Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Alabama is known for its beautiful landscapes, from the Gulf Coast to the Appalachian Mountains. However, with scenic drives comes the risk of accidents. If you’re a driver in Alabama, you may be wondering if Personal Injury Protection (PIP) is required.

PIP is a type of car insurance that covers medical expenses and lost wages in the event of an accident. While PIP is required in some states, the laws vary from state to state. So, let’s dive into whether or not PIP is mandatory in Alabama.

Yes, Personal Injury Protection (PIP) is required in Alabama. The minimum coverage required is $2,500 for medical expenses and lost wages due to an accident. PIP coverage will pay for your medical expenses and lost wages regardless of who was at fault for the accident. It is important to note that PIP coverage does not cover property damage or liability for the accident.

Is Personal Injury Protection Required in Alabama?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident, regardless of who was at fault. While some states require drivers to carry PIP insurance, Alabama is not one of them. However, that doesn’t mean that you shouldn’t consider adding PIP coverage to your auto insurance policy if you live in Alabama.

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident, regardless of who was at fault. PIP coverage can help pay for medical expenses, lost wages, and other expenses related to an accident, such as child care or housekeeping services. Unlike other types of car insurance, PIP coverage is designed to cover your own expenses, regardless of who was at fault for the accident.

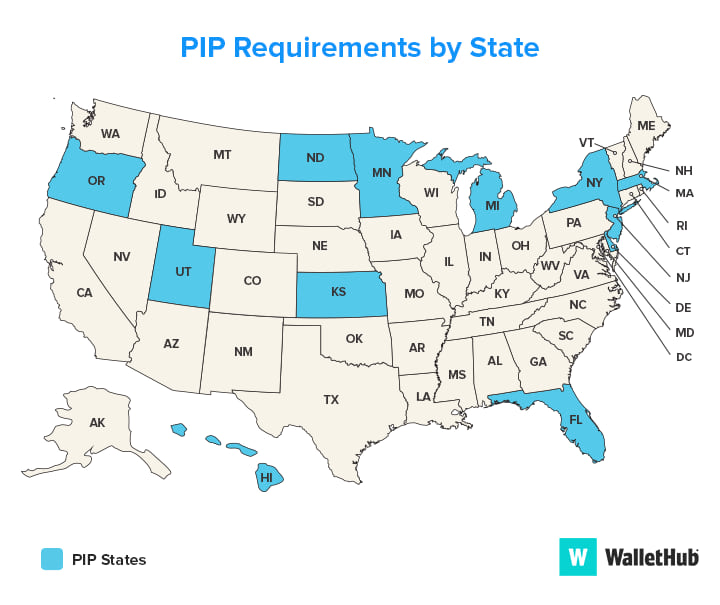

PIP coverage is typically optional, but some states require drivers to carry PIP insurance as part of their auto insurance policy. In states where PIP coverage is mandatory, drivers are required to carry a minimum amount of coverage to help pay for medical expenses and lost wages in the event of an accident.

Is PIP Required in Alabama?

While some states require drivers to carry PIP insurance, Alabama is not one of them. In Alabama, drivers are only required to carry liability insurance, which helps pay for damages and injuries you may cause to others in an accident. However, just because PIP coverage is not required in Alabama doesn’t mean that you shouldn’t consider adding it to your auto insurance policy.

PIP coverage can be a valuable addition to your auto insurance policy, especially if you have a high deductible or limited health insurance coverage. With PIP coverage, you can help protect yourself and your loved ones from the financial burden of medical expenses and lost wages related to an accident, regardless of who was at fault.

The Benefits of PIP Coverage

There are several benefits to adding PIP coverage to your auto insurance policy, including:

- Medical Expense Coverage: PIP coverage can help pay for medical expenses related to an accident, such as hospital bills, doctor visits, and rehabilitation.

- Lost Wages Coverage: PIP coverage can help replace lost wages if you are unable to work due to injuries sustained in an accident.

- No-Fault Coverage: PIP coverage is designed to cover your own expenses, regardless of who was at fault for the accident.

- Quick Payment: PIP coverage typically pays benefits quickly, without the need for lengthy investigations or negotiations with other parties.

PIP vs. Medical Payments Coverage

Medical Payments coverage (MedPay) is another type of car insurance that can help pay for medical expenses related to an accident. Unlike PIP coverage, MedPay coverage is not designed to cover lost wages or other expenses related to an accident. MedPay coverage is typically optional, and may be available in addition to or instead of PIP coverage.

So which type of coverage is right for you? The answer depends on your individual needs and situation. PIP coverage may be a better choice if you are concerned about lost wages or other expenses related to an accident, while MedPay coverage may be a better choice if you have a high-deductible health insurance plan or limited health insurance coverage.

Conclusion

While Personal Injury Protection (PIP) coverage is not required in Alabama, it can be a valuable addition to your auto insurance policy. PIP coverage can help pay for medical expenses and lost wages related to an accident, regardless of who was at fault. If you are considering adding PIP coverage to your auto insurance policy, be sure to compare quotes from several insurance providers to find the best coverage and rates for your needs.

Frequently Asked Questions

Here are some common questions related to personal injury protection in Alabama:

What is Personal Injury Protection (PIP)?

Personal Injury Protection, commonly known as PIP, is a type of car insurance coverage that pays for medical expenses and lost wages in the event of a car accident, regardless of who is at fault. PIP is also known as “no-fault” insurance because it pays out regardless of which driver caused the accident.

In Alabama, PIP coverage is optional, but it is strongly recommended as it can provide valuable protection in the event of an accident.

What Does PIP Cover in Alabama?

In Alabama, PIP coverage typically includes the following:

- Medical expenses, including hospital bills, doctor’s fees, and rehabilitation costs

- Lost wages if you are unable to work due to your injuries

- Funeral expenses if someone is killed in a car accident

PIP coverage can also include other expenses, such as child care or household services that you are unable to perform due to your injuries.

How Much PIP Coverage Should I Get in Alabama?

While PIP coverage is not required in Alabama, it is recommended that drivers carry at least $10,000 in coverage. However, you may want to consider purchasing more coverage if you have a high-risk job or if you frequently drive in areas with high accident rates.

It’s important to note that the amount of PIP coverage you have may affect your ability to file a lawsuit or recover damages from the at-fault driver in the event of an accident. Consult with an experienced personal injury attorney to determine the best amount of coverage for your situation.

Does PIP Cover Property Damage in Alabama?

No, PIP coverage does not cover property damage in Alabama. It only covers medical expenses, lost wages, and other related expenses as outlined in your policy. To cover property damage, you will need to purchase liability insurance or collision coverage.

Liability insurance pays for damages you cause to other people’s property, while collision coverage pays for damages to your own vehicle regardless of who is at fault.

Can I Waive PIP Coverage in Alabama?

Yes, you can waive PIP coverage in Alabama if you sign a written waiver indicating that you do not want the coverage. However, it is important to note that waiving PIP coverage can leave you vulnerable to expensive medical bills and other expenses in the event of an accident.

If you are considering waiving PIP coverage, consult with an experienced insurance agent or personal injury attorney to determine the best course of action for your situation.

What is Personal Injury Protection (PIP)?

In conclusion, the answer to whether personal injury protection is required in Alabama is yes. Alabama is one of the few states that require drivers to have personal injury protection coverage, which ensures that they have access to medical treatment and other related expenses in the event of an accident.

While some may see this as an added expense, the benefits of having personal injury protection coverage far outweigh the costs. In fact, having this coverage can provide peace of mind and help you avoid paying out-of-pocket expenses for medical bills and other related expenses.

Ultimately, personal injury protection is an essential coverage that every driver in Alabama should have. With this coverage, you can rest assured that you and your loved ones will be protected in the event of an accident, and you won’t have to worry about the financial burden that often comes with such situations. So, make sure to include this coverage in your policy when getting car insurance in Alabama.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts