Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

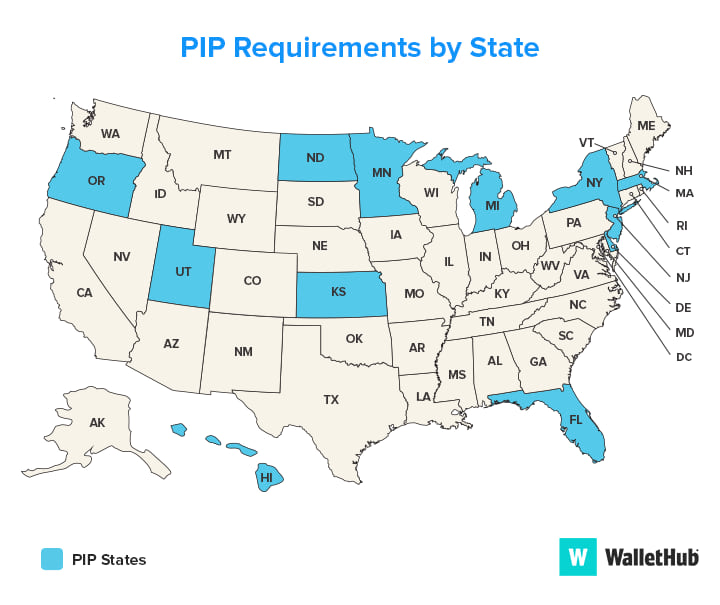

Utah is one of the few states in the country that requires motorists to have personal injury protection (PIP) as part of their auto insurance coverage. PIP is a type of insurance that covers medical expenses and lost wages in case of an accident, regardless of who is at fault.

This requirement has been in place since 1974, and it is intended to provide drivers with additional protection in case of an accident. But what exactly is PIP, and how does it work? Let’s take a closer look at this requirement and what it means for drivers in Utah.

Yes, Personal Injury Protection (PIP) is required in Utah. All registered vehicles in Utah must carry a minimum of $3,000 in PIP coverage, which covers medical expenses, lost wages, and other related expenses resulting from a car accident, regardless of who caused the accident. Failure to carry PIP coverage can result in fines and other penalties.

Is Personal Injury Protection Required in Utah?

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of a car accident. Utah is one of several states that requires drivers to carry PIP insurance. In this article, we’ll explore the details of Utah’s PIP requirements and what they mean for drivers.

What is Personal Injury Protection?

Personal injury protection, or PIP, is a type of car insurance that provides coverage for medical expenses and lost wages if you are injured in a car accident. PIP insurance is designed to be a “no-fault” system, meaning that it will cover your expenses regardless of who caused the accident. This can be especially important if you are in an accident where the other driver is uninsured or underinsured.

In Utah, PIP insurance is required for all drivers, with a minimum coverage limit of $3,000. This means that if you are injured in an accident, your PIP insurance will cover up to $3,000 in medical expenses and lost wages.

Benefits of Personal Injury Protection Insurance

There are several benefits to having PIP insurance in Utah. First and foremost, it provides coverage for your medical expenses and lost wages if you are injured in a car accident. This can be especially important if you don’t have health insurance or disability coverage through your employer.

Another benefit of PIP insurance is that it is a no-fault system. This means that your insurance will cover your expenses regardless of who caused the accident. This can be especially important if the other driver is uninsured or underinsured.

- Provides coverage for medical expenses and lost wages

- A no-fault system

- Covers expenses regardless of who caused the accident

PIP vs. Medical Payments Coverage

PIP insurance is often confused with medical payments coverage, which is another type of car insurance that covers medical expenses in the event of an accident. However, there are some key differences between the two types of coverage.

First, PIP insurance provides coverage for both medical expenses and lost wages, while medical payments coverage only covers medical expenses. Additionally, PIP insurance is a no-fault system, while medical payments coverage is not. This means that your medical payments coverage will only cover your expenses if the other driver is found to be at fault for the accident.

| Personal Injury Protection | Medical Payments Coverage | |

|---|---|---|

| Coverage | Medical expenses and lost wages | Medical expenses only |

| No-fault system | Yes | No |

| Coverage regardless of fault | Yes | No |

Penalties for Not Having PIP Insurance in Utah

If you are caught driving without PIP insurance in Utah, you could face some serious penalties. First, you may be fined up to $1,000. Additionally, your driver’s license and registration could be suspended until you provide proof of insurance.

It’s important to note that if you are involved in an accident and do not have PIP insurance, you could be held personally responsible for any medical expenses or lost wages that you incur as a result of the accident.

Conclusion

Personal injury protection insurance is required for all drivers in Utah. This type of insurance provides coverage for medical expenses and lost wages in the event of a car accident. PIP insurance is a no-fault system, meaning that it will cover your expenses regardless of who caused the accident. If you are caught driving without PIP insurance, you could face fines and the suspension of your driver’s license and registration.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages resulting from a car accident, regardless of who was at fault. PIP is also known as no-fault insurance because it covers your injuries regardless of who caused the accident.

PIP coverage may also include benefits for funeral expenses, rehabilitation, and other related costs. PIP is required in some states, but not all.

What are the PIP requirements in Utah?

Yes, Personal Injury Protection (PIP) is required in Utah. According to Utah state law, drivers must carry a minimum of $3,000 in PIP coverage to cover medical expenses and lost wages resulting from a car accident, regardless of who was at fault.

Utah’s no-fault insurance law requires that PIP coverage be included in every car insurance policy sold in the state. This means that if you own a car in Utah or are driving in Utah, you must have PIP coverage.

What does PIP coverage in Utah cover?

Personal Injury Protection (PIP) coverage in Utah covers medical expenses and lost wages resulting from a car accident, regardless of who was at fault. PIP coverage may also include benefits for funeral expenses, rehabilitation, and other related costs.

In Utah, PIP coverage is required to provide a minimum of $3,000 in coverage for medical expenses and lost wages. However, drivers can choose to purchase additional PIP coverage to provide more protection in the event of an accident.

What happens if I don’t have PIP coverage in Utah?

If you don’t have Personal Injury Protection (PIP) coverage in Utah, you may face legal and financial consequences. Utah state law requires all drivers to carry PIP coverage, so if you are caught driving without it, you may be subject to fines and other penalties.

Additionally, if you are involved in a car accident and don’t have PIP coverage, you may be responsible for paying for medical expenses and lost wages out of pocket. This can be very expensive and may put you in financial hardship.

Do I still need PIP coverage if I have health insurance?

Yes, you still need Personal Injury Protection (PIP) coverage in Utah even if you have health insurance. PIP coverage is specifically designed to cover medical expenses and lost wages resulting from a car accident, regardless of who was at fault.

While your health insurance may cover some of these costs, it may not cover everything. PIP coverage can help fill in the gaps and provide additional protection in the event of an accident. Additionally, PIP coverage may provide benefits for funeral expenses, rehabilitation, and other related costs that your health insurance may not cover.

Personal Injury Protection Benefits in a Utah car collision (PIP)

In conclusion, the answer to whether Personal Injury Protection is required in Utah is yes. It is a mandatory coverage that every driver must carry in the state. This ensures that in the event of an accident, medical expenses and lost wages can be taken care of without placing an undue burden on the injured party.

While some people may view this as an unnecessary expense, it is important to remember that accidents can happen to anyone, at any time. Personal Injury Protection provides peace of mind and financial protection, regardless of who is at fault.

In summary, if you are a driver in Utah, it is important to make sure you have Personal Injury Protection as part of your auto insurance policy. Not only is it required by law, but it also provides valuable protection for you and your passengers in the event of an accident.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts