Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

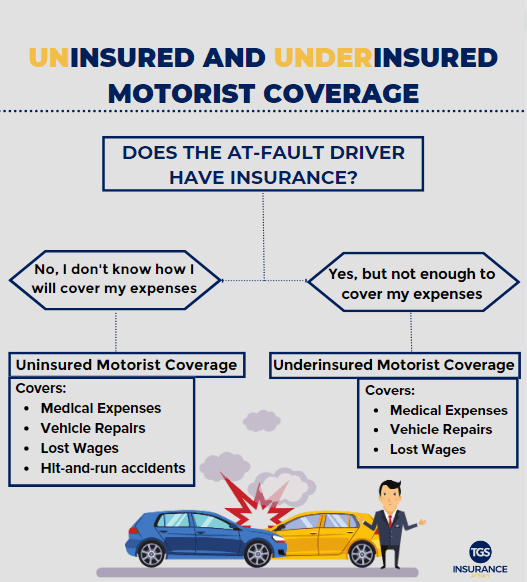

Car accidents can happen to anyone, even the most cautious of drivers. But what happens if the other driver is uninsured or underinsured? That’s where uninsured and underinsured motorist coverage comes in. In this article, we’ll explore what this type of coverage entails and why it’s important for every driver to understand. So buckle up and let’s get started!

Uninsured and underinsured motorist coverage is a type of car insurance that provides financial protection if you’re involved in an accident with a driver who doesn’t have enough insurance or no insurance at all. It covers your medical expenses, lost wages, and damages to your vehicle. It’s important to know that this coverage is optional in some states, but highly recommended to ensure you’re protected in case of an accident.

Contents

- Uninsured and Underinsured Motorist Coverage: What You Need to Know

- What is Uninsured Motorist Coverage?

- What is Underinsured Motorist Coverage?

- Benefits of Uninsured and Underinsured Motorist Coverage

- How Does Uninsured and Underinsured Motorist Coverage Work?

- Uninsured and Underinsured Motorist Coverage vs. Liability Coverage

- Uninsured and Underinsured Motorist Coverage vs. Collision Coverage

- How Much Uninsured and Underinsured Motorist Coverage Do You Need?

- What Does Uninsured and Underinsured Motorist Coverage Not Cover?

- Conclusion

- Frequently Asked Questions

Uninsured and Underinsured Motorist Coverage: What You Need to Know

What is Uninsured Motorist Coverage?

Uninsured Motorist Coverage is a type of insurance policy that covers you and your passengers in the event of an accident caused by a driver who does not have insurance. It is also known as UM coverage. According to the Insurance Research Council, nearly 13% of all drivers in the United States are uninsured.

UM coverage will pay for the damages caused by the uninsured driver, including medical expenses, lost wages, and property damage. This coverage is optional in some states and mandatory in others. In states where it is optional, you may want to consider purchasing UM coverage if you live in an area with a high number of uninsured drivers.

What is Underinsured Motorist Coverage?

Underinsured Motorist Coverage is similar to Uninsured Motorist Coverage. However, it covers you and your passengers when the at-fault driver has insurance, but their policy limits are not enough to cover your damages. For example, if the other driver’s policy has a limit of $50,000, but your damages exceed that amount, Underinsured Motorist Coverage can help cover the difference.

Underinsured Motorist Coverage is also optional in some states and mandatory in others. It is important to note that in some states, you cannot purchase Underinsured Motorist Coverage unless you also have Uninsured Motorist Coverage.

Benefits of Uninsured and Underinsured Motorist Coverage

There are several benefits of having Uninsured and Underinsured Motorist Coverage. First, it provides added protection in case you are involved in an accident with a driver who does not have insurance or whose insurance is not enough to cover your damages. Second, it can help cover medical expenses, lost wages, and property damage, which can quickly add up after an accident. Finally, it can provide peace of mind knowing that you and your passengers are covered in the event of an accident.

How Does Uninsured and Underinsured Motorist Coverage Work?

When you purchase Uninsured and Underinsured Motorist Coverage, you are essentially purchasing additional insurance coverage for yourself and your passengers. In the event of an accident with an uninsured or underinsured driver, you would file a claim with your own insurance company. Your insurance company would then pay for your damages up to the policy limits of your coverage.

It is important to note that Uninsured and Underinsured Motorist Coverage has policy limits, just like any other type of insurance coverage. You will want to make sure you have enough coverage to protect yourself and your passengers in the event of an accident.

Uninsured and Underinsured Motorist Coverage vs. Liability Coverage

Liability coverage is a type of insurance that covers damages you cause to other people and their property in the event of an accident. Uninsured and Underinsured Motorist Coverage, on the other hand, covers you and your passengers in the event of an accident caused by someone else.

While liability coverage is required in most states, Uninsured and Underinsured Motorist Coverage is optional in some states. However, it is important to consider purchasing this coverage, especially if you live in an area with a high number of uninsured drivers.

Uninsured and Underinsured Motorist Coverage vs. Collision Coverage

Collision coverage is a type of insurance that covers damages to your own vehicle in the event of an accident, regardless of who is at fault. Uninsured and Underinsured Motorist Coverage, on the other hand, covers you and your passengers in the event of an accident caused by someone else.

While collision coverage is also optional, it is important to consider purchasing both collision coverage and Uninsured and Underinsured Motorist Coverage to ensure you have adequate protection in the event of an accident.

How Much Uninsured and Underinsured Motorist Coverage Do You Need?

The amount of Uninsured and Underinsured Motorist Coverage you need will depend on several factors, including the number of drivers in your area who are uninsured or underinsured, the value of your vehicle, and your overall financial situation.

It is important to speak with your insurance agent to determine the right amount of coverage for your specific situation. In general, it is recommended that you have at least $100,000 in Uninsured and Underinsured Motorist Coverage.

What Does Uninsured and Underinsured Motorist Coverage Not Cover?

Uninsured and Underinsured Motorist Coverage does not cover damages to your vehicle in the event of an accident. It also does not cover intentional acts or criminal activity, such as vandalism or theft.

It is important to read the terms and conditions of your policy carefully to understand what is and is not covered under your Uninsured and Underinsured Motorist Coverage.

Conclusion

Uninsured and Underinsured Motorist Coverage is an important type of insurance coverage that can provide added protection in the event of an accident with an uninsured or underinsured driver. While it is optional in some states, it is recommended that you consider purchasing this coverage to ensure you and your passengers are fully protected. Be sure to speak with your insurance agent to determine the right amount of coverage for your specific situation.

Frequently Asked Questions

What is Uninsured Motorist Coverage?

Uninsured motorist coverage is a type of insurance that protects you if you are involved in an accident with someone who does not have insurance. If the other driver is at fault and does not have insurance, your uninsured motorist coverage will cover the damages to your vehicle and any medical expenses you incur.

However, it is important to note that uninsured motorist coverage only applies if the other driver is at fault. If you are at fault for the accident, your uninsured motorist coverage will not kick in.

What is Underinsured Motorist Coverage?

Underinsured motorist coverage is a type of insurance that protects you if you are involved in an accident with someone who has insurance, but their coverage is not enough to cover the damages. If the other driver is at fault and their insurance does not cover all of the damages, your underinsured motorist coverage will cover the difference.

It is important to note that underinsured motorist coverage only applies if the other driver is at fault and their insurance is not enough to cover the damages. If you are at fault for the accident, your underinsured motorist coverage will not kick in.

Do I Need Uninsured and Underinsured Motorist Coverage?

While uninsured and underinsured motorist coverage is not required by law in all states, it is highly recommended that you carry this type of coverage. If you are involved in an accident with someone who does not have insurance or does not have enough insurance to cover the damages, you could be left with significant out-of-pocket expenses.

By carrying uninsured and underinsured motorist coverage, you can protect yourself from these expenses and ensure that you are not left financially vulnerable in the event of an accident.

How Much Uninsured and Underinsured Motorist Coverage Should I Carry?

The amount of uninsured and underinsured motorist coverage you should carry depends on a number of factors, including your state’s requirements, your budget, and the value of your vehicle. In general, it is recommended that you carry at least the same amount of uninsured and underinsured motorist coverage as your liability coverage.

However, if you have a high-value vehicle or a significant amount of assets to protect, you may want to consider carrying higher limits of uninsured and underinsured motorist coverage to ensure that you are fully protected in the event of an accident.

How Can I Add Uninsured and Underinsured Motorist Coverage to My Policy?

To add uninsured and underinsured motorist coverage to your policy, you will need to contact your insurance provider. They will be able to provide you with information on the types of coverage available and help you select the coverage that best fits your needs.

In most cases, adding uninsured and underinsured motorist coverage to your policy is a simple process that can be completed quickly and easily. However, it is important to carefully review your policy and ensure that you understand the coverage and any limitations or exclusions that may apply.

In conclusion, uninsured and underinsured motorist coverage can provide crucial protection in the event of an accident with a driver who lacks sufficient insurance. It’s important to carefully review your policy and consider adding this coverage to ensure that you and your loved ones are fully protected on the road.

Remember that the cost of medical bills, vehicle repairs, and other damages can quickly add up, and relying solely on the other driver’s insurance coverage may not be enough. By investing in uninsured and underinsured motorist coverage, you can have peace of mind knowing that you won’t be left with unexpected expenses.

So, take the time to review your insurance policy and discuss your coverage options with your provider. With the right coverage in place, you can feel confident and secure while driving, no matter what unexpected situations may arise.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts