Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Rhode Island is a small state that is known for its beautiful beaches and historic landmarks. But, just like any other state in the US, it has its own set of laws and regulations that residents and visitors must follow. One of the most important laws that drivers should be aware of is the requirement for personal injury protection (PIP) in Rhode Island.

PIP is a type of auto insurance that covers medical expenses and lost wages if you are injured in a car accident, regardless of who is at fault. But, is it really mandatory in Rhode Island? Let’s explore the details of this law and what it means for drivers in the state.

Yes, Personal Injury Protection (PIP) is required in Rhode Island. The minimum coverage amount required is $25,000. PIP covers medical expenses, lost wages, and other related expenses if you are injured in a car accident, regardless of who is at fault. It is important to note that failure to carry PIP coverage can result in fines and penalties.

Is Personal Injury Protection Required in Rhode Island?

Overview

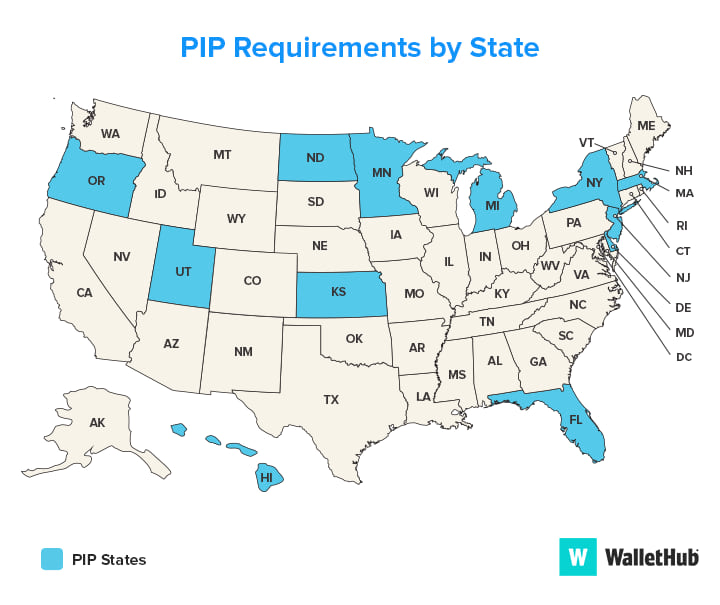

Rhode Island is one of the few states that requires Personal Injury Protection (PIP) coverage for all drivers. PIP coverage is designed to provide medical and other benefits to drivers and passengers involved in an accident, regardless of who is at fault. In this article, we will explore what PIP coverage is, what it covers, and why it is required in Rhode Island.

What is Personal Injury Protection?

Personal Injury Protection, or PIP, is a type of car insurance coverage that provides medical and other benefits to drivers and passengers involved in an accident. PIP coverage is sometimes referred to as no-fault coverage, because it pays out benefits regardless of who is at fault for the accident.

In Rhode Island, all drivers are required to carry PIP coverage as part of their car insurance policy. The minimum required amount of PIP coverage in Rhode Island is $2,000 per person, per accident.

What Does PIP Cover?

PIP coverage provides a variety of benefits to drivers and passengers involved in an accident. These benefits may include:

– Medical expenses: PIP coverage can help pay for medical expenses incurred as a result of an accident, including hospital bills, doctor’s visits, and prescription medications.

– Lost wages: If you are unable to work after an accident, PIP coverage can help compensate you for lost wages.

– Funeral expenses: In the event that someone is killed in an accident, PIP coverage can help pay for funeral expenses.

– Child care expenses: If you are unable to care for your children after an accident, PIP coverage can help pay for child care expenses.

Why is PIP Required in Rhode Island?

Rhode Island requires all drivers to carry PIP coverage in order to ensure that drivers and passengers have access to necessary medical and other benefits in the event of an accident. PIP coverage can also help reduce the burden on the state’s healthcare system by providing coverage for accident-related medical expenses.

Additionally, PIP coverage can help reduce the number of lawsuits resulting from car accidents, because it provides benefits regardless of who is at fault for the accident. This can help reduce the costs associated with litigation and make the process of resolving accident-related disputes more efficient.

Benefits of PIP Coverage

There are several benefits to carrying PIP coverage as part of your car insurance policy. Some of these benefits include:

– Access to medical benefits: PIP coverage can help ensure that you have access to necessary medical benefits in the event of an accident, regardless of who is at fault.

– Reduced litigation: PIP coverage can help reduce the number of lawsuits resulting from car accidents, which can save time and money for all parties involved.

– Peace of mind: Knowing that you have PIP coverage can provide peace of mind, knowing that you and your passengers will be taken care of in the event of an accident.

PIP vs. Medical Payments Coverage

While PIP coverage and medical payments coverage may seem similar, there are some key differences between the two. Medical payments coverage is an optional type of car insurance coverage that pays for medical expenses resulting from an accident, regardless of who is at fault. Unlike PIP coverage, medical payments coverage does not provide benefits for lost wages, child care expenses, or funeral expenses.

In Rhode Island, drivers are required to carry PIP coverage, but they can also choose to purchase medical payments coverage as an additional form of protection.

Conclusion

Personal Injury Protection, or PIP, is a type of car insurance coverage that provides medical and other benefits to drivers and passengers involved in an accident, regardless of who is at fault. Rhode Island is one of the few states that requires drivers to carry PIP coverage as part of their car insurance policy. By requiring PIP coverage, Rhode Island is ensuring that drivers and passengers have access to necessary medical and other benefits in the event of an accident, while also reducing the burden on the state’s healthcare system and the number of lawsuits resulting from car accidents.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that helps pay for medical expenses, lost wages, and other expenses if you or your passengers are injured in a car accident. PIP is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

PIP coverage typically pays for medical expenses, such as hospital bills, doctor’s visits, and rehabilitation costs. It may also cover lost wages if you are unable to work due to your injuries, and it may provide a death benefit if you or a passenger in your vehicle is killed in an accident.

Is PIP required in Rhode Island?

Yes, Personal Injury Protection (PIP) is required in Rhode Island. All drivers in the state are required to carry a minimum of $25,000 in PIP coverage per person, per accident. This means that if you or a passenger in your vehicle is injured in an accident, your PIP coverage will pay up to $25,000 for medical expenses, lost wages, and other expenses.

It’s important to note that PIP coverage is not the same as liability coverage, which pays for damages you may cause to other people or their property in an accident. Liability coverage is also required in Rhode Island, with minimum limits of $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage.

What happens if I don’t have PIP coverage?

If you don’t have Personal Injury Protection (PIP) coverage in Rhode Island, you may face penalties and fines. Additionally, if you or a passenger in your vehicle is injured in an accident, you may be responsible for paying all medical expenses and other costs out of pocket.

It’s important to make sure you have adequate car insurance coverage, including PIP and liability coverage, to protect yourself and your passengers in the event of an accident.

Can I waive PIP coverage in Rhode Island?

No, you cannot waive Personal Injury Protection (PIP) coverage in Rhode Island. PIP is a mandatory type of car insurance coverage in the state, and all drivers are required to carry it.

However, you may be able to choose a higher level of PIP coverage than the minimum required by law. Talk to your insurance agent or provider to learn more about your options for PIP coverage in Rhode Island.

How does PIP coverage differ from medical payments coverage?

Personal Injury Protection (PIP) coverage and medical payments coverage are both types of car insurance coverage that can help pay for medical expenses after an accident. However, there are some key differences between the two.

PIP coverage is “no-fault” insurance, which means it pays out regardless of who caused the accident. It typically covers a wider range of expenses than medical payments coverage, such as lost wages and rehabilitation costs.

Medical payments coverage, on the other hand, is not “no-fault” insurance. It only pays out if you are found to be at fault for the accident. Additionally, it typically covers a more limited range of expenses than PIP coverage, such as hospital bills and doctor’s visits.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is required in Rhode Island. This coverage provides important benefits for those injured in a car accident, including medical expenses, lost wages, and other related costs. While some drivers may choose to opt-out of PIP coverage, it is important to remember that accidents can happen to anyone at any time.

By having PIP coverage, drivers can protect themselves and their passengers from the financial burdens that come with an accident. In addition, PIP can provide peace of mind knowing that in the event of an accident, the necessary medical care and related expenses will be covered.

Overall, it is important for Rhode Island drivers to understand the importance of PIP coverage and to ensure that they have the necessary coverage in place. By doing so, they can protect themselves and their loved ones from the potential financial consequences of a car accident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts