Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

As a driver, one of the most important things you must consider is having the right insurance coverage in case of an accident. Knowing the difference between car accident insurance coverage and underinsured motorist coverage is essential, and can make a huge difference in the aftermath of an accident. In this article, we will explore the differences between car accident insurance coverage and underinsured motorist coverage, so you can make an informed decision when choosing the right coverage for you.

| Car Accident Insurance Coverage | Underinsured Motorist Coverage |

|---|---|

| Covers costs for medical expenses, property damage, and other costs associated with a car accident. | Provides additional coverage for costs that exceed the at-fault driver’s insurance limits. |

| Usually required by state law. | Optional in some states. |

| Generally covers injury and property damage to you and other drivers. | May provide coverage for additional costs that exceed the at-fault driver’s insurance limits. |

Chart Comparing: Car Accident Insurance Coverage Vs Underinsured Motorist Coverage

| Car Accident Insurance Coverage | Underinsured Motorist Coverage |

|---|---|

| Car accident insurance coverage is a type of coverage that helps drivers pay for expenses after an accident, such as medical bills and repair costs. | Underinsured motorist coverage is a type of insurance that helps drivers pay for expenses after an accident if the other driver has insufficient insurance coverage. |

| Benefits | Benefits |

|

|

| Cost | Cost |

| The cost of car accident insurance coverage varies depending on the type of coverage purchased and the deductible amount. | The cost of underinsured motorist coverage is usually included in the policyholder’s overall car insurance premium. |

| Eligibility | Eligibility |

| Most drivers are eligible to purchase car accident insurance coverage. | In order to be eligible for underinsured motorist coverage, the policyholder must purchase a car insurance policy that includes this type of coverage. |

Contents

Car Accident Insurance Coverage Vs Underinsured Motorist Coverage

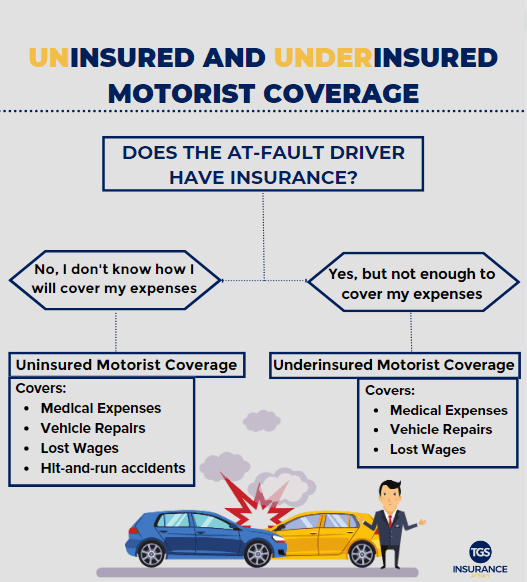

Car accidents can cause a great deal of damage and can put a significant financial burden on those involved. To help mitigate the costs, it is important to have adequate insurance coverage. Knowing the differences between car accident insurance coverage and underinsured motorist coverage can help you make the best decision for your individual situation.

Car Accident Insurance Coverage

Car accident insurance coverage is the most common type of car insurance and is typically required by law. It covers the costs associated with damages to your vehicle and medical expenses related to an accident. Most policies provide coverage for a set amount of money, generally up to the market value of the vehicle. This type of coverage is typically the most economical option and is the best choice for those who own a car with a lower value.

Underinsured Motorist Coverage

Underinsured Motorist Coverage is an additional type of car insurance coverage that helps protect you from costs associated with an accident caused by an underinsured driver. If the other driver is at fault and does not have sufficient insurance coverage to pay for the damages, this type of coverage will cover the difference. This type of coverage is typically more expensive but can provide peace of mind for those who own a car with a higher value.

Differences Between the Two

The primary difference between car accident insurance coverage and underinsured motorist coverage is the amount of coverage and the cost of the policy. Car accident insurance coverage is the most economical option and provides coverage up to the market value of the vehicle. Underinsured motorist coverage is typically more expensive but it provides additional coverage if the other driver is at fault and does not have sufficient insurance coverage.

Factors to Consider When Choosing Coverage

When deciding which type of coverage is best for you, it is important to consider your individual circumstances. If you own a car with a lower value, car accident insurance coverage may be the most cost-effective option. However, if you own a car with a higher value, underinsured motorist coverage may be the better choice. It is also important to consider the laws in your state as some states require a certain amount of coverage.

Comparison of Coverage and Cost

When comparing car accident insurance coverage and underinsured motorist coverage, it is important to consider both the amount of coverage and the cost of the policy. Car accident insurance coverage is typically the most economical option and provides coverage up to the market value of your vehicle. Underinsured motorist coverage is typically more expensive but provides additional coverage if the other driver is at fault and does not have sufficient insurance coverage.

Finding the Right Insurance

Finding the right insurance for your individual situation can be a daunting task. It is important to consider all of your options and determine which type of coverage is best suited for your individual needs. It is also important to compare policies and rates from different providers to ensure you are getting the best value for your money.

Car Accident Insurance Coverage Vs Underinsured Motorist Coverage Pros & Cons

Pros of Car Accident Insurance Coverage

- Provides protection if you are involved in an accident with an underinsured driver

- Protects you from the costs of repairing or replacing your vehicle and any medical bills

- Provides coverage if the other driver is uninsured

Cons of Car Accident Insurance Coverage

- May not provide enough coverage for serious accidents

- May be expensive to purchase and maintain

- Can be difficult to obtain if you have a bad driving record

Pros of Underinsured Motorist Coverage

- Provides extra coverage if an accident involves an uninsured or underinsured driver

- Can provide extra coverage if an accident involves a hit and run driver

- Can be less expensive than car accident insurance coverage

Cons of Underinsured Motorist Coverage

- May not provide enough coverage for serious accidents

- May be difficult to obtain if you have a bad driving record

- Can be expensive to purchase and maintain

Which is Better – Car Accident Insurance Coverage Vs Underinsured Motorist Coverage?

When it comes to car accident insurance coverage and underinsured motorist coverage, it can be difficult to decide which option is the better choice. Both types of coverage provide protection in the event of an accident, but there are some differences to consider. Ultimately, it will depend on your individual circumstances and needs. Here are some things to consider when deciding which type of coverage is best for you.

Car accident insurance coverage provides coverage for medical expenses, lost wages, and property damage resulting from an accident. Underinsured motorist coverage provides additional coverage for medical expenses if the other driver’s coverage is not adequate. In this case, the underinsured motorist coverage will provide the additional coverage up to the limits of the policy.

When weighing the two types of coverage, it is important to take into account your individual needs. Consider what type of coverage is best for your situation and budget. For example, if you have a high-end vehicle, you may want to opt for the additional coverage of underinsured motorist coverage. However, if you have an older vehicle, car accident insurance coverage may be sufficient.

To help make the decision, here are three reasons why underinsured motorist coverage is the better choice:

- It provides additional coverage in the event the other driver’s coverage is not adequate.

- It covers medical expenses, lost wages, and property damage up to the limits of the policy.

- It offers an extra layer of protection for high-end vehicles.

In conclusion, underinsured motorist coverage is often the better choice when it comes to car accident insurance coverage. It provides additional coverage in the event of an accident and is better suited for high-end vehicles. Ultimately, it will depend on your individual needs and budget.

Frequently Asked Questions:

Are you confused about car accident insurance coverage and underinsured motorist coverage? Here are some frequently asked questions to help you understand the difference.

What is Car Accident Insurance Coverage?

Car accident insurance coverage is a type of insurance policy that covers costs associated with damages caused in an automobile accident. This type of coverage typically pays for repairs to the car, as well as medical expenses for any injuries sustained in the accident. It can also cover lost wages if the accident results in a disability. Depending on the policy and the state you live in, car accident insurance coverage may also provide coverage for a rental car if the insured’s car is not drivable.

What is Underinsured Motorist Coverage?

Underinsured motorist coverage is an insurance policy that provides additional coverage if an accident is caused by a driver who does not have enough insurance to cover all of the damages. This type of coverage will pay for the difference between the amount of insurance coverage that the other driver has and the amount of damage that was caused. This type of coverage can be beneficial if the other driver doesn’t have enough insurance to cover all of the costs associated with the accident.

Do I Need Both Car Accident Insurance Coverage and Underinsured Motorist Coverage?

It depends on your situation. If you are not comfortable with the amount of car accident insurance coverage you have, then it is a good idea to consider purchasing underinsured motorist coverage. This type of coverage will provide additional protection if you are in an accident with an underinsured driver. If you are confident that your car accident insurance coverage is enough, then you may not need to purchase additional coverage.

How Much Does Car Accident Insurance Coverage Cost?

The cost of car accident insurance coverage varies depending on the policy and the state you live in. Generally speaking, it is a good idea to shop around and compare policies to get the best rate. Most insurers will also offer discounts if you have multiple vehicles covered.

How Much Does Underinsured Motorist Coverage Cost?

The cost of underinsured motorist coverage varies, but it is generally more affordable than car accident insurance coverage. The cost of this type of coverage is typically based on how much coverage you want and the type of policy you choose. It is important to remember that the cost of underinsured motorist coverage can be more than the cost of car accident insurance coverage, so it is important to compare policies to make sure you get the best coverage at the best price.

The decision of whether or not to opt for car accident insurance or underinsured motorist coverage is a difficult one. Ultimately, the decision should be based on personal preference and budget considerations. Both coverage types offer valuable protection and peace of mind knowing that if an accident occurs, you will be properly covered. With careful consideration and research, you can find the right coverage for your needs.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts