation for your expenses.

Finally, consider the amount of coverage you need. If you need more comprehensive coverage for medical and other expenses, full PIP may be the right choice for you. However, if you’re on a tight budget and don’t need the extra coverage, limited PIP may be the right choice.

Eligibility Requirements

In order to be eligible for personal injury protection coverage, you must meet certain requirements. Most states require drivers to carry a certain amount of auto insurance coverage, and PIP is typically included in this coverage. Additionally, some states require drivers to carry PIP coverage, while others allow it to be optional.

If you’re considering purchasing PIP coverage, it’s important to check with your state’s insurance regulations to make sure you meet the eligibility requirements. Additionally, you should contact your insurance provider to learn more about the different types of PIP coverage available and determine which one is right for you.

Costs

The cost of full and limited personal injury protection can vary depending on a number of factors, including your insurance provider, the amount of coverage you choose, and the deductible you select. Additionally, the cost of PIP coverage typically increases with age. Generally, younger drivers tend to pay less for PIP coverage than older drivers.

It’s important to compare the cost of full and limited PIP coverage when selecting car insurance coverage. This can help you determine which type of coverage is right for you and your budget.

Summary

When selecting car insurance coverage, it’s important to understand the difference between full and limited personal injury protection. Full PIP coverage is the most comprehensive form of PIP coverage and covers any necessary medical expenses, lost wages, death benefits, and funeral expenses. Limited PIP coverage is typically more affordable but may not provide as much coverage if you are in an accident. When deciding between full and limited PIP coverage, consider your budget, the potential for an accident, and the amount of coverage you need.

Full Vs Limited Personal Injury Protection Pros & Cons

Pros of Full Personal Injury Protection

- It covers the medical expenses of the policyholder and passengers

- It covers the wages of the policyholder and passengers

- It covers the funeral costs of the policyholder and passengers

Cons of Full Personal Injury Protection

- It can be expensive

- It only covers medical bills and can’t cover any property damage

- It does not cover any injuries suffered by the other party

Pros of Limited Personal Injury Protection

- It is cheaper than full PIP

- It covers medical bills, lost wages, and funeral expenses

- It covers the medical bills of the other party

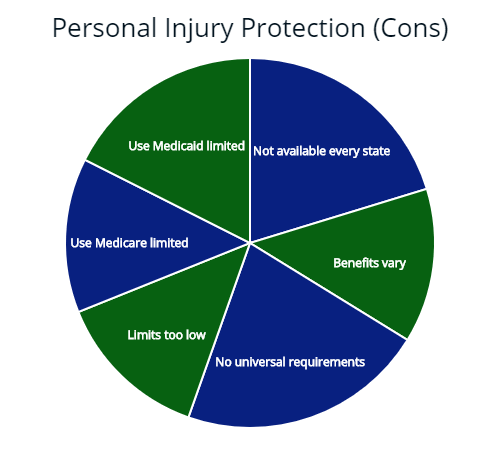

Cons of Limited Personal Injury Protection

- It does not cover the wages of the policyholder and passengers

- It does not cover funeral costs of the policyholder and passengers

- It does not cover any property damage

Full Vs Limited Personal Injury Protection

After having carefully considered the differences between full and limited personal injury protection, a final decision can be made. After weighing the pros and cons of each, it is clear that full personal injury protection is the superior option.

Full personal injury protection provides a greater level of coverage for victims of an accident. It covers medical bills, lost wages, and other expenses related to an accident, regardless of who is at fault. This ensures that those injured in an accident are fully taken care of and not left to bear the burden of any financial costs.

In addition to providing a greater level of coverage, full personal injury protection also eliminates the need for legal action. With limited personal injury protection, victims can only receive a certain dollar amount for their injuries, which may not be enough to cover all of their expenses. This can lead to a lengthy legal battle in order to seek additional compensation.

Below are three reasons why full personal injury protection is the best choice:

- It provides greater coverage for victims of an accident.

- It eliminates the need for costly legal action.

- It provides peace of mind that all expenses related to an accident will be covered.

Full personal injury protection is the clear choice for those looking for the most comprehensive coverage possible. It ensures that victims of an accident are fully taken care of and not left to bear the burden of any financial costs.

Frequently Asked Questions: Full Vs Limited Personal Injury Protection

Personal Injury Protection (PIP) is a coverage option that pays for medical and other expenses incurred by you, your family members, and other passengers in your vehicle, in the event of an accident, regardless of who is at fault. PIP can come in two different forms: Full PIP and Limited PIP.

What is Full PIP?

Full PIP is a form of PIP that covers all medical expenses incurred in the event of an accident, as well as any lost wages or other damages. This coverage is typically the most comprehensive option available and is recommended for those who want the most protection in the event of an accident. It will cover all medical costs, including hospital bills, ambulance fees, prescriptions, and any rehabilitation costs associated with the accident. It will also cover lost wages and other economic losses such as childcare or funeral expenses.

What is Limited PIP?

Limited PIP is a form of PIP coverage that only covers a portion of the medical expenses and other losses associated with an accident. This coverage typically only covers medical expenses up to a certain limit, and does not cover lost wages or other economic losses. It is generally less expensive than Full PIP coverage, but it does not provide the same level of protection.

What are the Benefits of Full PIP?

The primary benefit of Full PIP coverage is the comprehensive level of protection it provides. In the event of an accident, you will be covered for all medical expenses and any other losses, such as lost wages and funeral expenses. This coverage can provide peace of mind, knowing that you will be financially protected in the event of an accident.

What are the Benefits of Limited PIP?

The primary benefit of Limited PIP coverage is the cost savings it offers. This coverage is typically cheaper than Full PIP, making it a more affordable option for those who are on a budget. It also provides some level of protection in the event of an accident, however it does not provide the same level of protection as Full PIP.

Which Option is Right for Me?

The right option for you will depend on your individual needs and budget. If you are looking for the most comprehensive protection, Full PIP is the best option. However, if you are looking to save money, Limited PIP may be the more affordable option. Ultimately, the decision should be based on your individual needs and financial situation.

Full and limited personal injury protection are both valid options when it comes to choosing the right type of insurance coverage for you and your family. Full personal injury protection offers more extensive coverage, including medical expenses, loss of wages, and other damages in the event of an accident. Limited personal injury protection covers medical bills, but does not cover wage replacement or other damages. Ultimately, the choice between full and limited personal injury protection depends on your unique needs, budget, and risk tolerance. No matter which option you choose, it is important to make sure that you are adequately protected in the event of an accident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts