Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

As drivers, we all know that accidents happen. But what happens after an accident can be just as important as the crash itself. That’s where Personal Injury Protection (PIP) comes in – but do you really need it?

In this article, we’ll explore everything you need to know about PIP insurance, including what it covers, how much it costs, and whether or not it’s worth it for you to add it to your policy. So buckle up and get ready to learn all about this important aspect of car insurance.

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages after a car accident, regardless of who was at fault. Whether you need PIP coverage depends on your state’s laws and your personal circumstances. Some states require PIP coverage, while others don’t. If you have good health insurance, disability insurance, or a solid emergency fund, you may not need PIP coverage. It’s important to carefully consider your options and speak with your insurance agent to make an informed decision.

Do I Need Personal Injury Protection?

Personal injury protection, or PIP, is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. PIP is not available in all states, but if you live in a state where it is an option, you may be wondering if you need it. Here’s what you need to know.

What is Personal Injury Protection?

Personal injury protection is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. Unlike traditional car insurance, which only pays for damages to your car or other people’s property, PIP is designed to cover the costs associated with injuries.

In addition to medical expenses and lost wages, PIP may also cover expenses like funeral costs, childcare expenses, and household services that you may need if you are unable to perform them due to your injuries.

If you live in a state where PIP is an option, you may be required to purchase it as part of your car insurance policy. Even if it’s not required, you may still want to consider purchasing PIP coverage to ensure that you and your passengers are protected in the event of an accident.

Benefits of Personal Injury Protection

There are several benefits to purchasing personal injury protection coverage. First and foremost, PIP can help cover the costs associated with injuries sustained in a car accident. This can include medical expenses, lost wages, and other expenses that you may incur as a result of your injuries.

Another benefit of PIP is that it can help cover expenses that traditional car insurance policies may not cover. For example, PIP may pay for childcare expenses or household services that you are unable to perform due to your injuries.

Finally, PIP can provide peace of mind knowing that you and your passengers are protected in the event of an accident. If you or your passengers are injured in a car accident, PIP can help cover the costs associated with your injuries, which can be a significant financial burden.

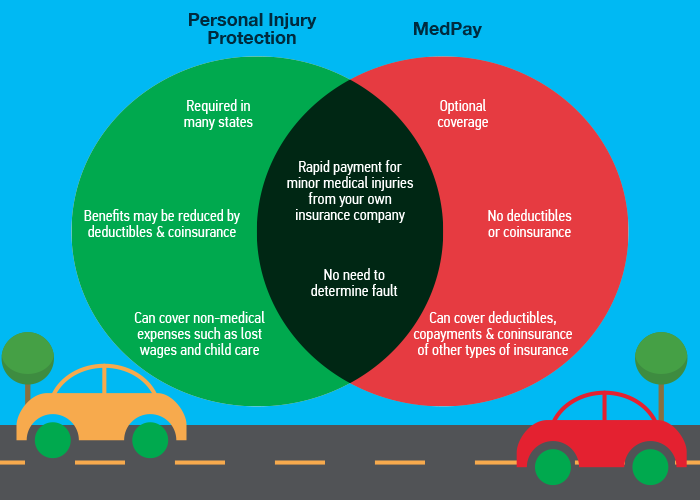

Personal Injury Protection vs. Medical Payments Coverage

Personal injury protection and medical payments coverage are two types of car insurance coverage that are often confused with one another. While both types of coverage provide medical expense coverage, there are some key differences between the two.

Personal injury protection is designed to cover a wider range of expenses than medical payments coverage. In addition to medical expenses, PIP may also cover lost wages, funeral expenses, and other expenses that you may incur as a result of your injuries.

Medical payments coverage, on the other hand, only covers medical expenses. It does not cover lost wages or other expenses that may be associated with your injuries.

Another key difference between the two types of coverage is that PIP is only available in certain states, while medical payments coverage is available in most states.

Personal Injury Protection vs. Bodily Injury Liability Coverage

Personal injury protection and bodily injury liability coverage are two different types of car insurance coverage that provide very different types of protection.

Personal injury protection is designed to cover the costs associated with injuries sustained by you or your passengers in a car accident. Bodily injury liability coverage, on the other hand, is designed to cover the costs associated with injuries sustained by other people in a car accident that you are responsible for.

In other words, PIP is designed to protect you and your passengers, while bodily injury liability coverage is designed to protect other people.

It’s important to note that bodily injury liability coverage is required in most states, while PIP is only available in certain states.

Do I Need Personal Injury Protection?

Whether or not you need personal injury protection depends on a variety of factors, including where you live, how much coverage you already have, and how much risk you are willing to take on.

If you live in a state where PIP is required, you will need to purchase it as part of your car insurance policy. If PIP is not required in your state, you may still want to consider purchasing it to ensure that you and your passengers are protected in the event of an accident.

If you already have health insurance that covers medical expenses, you may not need PIP coverage. However, it’s important to note that health insurance may not cover all of the expenses associated with a car accident, such as lost wages or household services.

Ultimately, the decision to purchase personal injury protection is up to you. It’s important to weigh the costs and benefits of PIP coverage and determine whether or not it’s worth the investment for you and your family.

Frequently Asked Questions

Here are some common questions and answers about personal injury protection.

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. PIP is often called “no-fault” insurance because it covers your injuries regardless of who caused the accident.

PIP is not required in all states, but it is mandatory in some states. It is also an optional coverage in other states. Check with your insurance provider or the Department of Motor Vehicles to see if PIP is required in your state.

What Does Personal Injury Protection Cover?

Personal Injury Protection typically covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP may also cover rehabilitation services, funeral expenses, and other costs related to the accident.

PIP coverage varies by state and insurance provider. Some states have mandatory minimum coverage requirements, while others allow you to choose your coverage limits. It’s important to review your policy carefully to understand what is covered and how much coverage you have.

Do I Need Personal Injury Protection if I Have Health Insurance?

If you have health insurance, you may wonder if you need Personal Injury Protection. While health insurance may cover some of your medical expenses, it may not cover all of them. PIP can help cover your out-of-pocket expenses for medical treatment, as well as lost wages if you are unable to work due to your injuries.

Additionally, PIP pays benefits regardless of who was at fault for the accident. Health insurance may not cover your medical expenses if the accident was caused by someone else’s negligence.

Is Personal Injury Protection Worth the Cost?

Whether Personal Injury Protection is worth the cost depends on several factors, including your state’s laws, your insurance provider, and your individual needs. If PIP is mandatory in your state, you will have to pay for it regardless of whether you think it’s worth it.

If PIP is optional in your state, you should consider your personal circumstances before deciding whether to purchase it. If you have health insurance and disability insurance, you may not need as much PIP coverage. However, if you frequently drive with passengers or have a high-risk occupation, PIP may be worth the cost.

What Happens if I Don’t Have Personal Injury Protection?

If Personal Injury Protection is mandatory in your state and you don’t have it, you may be subject to fines or other penalties. If PIP is optional in your state and you choose not to purchase it, you may be responsible for paying your own medical expenses and lost wages if you or your passengers are injured in a car accident.

Additionally, if you are at fault for the accident and don’t have PIP coverage, you may be sued by the other driver or passengers for their medical expenses and other damages.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection is an added coverage that you may consider when purchasing car insurance. It can provide you with financial assistance in case of an accident, regardless of who is at fault.

While it’s not a mandatory coverage in all states, it’s worth checking your state’s requirements and considering your personal circumstances before making a decision.

At the end of the day, having personal injury protection can offer you peace of mind and protect you and your loved ones from unexpected expenses and financial difficulties.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts