Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

If you are a driver in Iowa, you may be wondering whether personal injury protection (PIP) coverage is required by law. While Iowa does not mandate PIP coverage, it is still important to understand what it is and how it can benefit you in the event of an accident.

In this article, we will explore the ins and outs of PIP coverage, including what it is, what it covers, and whether it is worth considering for your auto insurance policy. By the end, you will have a better understanding of whether PIP is right for you and your driving needs.

Yes, Personal Injury Protection (PIP) is required in Iowa. It covers medical expenses, lost wages, and other expenses regardless of who was at fault in an accident. The minimum coverage required is $20,000 per person and $40,000 per accident. PIP can be waived if the policyholder chooses to do so in writing.

Is Personal Injury Protection Required in Iowa?

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses, lost wages, and other expenses related to a car accident regardless of who caused the accident. PIP is also known as no-fault insurance because it provides coverage regardless of who is at fault for the accident. In Iowa, PIP is an optional coverage that drivers can choose to purchase.

PIP can provide coverage for a range of expenses, including medical bills, lost wages, and even funeral expenses in the event of a fatal accident. This coverage can be particularly beneficial for drivers who do not have health insurance or disability insurance, as it can help cover their expenses in the event of an accident, regardless of who is at fault.

Is PIP Required in Iowa?

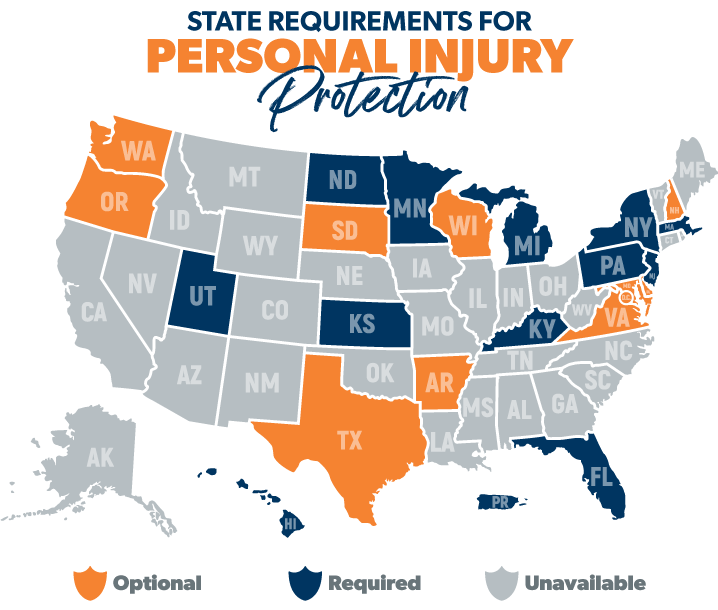

No, PIP is not required in Iowa. Unlike some states, such as Florida and Hawaii, Iowa does not have a mandatory PIP law. However, drivers in Iowa are required to carry liability insurance, which covers damages and injuries that you may cause to another driver, passenger, or pedestrian in an accident that you are at fault for.

While PIP is not required in Iowa, it can be a valuable addition to your insurance policy. If you are involved in an accident and do not have PIP coverage, you may be responsible for paying your own medical bills and other expenses out of pocket. This can be a significant financial burden, especially if you are unable to work due to your injuries.

Benefits of PIP Coverage

There are several benefits to purchasing PIP coverage, even if it is not required in Iowa. These benefits include:

- Coverage for medical expenses, lost wages, and other expenses related to a car accident

- No-fault coverage, which means that you can receive benefits regardless of who caused the accident

- Peace of mind knowing that you are protected in the event of an accident

Additionally, PIP coverage can be particularly beneficial for drivers who do not have health insurance or disability insurance. If you are injured in an accident, PIP can help cover your medical bills and other expenses, even if you are unable to work due to your injuries.

PIP vs. Liability Insurance

While liability insurance is required in Iowa, it only covers damages and injuries that you may cause to another driver, passenger, or pedestrian in an accident that you are at fault for. PIP, on the other hand, provides coverage for medical expenses, lost wages, and other expenses related to a car accident, regardless of who caused the accident.

If you are involved in an accident and only have liability insurance, you may be responsible for paying your own medical bills and other expenses out of pocket. This can be a significant financial burden, especially if your injuries are severe and you are unable to work.

How much PIP coverage should I purchase?

If you decide to purchase PIP coverage in Iowa, you will need to choose how much coverage to purchase. The amount of coverage you need will depend on a variety of factors, including your budget, your health insurance coverage, and your risk tolerance.

Some insurance companies offer PIP coverage with limits ranging from $1,000 to $10,000 or more. It is important to carefully consider your options and choose a coverage limit that will provide adequate protection in the event of an accident.

Conclusion

While PIP is not required in Iowa, it can be a valuable addition to your insurance policy. PIP provides coverage for medical expenses, lost wages, and other expenses related to a car accident, regardless of who caused the accident. If you are considering purchasing PIP coverage, it is important to carefully consider your options and choose a coverage limit that will provide adequate protection in the event of an accident.

Contents

Frequently Asked Questions

Here are some common questions about Personal Injury Protection (PIP) requirements in Iowa.

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in case of an accident. It is sometimes called “no-fault” insurance because it pays out regardless of who caused the accident. PIP also covers passengers in your car, pedestrians, and bicyclists who are injured in a car accident.

In Iowa, PIP is optional. However, if you choose to purchase it, you must have a minimum coverage of $1,000 per person per accident.

What does PIP cover?

PIP covers medical expenses, lost wages, and other related expenses resulting from an accident. Medical expenses may include hospital bills, doctor’s fees, and medical supplies. Lost wages may include income lost due to being unable to work because of the accident. PIP may also cover expenses related to rehabilitation and funeral expenses in case of death.

It is important to note that PIP only covers medical expenses and lost wages up to the limit of your policy. If your expenses exceed your policy limit, you will be responsible for paying the remaining balance.

Is PIP required in Iowa?

No, PIP is not required in Iowa. However, it is important to note that Iowa is a “fault” state. This means that if you are at fault for an accident, you may be liable for the other driver’s medical expenses and lost wages. PIP can help protect you from financial responsibility for these expenses.

Additionally, if you are injured in an accident and do not have health insurance, PIP can help cover your medical expenses. It is often recommended that drivers in Iowa purchase PIP as a form of protection in case of an accident.

How do I purchase PIP in Iowa?

You can purchase PIP as an additional coverage option when you buy car insurance in Iowa. It is important to shop around and compare rates from different insurance companies to find the best coverage for your needs and budget.

If you already have car insurance in Iowa, you can contact your insurance company to add PIP to your policy. Your insurance agent can help you determine how much coverage you need and answer any questions you may have about PIP.

Can I waive PIP coverage in Iowa?

Yes, you can waive PIP coverage in Iowa. However, it is important to understand the potential risks of doing so. If you are injured in an accident and do not have PIP coverage, you may be responsible for paying your own medical expenses and lost wages, even if the accident was not your fault.

If you choose to waive PIP coverage, you must do so in writing. Your insurance company may require you to sign a waiver form stating that you understand the risks of waiving PIP coverage. It is recommended that you speak with an insurance agent or attorney before waiving PIP coverage.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is not required in Iowa, but it is an essential coverage that can help protect you and your loved ones in case of an accident. PIP can cover medical expenses, lost wages, and other costs associated with the accident, regardless of who was at fault. While it may not be mandatory, adding PIP coverage to your car insurance policy can provide additional peace of mind on the road.

It is important to note that Iowa does require drivers to carry liability insurance, which covers damages and injuries caused by the driver to others. However, this coverage does not extend to the driver or their passengers. Without PIP coverage, you may be left with significant out-of-pocket expenses in the event of an accident.

Ultimately, the decision of whether or not to add PIP coverage to your car insurance policy is up to you. However, it is worth considering the potential benefits and protection that this coverage can provide. It may be worth speaking with your insurance agent to determine the best coverage options for your specific needs.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts