Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Maine is a state that takes auto insurance coverage very seriously. With strict laws in place, it’s important to understand the requirements for driving in the state. One question that often arises is whether personal injury protection (PIP) is required in Maine. Let’s dive deeper into this topic to gain a better understanding of what is expected of drivers in the Pine Tree State.

As a driver in Maine, it’s crucial to know the minimum insurance requirements to avoid any legal complications. Personal injury protection is one of the types of insurance coverage that Maine law mandates. However, there are some exceptions to this requirement, which we’ll explore further in this article. So, buckle up and let’s get started on understanding the ins and outs of PIP in Maine.

Yes, Personal Injury Protection (PIP) is required in Maine. PIP provides coverage for medical expenses, lost wages, and other related expenses regardless of who was at fault in an accident. Maine requires a minimum of $2,000 in PIP coverage, but you can choose to purchase additional coverage. PIP is designed to help you get the care you need after an accident and can be an important part of your auto insurance policy.

Is Personal Injury Protection Required in Maine?

What is Personal Injury Protection?

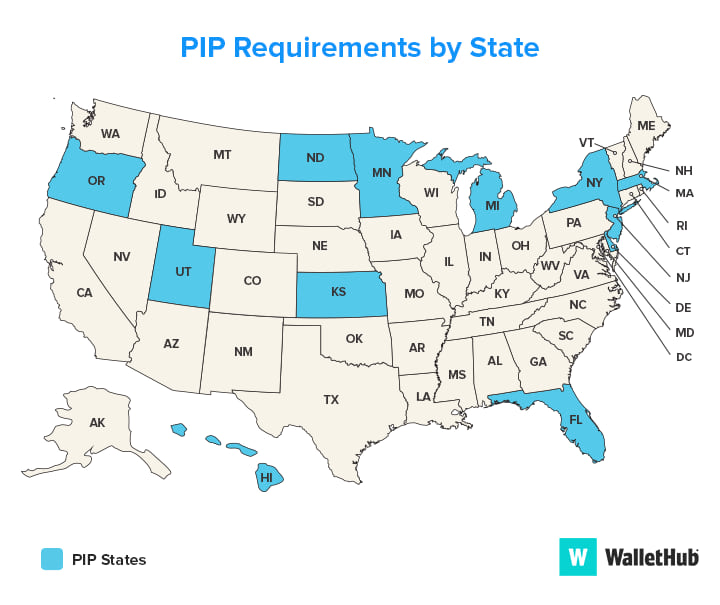

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident. It is a no-fault insurance, which means that it pays out regardless of who is determined to be at fault for the accident. PIP coverage is required in some states, including Maine.

Benefits of Personal Injury Protection

One of the main benefits of Personal Injury Protection is that it covers medical expenses for both the driver and passengers in the car. This can include expenses such as hospitalization, doctor visits, and surgeries. PIP can also cover lost wages if the injured party is unable to work due to their injuries.

Another benefit of PIP is that it is a no-fault insurance, which means that it pays out regardless of who is determined to be at fault for the accident. This can help to speed up the claims process and ensure that injured parties receive the compensation they need in a timely manner.

Personal Injury Protection vs. Medical Payments Coverage

While Personal Injury Protection and Medical Payments Coverage may seem similar, there are some key differences between the two. Medical Payments Coverage only covers medical expenses, while PIP also covers lost wages and other related expenses.

Additionally, Medical Payments Coverage is not a no-fault insurance and only pays out if the injured party is not at fault for the accident. PIP, on the other hand, pays out regardless of who is at fault for the accident.

Is Personal Injury Protection Required in Maine?

Yes, Personal Injury Protection is required in Maine. The minimum amount of PIP coverage required is $2,000 per person, per accident. However, drivers can choose to purchase additional PIP coverage if they wish.

Penalties for Not Having Personal Injury Protection in Maine

If you are caught driving without the required amount of PIP coverage in Maine, you may face penalties such as fines and license suspension. Additionally, if you are involved in an accident and do not have PIP coverage, you may be responsible for paying for your own medical expenses and lost wages.

Additional Car Insurance Coverage in Maine

In addition to Personal Injury Protection, Maine also requires drivers to carry liability insurance. This type of insurance covers damages and injuries that you may cause to other drivers or their property in an accident.

Maine also offers optional coverage such as collision coverage, which covers damages to your own vehicle in an accident, and comprehensive coverage, which covers damages to your vehicle that are not caused by an accident.

Conclusion

Personal Injury Protection is a type of car insurance that covers medical expenses and lost wages in the event of an accident. It is required in Maine and can help to speed up the claims process and ensure that injured parties receive the compensation they need in a timely manner. If you are caught driving without the required amount of PIP coverage in Maine, you may face penalties such as fines and license suspension.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection?

- How much Personal Injury Protection coverage do I need in Maine?

- What does Personal Injury Protection cover in Maine?

- Can I waive Personal Injury Protection coverage in Maine?

- How does Personal Injury Protection differ from Bodily Injury Liability coverage?

- What is personal injury protection (PIP) ? 🤔

Frequently Asked Questions

Here are some common questions related to Personal Injury Protection in Maine:

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of insurance coverage that provides medical and other related expenses coverage to you and your passengers if you are involved in a car accident. PIP coverage also covers lost wages and other expenses related to the accident, regardless of who was at fault for the accident.

In Maine, PIP coverage is mandatory for all drivers who register a vehicle in the state.

How much Personal Injury Protection coverage do I need in Maine?

In Maine, the minimum PIP coverage required is $2,000 per person, per accident. However, insurance companies offer higher PIP coverage options that you can choose from to ensure that you have sufficient coverage in case of an accident.

It is recommended that you speak with an insurance agent to determine the appropriate amount of PIP coverage that you need based on your specific circumstances.

What does Personal Injury Protection cover in Maine?

Maine’s mandatory PIP coverage includes medical expenses, lost wages, and other related expenses like transportation costs related to medical treatment and household services. PIP coverage also covers funeral expenses and survivor benefits in case of death due to a car accident.

It is important to note that PIP coverage only applies to injuries sustained in a car accident and does not cover damage to your vehicle or other property damage.

Can I waive Personal Injury Protection coverage in Maine?

No, you cannot waive PIP coverage in Maine. PIP coverage is mandatory for all drivers who register a vehicle in the state. However, you can choose to opt for higher coverage options if you feel that the minimum required coverage is not sufficient for your needs.

It is essential to have PIP coverage in Maine to ensure that you and your passengers are protected in case of an accident.

How does Personal Injury Protection differ from Bodily Injury Liability coverage?

PIP coverage and Bodily Injury Liability (BIL) coverage are two different types of car insurance coverage. PIP coverage provides medical and other related expenses coverage to you and your passengers, regardless of who was at fault for the accident.

BIL coverage, on the other hand, covers the injuries that you may cause to other drivers, passengers, or pedestrians if you are at fault for the accident. BIL coverage is also mandatory in Maine, and the minimum required coverage is $50,000 per person, per accident.

What is personal injury protection (PIP) ? 🤔

In conclusion, personal injury protection is indeed required in Maine. It is a mandatory form of car insurance that provides coverage for medical expenses, lost wages, and other related expenses in the event of an accident. While some may see it as an added expense, it is important to remember that it can provide valuable protection in case of an unforeseen accident.

Furthermore, personal injury protection can help alleviate some of the financial burden that may arise from a car accident. It can help cover medical expenses, lost wages, and other related costs, reducing the stress and worry that can come with such an event.

Ultimately, it is important for Maine drivers to understand the importance of personal injury protection and the role it plays in providing valuable coverage in case of an accident. By having this coverage, drivers can have peace of mind knowing that they are protected in the event of an unexpected accident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts