Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Getting into a car accident can be a traumatic experience, both physically and emotionally. It’s important to have the right insurance coverage to protect yourself and your loved ones. In Arizona, one type of coverage that you might be wondering about is Personal Injury Protection (PIP). So, is PIP required in Arizona? Let’s take a closer look.

Personal Injury Protection, also known as “no-fault” insurance, covers medical expenses, lost wages, and other damages in the event of a car accident, regardless of who was at fault. But is it mandatory in Arizona? The answer is not a straightforward yes or no. Read on to learn more about the requirements and benefits of PIP in Arizona.

Yes, Personal Injury Protection (PIP) is required in Arizona. Arizona law mandates that all auto insurance policies must include PIP coverage with a minimum limit of $5,000. PIP covers medical expenses, lost wages, and other related expenses in the event of a car accident, regardless of who was at fault. Failure to comply with this requirement may result in fines and penalties.

Contents

- Is Personal Injury Protection Required in Arizona?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) and how does it work in Arizona?

- What other types of car insurance are required in Arizona?

- What are the benefits of having Personal Injury Protection (PIP) in Arizona?

- Can I decline Personal Injury Protection (PIP) coverage in Arizona?

- How much does Personal Injury Protection (PIP) coverage cost in Arizona?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in Arizona?

If you are a resident of Arizona and own a car, you may be wondering if personal injury protection (PIP) is required in the state. PIP is a type of car insurance that provides coverage for medical expenses and lost wages in case of an accident, regardless of who is at fault. In this article, we will explore the requirements for PIP in Arizona and whether it is a necessary coverage option for drivers.

What is Personal Injury Protection?

Personal injury protection, or PIP, is a type of car insurance that provides coverage for medical expenses, lost wages, and other related expenses in case of an accident. PIP is often referred to as “no-fault” insurance because it provides coverage regardless of who is at fault in the accident. This means that even if you are the one responsible for the accident, your PIP insurance will cover your medical expenses and lost wages.

Benefits of PIP

One of the main benefits of PIP insurance is that it provides coverage for medical expenses and lost wages, regardless of who is at fault in the accident. This can be especially helpful if you are unable to work due to your injuries. PIP can also provide coverage for other related expenses such as funeral costs and childcare expenses.

Limitations of PIP

While PIP insurance can be beneficial, it does have some limitations. In Arizona, PIP coverage is limited to $10,000 per person per accident. This means that if your medical expenses and lost wages exceed $10,000, you may be responsible for paying the additional costs out of pocket. Additionally, PIP insurance does not provide coverage for property damage, so you will need to have separate insurance for that.

Is PIP Required in Arizona?

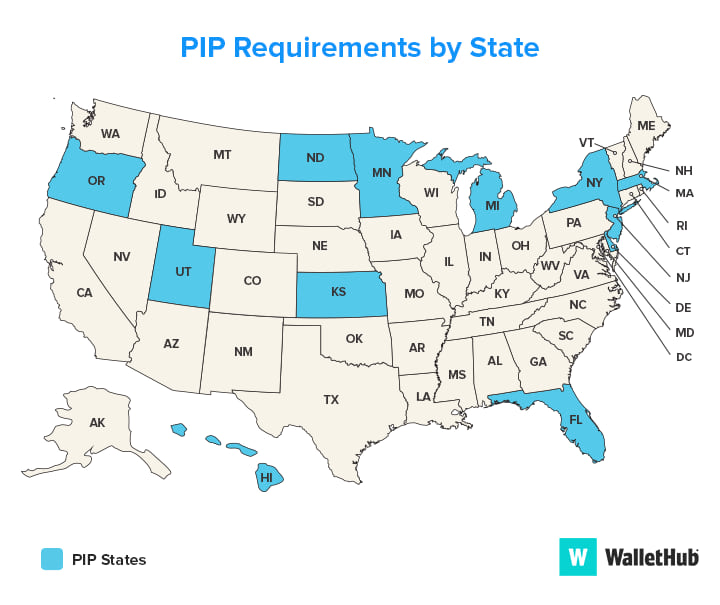

In Arizona, PIP is not a required type of insurance coverage. However, drivers are required to carry liability insurance, which provides coverage for damages and injuries that you may cause to other people in an accident. In addition to liability insurance, drivers can also choose to purchase collision insurance, which provides coverage for damages to your own vehicle, and comprehensive insurance, which provides coverage for non-collision-related damages such as theft or vandalism.

Benefits of Liability Insurance

Liability insurance is a necessary coverage option because it provides protection for damages and injuries that you may cause to other people in an accident. This coverage can help to prevent you from being held personally responsible for the costs of the accident, which can be substantial. Liability insurance can also provide coverage for legal fees if you are sued as a result of the accident.

Limitations of Liability Insurance

While liability insurance is an essential coverage option, it does have some limitations. Liability insurance only provides coverage for damages and injuries that you may cause to other people in an accident. It does not provide coverage for damages or injuries to you or your own vehicle. Additionally, liability insurance coverage limits can vary, so it is important to ensure that you have adequate coverage.

Conclusion

In conclusion, while personal injury protection is not a required type of insurance coverage in Arizona, it can be a beneficial option for drivers. PIP provides coverage for medical expenses and lost wages, regardless of who is at fault in the accident. However, PIP coverage is limited to $10,000 per person per accident, and it does not provide coverage for property damage. Drivers in Arizona are required to carry liability insurance, which provides coverage for damages and injuries that you may cause to other people in an accident. Liability insurance is an essential coverage option, but it does have limitations. It is important to ensure that you have adequate coverage for your specific needs.

Frequently Asked Questions

What is Personal Injury Protection (PIP) and how does it work in Arizona?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. PIP also covers expenses related to funeral services and childcare. In Arizona, PIP is not required by law, but it may be a good idea to have this coverage to protect yourself and your loved ones in case of an accident.

What other types of car insurance are required in Arizona?

In Arizona, drivers are required to have liability insurance to cover damages or injuries they may cause to others in an accident. The minimum liability coverage required by law is $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $10,000 for property damage. Uninsured and underinsured motorist coverage may also be required, depending on your insurance policy.

What are the benefits of having Personal Injury Protection (PIP) in Arizona?

Personal Injury Protection (PIP) can provide several benefits in Arizona, especially if you are injured in a car accident. PIP can cover medical expenses, lost wages, and other related expenses, regardless of who was at fault for the accident. PIP can also help cover costs for rehabilitation and physical therapy, and may provide benefits for household services, such as cleaning or cooking, if you are unable to perform these tasks due to your injuries.

Can I decline Personal Injury Protection (PIP) coverage in Arizona?

Yes, you can decline Personal Injury Protection (PIP) coverage in Arizona, but it may not be in your best interest to do so. If you decline PIP coverage, you may be responsible for paying for medical expenses and other related costs out of pocket if you or your passengers are injured in a car accident. It is important to consider your options and consult with an insurance professional before making a decision.

How much does Personal Injury Protection (PIP) coverage cost in Arizona?

The cost of Personal Injury Protection (PIP) coverage in Arizona can vary depending on several factors, such as your age, driving record, and the amount of coverage you choose. PIP coverage can be added to your car insurance policy for an additional premium, and the cost may be lower if you choose a higher deductible. It is important to compare quotes from different insurance companies to find the best coverage and rates for your needs.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is not required in Arizona, but it can be a wise investment for drivers. While Arizona does not mandate PIP coverage, it can provide added financial security in the event of an accident. PIP can help cover medical expenses, lost wages, and other related costs, regardless of who was at fault. It’s important to weigh the potential benefits of PIP coverage against the cost to determine if it’s right for you.

Ultimately, the decision to purchase PIP coverage in Arizona is a personal one. Drivers should carefully consider their individual needs and budget before making a decision. For some, the peace of mind that comes with additional coverage may be worth the added expense. For others, the minimum required coverage may be sufficient. Regardless of your decision, make sure to stay informed about Arizona’s insurance requirements and shop around for the best coverage options.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts