Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

General liability insurance is an essential part of any business’s risk management strategy. It protects against third-party claims for bodily injury, property damage, and other liabilities that may arise from your business operations. However, many business owners are still confused about whether general liability insurance covers personal injury claims. In this article, we will explore the intricacies of general liability insurance and help you understand whether it covers personal injury claims.

Personal injury claims can be costly and time-consuming for any business. That’s why it’s important to have a clear understanding of your insurance coverage. By the end of this article, you will have a better understanding of what general liability insurance covers, what it doesn’t cover, and how it can protect your business from financial loss. So, let’s dive in and explore the world of general liability insurance and personal injury claims.

Yes, general liability insurance typically covers personal injury claims. This type of insurance can protect individuals and businesses from financial losses resulting from bodily injuries, property damage, and other liabilities that may arise during normal business operations. However, it’s important to review the terms and conditions of your policy to ensure that your personal injury claim is covered.

Does General Liability Insurance Cover Personal Injury?

When it comes to owning a business, there are many risks and challenges that come with it. One of the most significant risks is the possibility of a customer or employee getting injured on your property. In such cases, general liability insurance can come in handy. But the question arises, does general liability insurance cover personal injury?

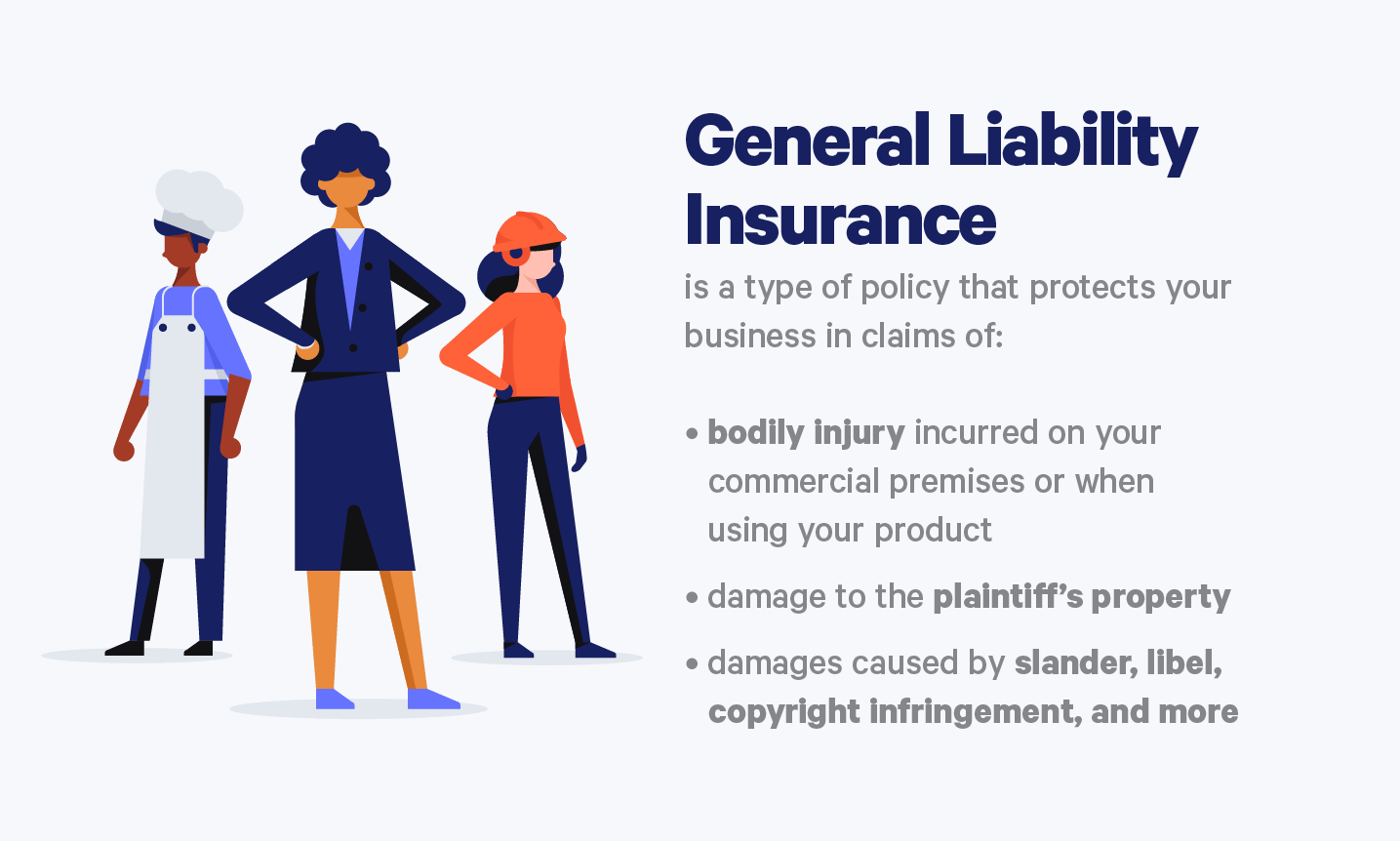

What is General Liability Insurance?

General Liability Insurance (GLI) is an insurance policy that protects businesses from third-party claims of bodily injury, property damage, and personal injury. It covers a range of risks that businesses may face, such as slip-and-fall accidents, product liability claims, and damage to customer property.

The policy covers the legal costs of defending against claims made by third parties and the damages awarded to the plaintiff. It also covers medical expenses, lost wages, and other costs associated with the injury or damage.

Does General Liability Insurance Cover Personal Injury?

Yes, General Liability Insurance does cover personal injury. The policy covers bodily injury, which includes physical harm, sickness, disease, or death. Personal injury, on the other hand, includes harm caused by false arrest, detention, or imprisonment, malicious prosecution, wrongful eviction, slander, or libel.

The coverage applies to injuries that occur on the business premises or as a result of the business operations. For example, if a customer slips and falls in your store, general liability insurance will cover their medical expenses. If an employee causes injury to a customer while performing their duties, the policy will cover the damages.

Benefits of General Liability Insurance

Having general liability insurance has several benefits for businesses. Firstly, it protects against the financial burden of lawsuits and damages. Secondly, it gives customers and employees peace of mind knowing that they are protected if anything goes wrong.

Thirdly, it helps businesses maintain their reputation by showing that they are responsible and reliable. Finally, having general liability insurance can make it easier to secure contracts and partnerships with other businesses.

General Liability Insurance Vs. Personal Injury Insurance

While General Liability Insurance covers personal injury, it is not the same as Personal Injury Insurance. Personal Injury Insurance is a separate policy that covers injuries caused by the business owner or employees. It covers actions such as false arrest, malicious prosecution, and invasion of privacy.

The coverage is more specific and may not be necessary for all businesses. However, it can be beneficial for businesses that deal with sensitive information or have a high risk of personal injury claims.

Conclusion

In conclusion, General Liability Insurance does cover personal injury. It provides businesses with protection against third-party claims of bodily injury, property damage, and personal injury. Having this insurance can help businesses avoid financial ruin and maintain their reputation. It is essential to understand the coverage provided by general liability insurance and to assess whether additional personal injury insurance is necessary for your business.

Contents

Frequently Asked Questions

What is General Liability Insurance?

General Liability Insurance is a type of insurance that is designed to protect businesses from financial losses due to legal claims made against them by third parties. This type of insurance typically covers claims that arise from bodily injury or property damage that is caused by the business or its employees.

What is Personal Injury?

Personal Injury is a legal term that refers to any injury that is suffered by a person, rather than damage to property. Examples of personal injury include slip and fall accidents, dog bites, and car accidents.

Does General Liability Insurance Cover Personal Injury?

Yes, General Liability Insurance typically covers personal injury claims. However, it is important to note that not all personal injury claims are covered by this type of insurance. For example, if a business owner intentionally causes harm to someone, that would not be covered by General Liability Insurance.

In addition, some types of personal injury claims, such as those that arise from professional services provided by a business, may not be covered by General Liability Insurance. It is important to carefully review the terms of your policy to understand what is and is not covered.

What is the Difference Between General Liability Insurance and Personal Injury Insurance?

General Liability Insurance is a type of insurance that is designed to protect businesses from financial loss due to legal claims made against them by third parties. Personal Injury Insurance, on the other hand, is a type of insurance that is designed to protect individuals from financial loss due to injuries suffered in accidents.

While both types of insurance may cover personal injury claims, they are designed to protect different parties. General Liability Insurance is designed to protect businesses, while Personal Injury Insurance is designed to protect individuals.

How Much General Liability Insurance Should I Have?

The amount of General Liability Insurance that you should have depends on a number of factors, including the size of your business, the types of products or services that you offer, and the level of risk associated with your industry.

In general, it is a good idea to have enough General Liability Insurance to cover the maximum potential loss that your business could incur in a legal claim. This may require working with an insurance agent to evaluate your specific risks and needs, and to determine the appropriate amount of coverage.

In conclusion, it is essential for individuals and businesses to understand the coverage provided by general liability insurance policies. While these policies generally cover bodily injury and property damage claims, they may not cover personal injury claims. Personal injury claims may require a separate policy, such as a personal injury liability policy or a worker’s compensation policy. It is important to carefully review policy language and consult with an insurance professional to determine the appropriate coverage needed to protect against unforeseen accidents and injuries. By taking these steps, individuals and businesses can ensure they are adequately protected and prepared for any potential liability claims.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts