Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Biking has become a popular mode of transportation for many people, especially those who want to save money and reduce their carbon footprint. However, accidents can happen, and it’s important to know if your homeowners insurance covers bike accidents.

In this article, we’ll explore the ins and outs of homeowners insurance and bike accidents. We’ll discuss what is covered, what is not covered, and how to ensure that you have the protection you need in case of an accident. So, let’s dive in and find out if your homeowners insurance has got your back when it comes to bike accidents.

Homeowners insurance may or may not cover bike accidents, depending on the policy and circumstances of the accident. Some policies may provide coverage for bike accidents as a form of personal liability coverage, while others may exclude coverage for accidents involving vehicles or non-motorized transportation. It’s important to review your policy or speak with your insurance provider to understand what is and isn’t covered.

Does Homeowners Insurance Cover Bike Accidents?

Biking is a fun and healthy way to get around, but accidents can happen. If you are a homeowner who loves to bike, you may be wondering if your homeowners insurance covers bike accidents. The short answer is, it depends. Let’s take a closer look at what your homeowners insurance policy may cover.

1. Personal Liability Coverage

Personal liability coverage is a part of most homeowners insurance policies. This coverage protects you if you are found liable for injuring someone else or damaging their property. So, if you were biking and accidentally hit someone, your personal liability coverage may help pay for their medical expenses and any damages they incurred.

However, your personal liability coverage may not cover injuries or damages that you caused intentionally. It’s important to read your policy carefully to understand the exclusions and limitations of your coverage.

2. Medical Payments Coverage

Medical payments coverage is another type of coverage that is included in most homeowners insurance policies. This coverage helps pay for medical expenses if someone is injured on your property, regardless of who is at fault.

If you were biking on your own property and were injured, your medical payments coverage may help pay for your medical expenses. However, if you were biking on someone else’s property and were injured, their homeowners insurance may be responsible for paying your medical expenses.

3. Property Damage Coverage

If you accidentally damage someone else’s property while biking, your homeowners insurance may help pay for the damages. For example, if you accidentally hit a parked car while biking, your property damage coverage may help pay for the damages to the car.

It’s important to note that your property damage coverage may not cover damages to your own property. If you want to protect your bike, you may need to purchase additional coverage, such as a separate bike insurance policy.

4. Exclusions and Limitations

While homeowners insurance may provide some coverage for bike accidents, there are often exclusions and limitations. For example, your coverage may only apply if you were biking on your own property, or if the accident was not caused intentionally.

It’s important to read your policy carefully to understand the exclusions and limitations of your coverage. If you have any questions, be sure to speak with your insurance agent.

5. Benefits of Homeowners Insurance for Bikers

While homeowners insurance may not provide comprehensive coverage for bike accidents, it can still be a valuable resource for bikers. Homeowners insurance can provide liability coverage for accidents that occur on your property, as well as protect your property from damage caused by other perils, such as fire or theft.

Additionally, if you have a home-based business that involves biking, your homeowners insurance may provide some coverage for your business equipment and liability. Be sure to speak with your insurance agent to understand the limits of your coverage.

6. Bike Insurance vs Homeowners Insurance

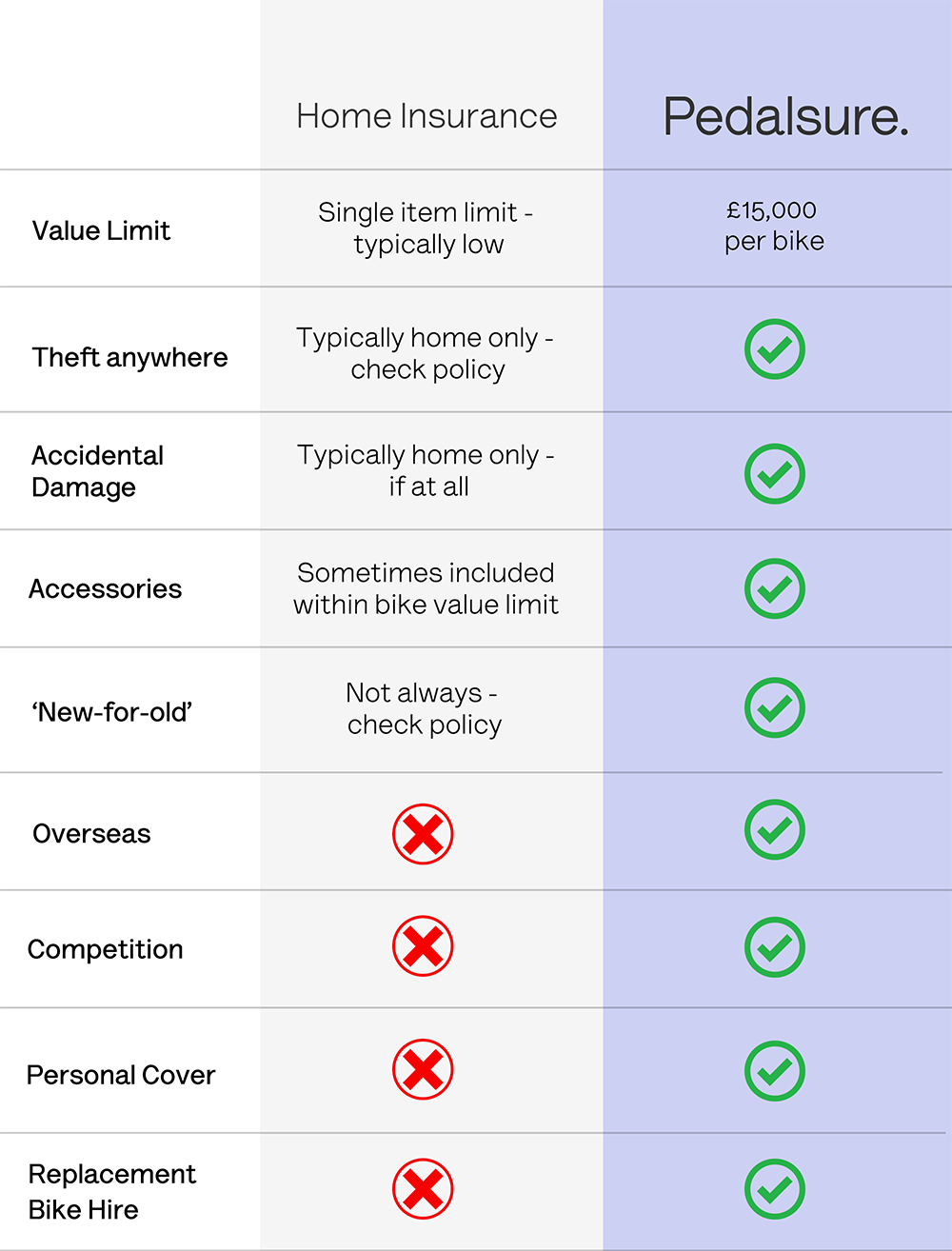

If you are a serious biker, you may want to consider purchasing a separate bike insurance policy. Bike insurance can provide more comprehensive coverage for your bike, including theft, damage, and liability coverage while you are riding.

While homeowners insurance may provide some coverage for bike accidents, it may not be enough to fully protect your bike. Additionally, if you frequently bike outside of your property, your homeowners insurance may not provide coverage for accidents that occur off your property.

7. How to Choose the Right Coverage

When it comes to protecting yourself and your bike, it’s important to choose the right coverage. If you are a casual biker who only rides on your own property, your homeowners insurance may provide enough coverage.

However, if you are a serious biker who frequently rides on public roads or trails, you may want to consider purchasing a separate bike insurance policy. Be sure to compare different policies and speak with your insurance agent to find the coverage that is right for you.

8. Tips for Preventing Bike Accidents

While insurance can provide financial protection after a bike accident, it’s always better to prevent accidents from happening in the first place. Here are some tips for preventing bike accidents:

– Wear a helmet and other protective gear

– Follow traffic laws and signals

– Use bike lanes or paths when available

– Be visible to drivers by wearing bright or reflective clothing

– Use hand signals to communicate your intentions

– Stay alert and focused on the road

9. What to Do If You Are in a Bike Accident

If you are in a bike accident, it’s important to stay calm and take the following steps:

– Check yourself and others for injuries

– Call for medical help if needed

– Exchange contact and insurance information with the other party

– Take photos of the scene and any damages

– Report the accident to your insurance company

10. Conclusion

In conclusion, homeowners insurance may provide some coverage for bike accidents, but it’s important to read your policy carefully to understand the limitations and exclusions of your coverage. If you are a serious biker, you may want to consider purchasing a separate bike insurance policy to fully protect yourself and your bike. Regardless of your coverage, always take steps to prevent bike accidents and be prepared in case an accident does occur.

Contents

Frequently Asked Questions

Homeowners insurance is an important investment to protect your home and personal property. However, many people wonder if it covers bicycle accidents. Here are some frequently asked questions and answers to help you understand how homeowners insurance works in relation to bike accidents.

What is covered under homeowners insurance for bike accidents?

Homeowners insurance typically covers personal liability, which includes accidents that occur on your property or off it. If you are found responsible for causing a bike accident while riding your bike, your homeowners insurance may cover any damages or injuries caused to the other party. However, it’s important to check with your insurance provider to understand the specifics of your policy and any limitations or exclusions.

Additionally, some homeowners insurance policies may offer coverage for stolen or damaged bicycles. Again, it’s essential to read your policy to understand the coverage limits and any restrictions that may apply.

What is not covered under homeowners insurance for bike accidents?

While homeowners insurance may provide coverage for bike accidents, there are some situations where it may not apply. For example, if you are involved in a bike accident while operating a motor vehicle, your car insurance policy would likely be responsible for covering any damages or injuries. Additionally, if you are injured while riding your own bike, your health insurance policy would typically be responsible for medical expenses.

It’s also important to note that if you cause a bike accident while under the influence of drugs or alcohol, your homeowners insurance policy may not provide coverage.

Do I need additional insurance for bike accidents?

It’s always a good idea to consider additional insurance coverage for bike accidents. While homeowners insurance may provide some coverage, it may not be enough to cover all damages or injuries. If you frequently ride your bike, you may want to consider a separate bicycle insurance policy that provides comprehensive coverage for theft, damage, and liability.

Additionally, if you participate in organized bike races or events, you may need specialized insurance coverage to protect yourself and others from accidents that may occur during these activities.

How can I minimize the risk of bike accidents?

While accidents can happen, there are steps you can take to minimize the risk of bike accidents. Always wear a helmet and make sure your bike is in good condition before riding. Follow traffic laws and be aware of your surroundings. Avoid riding at night or in inclement weather, and always use appropriate lighting or reflective gear to make yourself visible to others on the road.

It’s also a good idea to consider taking a bike safety course to improve your riding skills and learn how to avoid accidents.

What should I do if I am involved in a bike accident?

If you are involved in a bike accident, the first step is to seek medical attention if necessary. If possible, exchange contact and insurance information with the other party involved in the accident. Take photos of the scene and any damage to your bike or personal property.

Report the accident to your insurance provider as soon as possible. Depending on the circumstances, you may also need to file a police report or seek legal advice if you are facing liability or damages claims.

In conclusion, homeowners insurance may cover bike accidents under certain circumstances. It is important to review your policy and speak with your insurance provider to understand the specific coverage options available to you. While some policies may include coverage for personal liability and property damage, others may require additional endorsements or separate policies for adequate protection.

It is also important to note that in the event of a bike accident, you should take the necessary steps to document the incident and gather any relevant information, such as witness statements and police reports. This can help to support your insurance claim and ensure that you receive the coverage you need.

Ultimately, the best way to protect yourself and your property from bike accidents is to practice safe riding habits and invest in quality protective gear. By taking these steps and understanding your insurance coverage options, you can enjoy the freedom and convenience of biking with greater peace of mind.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts