Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Car accidents can be a major headache, from the damage to your vehicle to the potential injuries and complications that can arise. But what about the impact on your car insurance? Many drivers wonder whether their rates will go up after an accident, and the answer is not always clear-cut. In this article, we’ll explore the factors that can influence your car insurance rates after an accident, so you can be better prepared for the potential consequences.

Whether you’re a new driver or an experienced one, accidents can happen to anyone. And when they do, it’s natural to worry about the financial fallout. But understanding how car insurance rates are calculated and what factors can influence them can help you make informed decisions about your coverage. So, let’s dive in and explore the ins and outs of car insurance after an accident.

Yes, your car insurance may go up after an accident, depending on various factors such as the severity of the accident, who was at fault, and your driving history. If you were found at fault for the accident, your premium could increase significantly. However, if the accident was not your fault, your premium may not increase or may only increase slightly. It’s always a good idea to speak with your insurance provider to understand how an accident may impact your policy.

Contents

- Does Your Car Insurance Go Up After an Accident?

- Frequently Asked Questions

- What factors determine if my car insurance rates will go up after an accident?

- How much can my car insurance rates go up after an accident?

- How long will my car insurance rates stay high after an accident?

- What can I do to lower my car insurance rates after an accident?

- Will my car insurance rates go up if the accident wasn’t my fault?

Does Your Car Insurance Go Up After an Accident?

Understanding How Car Insurance Works

Car insurance is a contract between you and your insurance company. The insurance company agrees to pay for damages you cause to other people or their property, while you pay a premium to the insurance company. The amount of the premium you pay depends on a variety of factors including your age, driving record, and the type of car you drive.

When you are involved in an accident, your insurance company will likely increase your premium. This is because accidents are a sign of increased risk. Insurance companies base their premiums on the likelihood that a driver will be involved in an accident. If you are involved in an accident, your insurance company will view you as a higher risk driver and will increase your premium accordingly.

How Much Will Your Premium Increase?

There is no set amount that your premium will increase after an accident. The amount of the increase will depend on several factors including the severity of the accident, your driving record, and the type of car you drive.

If you have a history of accidents or traffic violations, your premium increase will likely be more significant. Additionally, if you are driving a high-performance car, your premium increase will be higher because these cars are more expensive to repair.

How Long Will Your Premium Increase Last?

After an accident, your premium increase will typically last for three years. During this time, you will pay a higher premium than you did before the accident. After three years, your premium will decrease, assuming you do not have any additional accidents or traffic violations.

What Can You Do to Lower Your Premium After an Accident?

There are several things you can do to lower your premium after an accident. The first thing you should do is shop around for insurance. Different insurance companies have different rates, and you may be able to find a company that offers a lower premium than your current insurance company.

You can also take a defensive driving course. Many insurance companies offer discounts to drivers who complete these courses because they are seen as lower risk drivers.

The Benefits of Having Car Insurance

Having car insurance is important because it protects you financially if you are involved in an accident. Without insurance, you would be responsible for paying for any damages you cause out of your own pocket. This could be financially devastating, especially if the damages are significant.

Car insurance also provides peace of mind. Knowing that you are protected if you are involved in an accident can help you feel more secure when you are on the road.

Car Insurance Vs Not Having Car Insurance

The difference between having car insurance and not having car insurance can be significant. If you are involved in an accident and do not have insurance, you will be responsible for paying for any damages you cause out of your own pocket. This could be a significant financial burden, especially if the damages are significant.

Having car insurance provides you with financial protection and peace of mind. If you are involved in an accident, your insurance company will pay for any damages you cause, up to the limits of your policy. This can help you avoid significant financial hardship.

In Summary

If you are involved in an accident, your car insurance premium will likely increase. The amount of the increase will depend on several factors, including the severity of the accident and your driving record. However, there are things you can do to lower your premium after an accident, including shopping around for insurance and taking a defensive driving course.

Having car insurance is important because it provides financial protection and peace of mind. Without insurance, you would be responsible for paying for any damages you cause out of your own pocket, which could be financially devastating.

Frequently Asked Questions

Car accidents are stressful situations, and one of the most common concerns for drivers is how it will affect their car insurance rates. Here are some frequently asked questions about whether or not your car insurance rates will go up after an accident.

What factors determine if my car insurance rates will go up after an accident?

There are several factors that can determine if your car insurance rates will go up after an accident. These can include the severity of the accident, who was at fault, and how much damage was done to your car and any other vehicles involved. Your driving record and insurance history may also be taken into consideration.

If you have a history of accidents or traffic violations, your rates may be more likely to increase. On the other hand, if you have a clean driving record and have been a loyal customer of your insurance company, they may be more lenient with your rates.

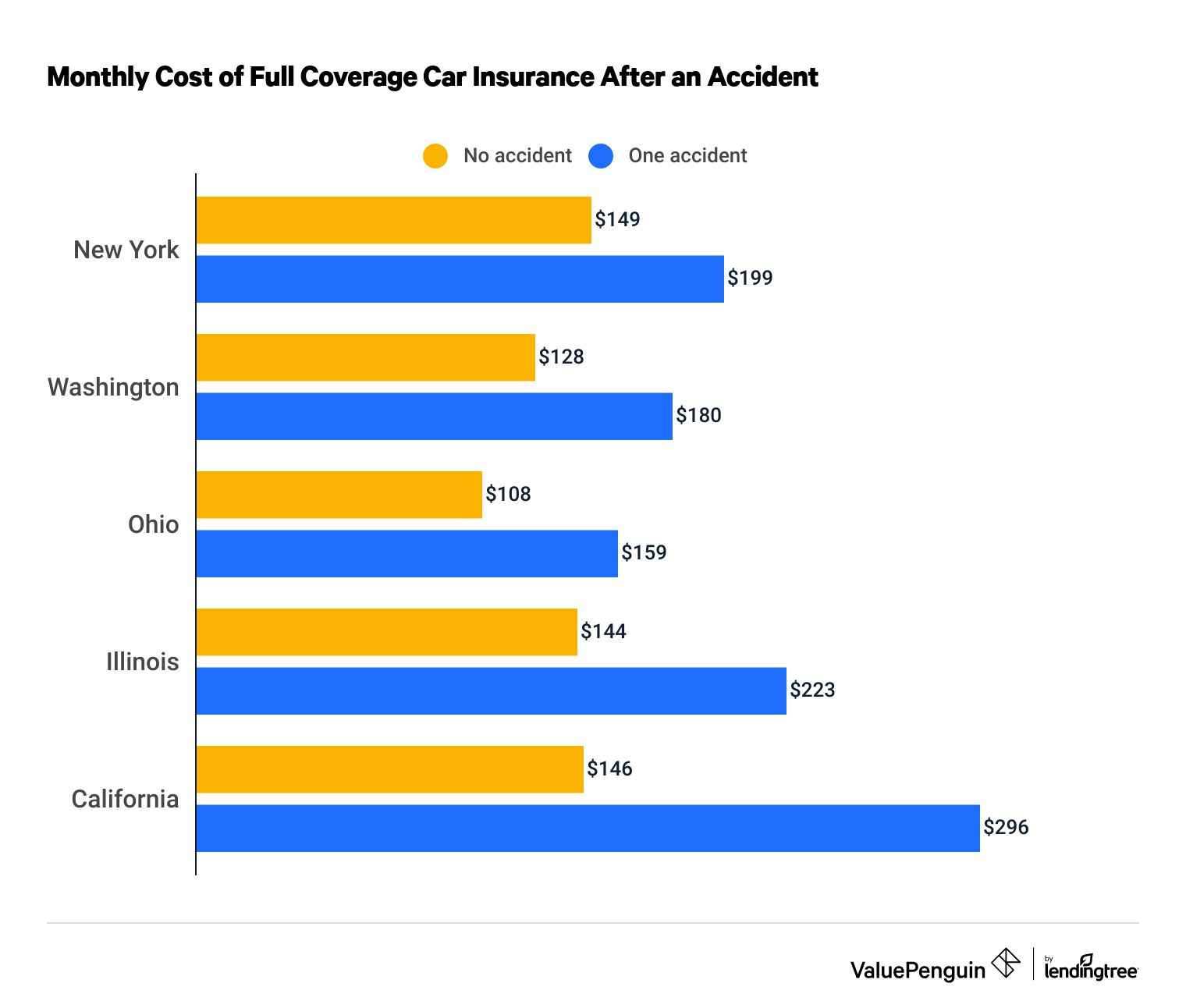

How much can my car insurance rates go up after an accident?

The amount that your car insurance rates will go up after an accident can vary. Typically, if you are found to be at fault for the accident, your rates will increase more than if the other driver was at fault. The amount of damage done to the vehicles involved can also impact your rates.

On average, a single accident can cause your rates to increase by anywhere from 20% to 50%. However, this can vary depending on your insurance company and the specific details of the accident.

How long will my car insurance rates stay high after an accident?

The length of time that your car insurance rates will stay high after an accident can vary. Generally, your rates will stay high for at least three years after the accident. However, if you have a clean driving record and no additional accidents or traffic violations, your rates may start to decrease after the first year.

It’s important to note that insurance companies have different policies when it comes to how long they consider an accident when determining rates. Some may only look back three years, while others may look back five or more years.

What can I do to lower my car insurance rates after an accident?

If your car insurance rates have increased after an accident, there are a few things you can do to try and lower them. One option is to shop around for a new insurance policy. Different insurance companies may offer lower rates or be more willing to forgive a single accident.

You can also consider increasing your deductible, which is the amount you pay out of pocket before your insurance kicks in. A higher deductible can lower your monthly premiums, but keep in mind that you’ll need to pay more out of pocket if you get into another accident.

Will my car insurance rates go up if the accident wasn’t my fault?

If the accident wasn’t your fault, your car insurance rates may or may not go up. It depends on your insurance company and their policies. Some insurance companies may not increase your rates if you were not at fault for the accident.

However, even if your rates don’t go up, filing a claim with your insurance company can still impact your rates. This is because insurance companies use claims history to determine rates, so even if you were not at fault for the accident, your rates may still increase slightly.

In conclusion, it is important to understand that car insurance rates can go up after an accident, but it is not always the case. Insurance companies take several factors into consideration when determining a driver’s rate, including their driving history, age, and location.

If you are involved in an accident, it is important to report it to your insurance company as soon as possible. Your insurance company will investigate the accident and determine who is at fault. Depending on the circumstances, your rate may increase or remain the same.

To avoid a potential rate increase, it is important to drive safely and follow traffic laws. This includes avoiding distracted driving, following speed limits, and always wearing a seatbelt. Remember, the best way to keep your car insurance rates low is by being a safe and responsible driver.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts