Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Accidents happen, and when they do, the last thing you want to worry about is how to pay for medical bills. That’s where Personal Injury Protection (PIP) and Medical Payments (MedPay) come in. But what’s the difference between these two types of insurance coverage? Let’s explore the nuances of PIP vs. MedPay and which one might be the better choice for you.

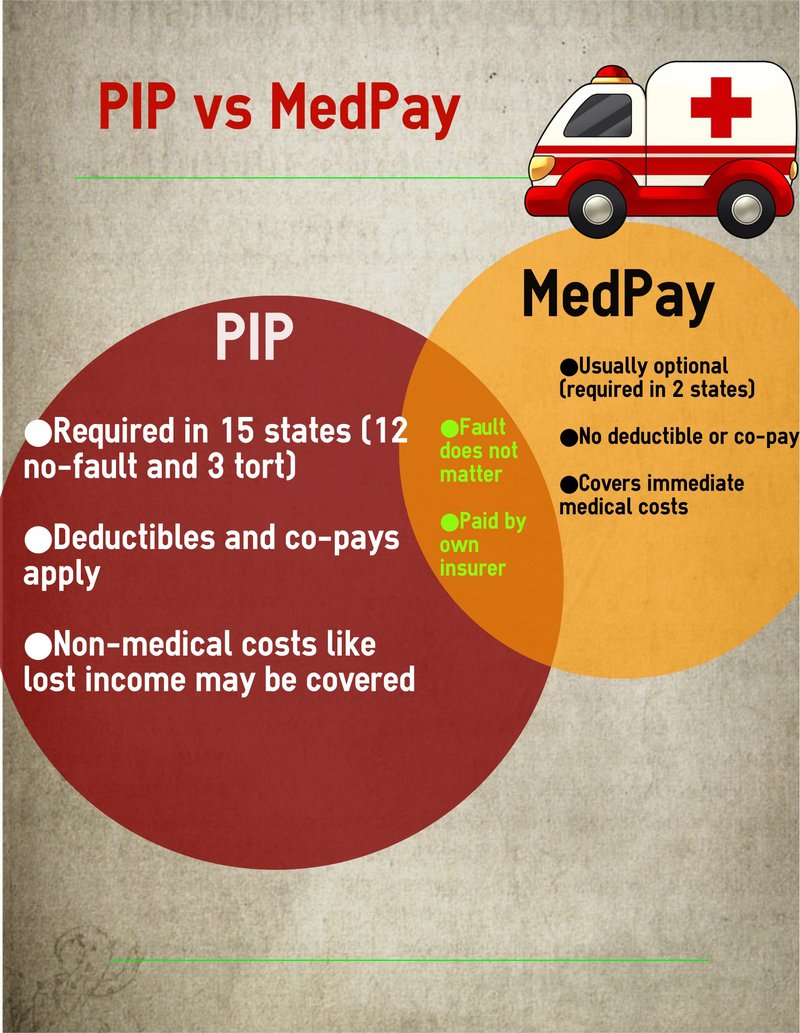

Personal Injury Protection and Medical Payments are both designed to cover medical expenses in the event of an accident, but they differ in their coverage limits, the types of expenses they cover, and the states where they’re required. Understanding the similarities and differences between PIP and MedPay can help you make an informed decision about which coverage is best for your needs.

Personal Injury Protection (PIP) and Medical Payments (MedPay) are both types of car insurance coverage that can help pay for medical expenses after a car accident. PIP typically covers a wider range of expenses, including lost wages and rehabilitation, while MedPay only covers medical expenses. PIP is required in some states, while MedPay is optional. It’s important to compare the coverage and costs of both options before choosing which one to add to your car insurance policy.

Understanding Personal Injury Protection Vs Medical Payments

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that is often included in car insurance policies. PIP provides coverage for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who was at fault.

PIP can also cover expenses like childcare, housekeeping, and funeral costs in the event of a fatal accident. PIP is often referred to as “no-fault” insurance because it provides coverage regardless of who caused the accident.

What are Medical Payments (MedPay)?

Medical Payments (MedPay) is another type of insurance coverage that can be included in car insurance policies. MedPay provides coverage for medical expenses for you or your passengers if you are injured in a car accident, regardless of who was at fault.

MedPay is similar to PIP in that it provides coverage for medical expenses, but it does not cover lost wages or other related expenses. Unlike PIP, MedPay is not available in all states and is not considered “no-fault” insurance.

Benefits of PIP

One of the main benefits of PIP is that it provides coverage for a wider range of expenses than MedPay. In addition to medical expenses, PIP can cover lost wages, rehabilitation expenses, and other related costs.

PIP can also provide coverage for expenses like childcare, housekeeping, and funeral costs in the event of a fatal accident. This can help ease the financial burden on the policyholder and their family during a difficult time.

Benefits of MedPay

MedPay can be a good option for people who already have health insurance coverage but want additional coverage for medical expenses related to a car accident. MedPay can also be a more affordable option than PIP in some cases.

Because MedPay is not considered “no-fault” insurance, it may be easier to file a claim with the at-fault driver’s insurance company for additional expenses that are not covered by MedPay.

PIP vs MedPay

| PIP | MedPay |

|---|---|

| Covers a wider range of expenses | Covers only medical expenses |

| Considered “no-fault” insurance | Not considered “no-fault” insurance |

| Can be more expensive than MedPay | Can be a more affordable option |

Ultimately, the decision between PIP and MedPay will depend on a variety of factors, including your budget, existing insurance coverage, and your personal preferences. It’s important to compare the benefits and costs of each option carefully before making a decision.

How to Choose Between PIP and MedPay

- Consider your budget: PIP can be more expensive than MedPay, so it’s important to consider how much you can afford to spend on insurance.

- Review your existing insurance coverage: If you already have health insurance that provides coverage for car accident injuries, you may not need as much coverage from PIP or MedPay.

- Think about the level of coverage you need: If you want coverage for lost wages and other related expenses, PIP may be a better option. If you only need coverage for medical expenses, MedPay may be sufficient.

Conclusion

Personal Injury Protection (PIP) and Medical Payments (MedPay) are two types of insurance coverage that can provide coverage for medical expenses related to a car accident. PIP provides coverage for a wider range of expenses, while MedPay is typically more affordable and can be a good option for people who already have health insurance coverage.

Ultimately, the decision between PIP and MedPay will depend on a variety of factors, including your budget, existing insurance coverage, and your personal preferences. It’s important to compare the benefits and costs of each option carefully before making a decision.

Frequently Asked Questions

Personal Injury Protection and Medical Payments are both types of coverage that help pay for medical expenses in the event of an accident. While they may seem similar, there are some differences between the two. Here are five frequently asked questions about Personal Injury Protection Vs Medical Payments.

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you are injured in a car accident. PIP is often referred to as “no-fault” insurance because it pays out regardless of who is at fault for the accident. PIP also covers other passengers in your car and pedestrians who are injured in the accident.

PIP coverage is required in some states and optional in others. It is important to check with your insurance provider to see if it is required where you live.

What is Medical Payments coverage?

Medical Payments coverage is another type of car insurance that pays for medical expenses related to an accident. Unlike PIP, Medical Payments coverage is not required in any state. Medical Payments coverage typically covers the same things as PIP, such as medical expenses and lost wages. However, it does not cover other related expenses like PIP does.

Medical Payments coverage is often used as a supplement to health insurance. If you have health insurance, Medical Payments coverage can help cover any out-of-pocket expenses you may have after your health insurance pays out.

Is PIP or Medical Payments coverage better?

Both PIP and Medical Payments coverage have their pros and cons. PIP is more comprehensive and covers more expenses than Medical Payments coverage. However, PIP is also more expensive and may not be necessary if you already have health insurance. Medical Payments coverage is typically less expensive and can be used as a supplement to health insurance. Ultimately, the best choice depends on your individual situation and needs.

To determine which coverage is right for you, talk to your insurance provider and consider your budget, health insurance coverage, and the amount of coverage you feel comfortable with.

Do I need PIP or Medical Payments coverage if I already have health insurance?

If you have health insurance, you may not need PIP or Medical Payments coverage. Your health insurance should cover your medical expenses related to an accident. However, if you have a high deductible or other out-of-pocket expenses, PIP or Medical Payments coverage can help cover those costs. Additionally, if you are in a state that requires PIP coverage, you will need to purchase it regardless of your health insurance coverage.

To determine if you need PIP or Medical Payments coverage, talk to your insurance provider and review your health insurance policy to see what is covered and what your out-of-pocket expenses may be in the event of an accident.

Can I have both PIP and Medical Payments coverage?

Yes, you can have both PIP and Medical Payments coverage. Having both types of coverage can provide extra protection in the event of an accident. If you have health insurance, having both types of coverage can help cover any out-of-pocket expenses you may have after your health insurance pays out.

However, having both types of coverage may not be necessary or financially feasible for everyone. To determine if you need both types of coverage, talk to your insurance provider and consider your budget, health insurance coverage, and the amount of coverage you feel comfortable with.

Personal Injury Protection or Medical Payments

In conclusion, understanding the difference between Personal Injury Protection (PIP) and Medical Payments (MedPay) can save you from a lot of confusion and financial loss in the event of an accident. While both cover medical expenses, PIP goes beyond just medical bills and also covers lost wages and other related expenses. On the other hand, MedPay is more straightforward and only covers medical bills.

When choosing between PIP and MedPay, consider your unique needs and budget. If you have a high-risk job or have dependents who rely on your income, PIP may be a better option for you. However, if you have a good health insurance policy and want to keep your car insurance premiums low, MedPay might be the way to go.

Ultimately, it’s important to discuss your options with a licensed insurance agent who can help you determine the best coverage for your specific situation. With the right coverage, you can have peace of mind knowing that you and your loved ones are protected in the event of an accident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts