Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Hit and run accidents can be some of the most devastating experiences for anyone involved, and the legal process of filing a claim can be complicated and overwhelming. In the United States, if you are involved in a hit and run accident, you may be able to file a claim with your insurance company for uninsured motorist coverage. In this article, we will explore the differences between a hit and run accident and an uninsured motorist claim and what you should do if you ever find yourself in this situation.

| Hit and Run Accident | Uninsured Motorist Claim |

|---|---|

| Hit and run accidents refer to collisions where the at-fault driver does not stop after the crash. | Uninsured motorist claims are insurance claims made against your own insurance policy when the at-fault driver does not carry insurance. |

| Often difficult to find the at-fault driver, or prove fault. | The at-fault driver can be identified, and liability is usually easier to prove. |

| Compensation for damages may be limited. | Higher potential for compensation for damages, since the at-fault driver’s insurance company is liable. |

Hit And Run Accident Vs Uninsured Motorist Claim: In-Depth Comparison Chart

| Hit and Run Accident | Uninsured Motorist Claim |

|---|---|

| Involves a driver hitting another vehicle or person and then leaving the scene without providing contact information. | Involves a driver causing damage to another vehicle or person, and the other driver does not have the necessary insurance coverage. |

| The police are usually involved in investigating the incident. | The police are usually not involved in investigating the incident. |

| Will require the driver to file a police report. | Will require the driver to file a claim with their insurance company. |

| Can often result in criminal charges for the offending driver. | Can often result in the driver being denied coverage. |

| Can be difficult to identify the offending driver. | The offending driver is usually known. |

| The driver may be responsible for paying the damages out-of-pocket. | The driver’s insurance company may be responsible for paying the damages. |

| May involve a lengthy and complex legal process. | May involve a lengthy and complex insurance claims process. |

| Can be expensive for the victim to pursue. | Can be expensive for the victim to pursue. |

| The victim may be able to seek compensation from the driver through a civil suit. | The victim may be able to seek compensation from the driver’s insurance company. |

| The victim may be able to seek compensation through a personal injury protection (PIP) claim. | The victim may be able to seek compensation through uninsured motorist coverage. |

| The victim may be able to seek compensation through a uninsured motorist claim. | The victim may be able to seek compensation through a hit and run claim. |

Contents

Hit and Run Accident Vs Uninsured Motorist Claim

Hit and run accidents and uninsured motorist claims can both be emotionally and financially taxing to endure. It is important to have an understanding of how they differ and what to do in the event of either situation. This article will discuss the differences between a hit and run accident and an uninsured motorist claim, as well as provide information on how to take action in both scenarios.

Hit and Run Accident

A hit and run accident occurs when an individual is struck by another driver who then leaves the scene of the accident without providing their name, contact information, or insurance details. In most states, it is illegal to leave the scene of an accident without providing this information. The victim of the hit and run accident will need to file a police report and submit a claim to their own insurance provider in order to have their vehicle repaired and receive medical care.

The victim can also take additional steps to try and identify the driver who fled the scene. These can include reviewing surveillance footage of the area, speaking to witnesses, and/or working with a private investigator. However, it is important to note that in many cases, the driver may never be identified.

If the driver is identified, the victim may have the option of filing a personal injury lawsuit against them or filing a claim with the driver’s insurance provider (if they have one). It is important to note that if the driver is not identified, the victim may have no legal recourse.

Uninsured Motorist Claim

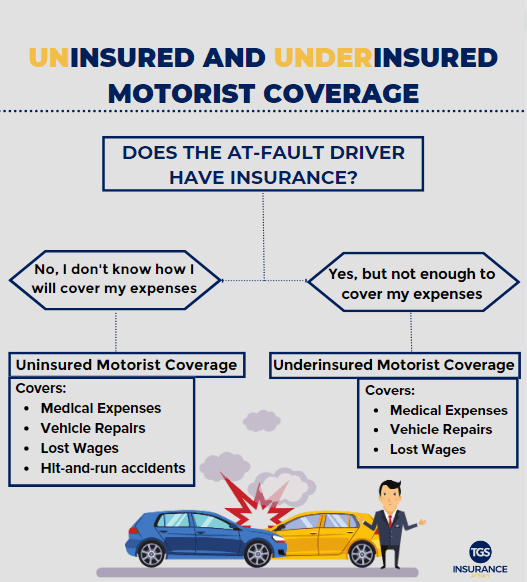

An uninsured motorist claim occurs when another driver is at fault for an accident, but they do not have insurance. This can be a situation where the driver does not have insurance, or the driver’s insurance does not cover the costs of the accident. In this situation, the victim can file a claim with their own insurance provider in order to receive compensation for the damages.

In some states, uninsured motorist coverage may be included in the victim’s own insurance policy. Uninsured motorist coverage can provide financial compensation for medical bills, car repairs, and in some cases, lost wages. It is important to note that the amount of coverage varies depending on the insurance provider and the state in which the accident occurred.

In addition, the victim may also have the option of filing a personal injury lawsuit against the other driver if they have the financial means to do so. This can be a lengthy and costly process, but it can often provide more compensation than submitting a claim to the victim’s own insurance provider.

Filing a Claim

In both scenarios, it is important to take action quickly in order to receive the maximum amount of compensation. The victim should file a police report and contact their insurance provider as soon as possible to begin the process of filing a claim. The victim should also gather evidence of the accident, such as photos, witness statements, and medical records.

It is also important to speak to a qualified personal injury attorney in order to understand the legal options available in the case. An attorney can provide guidance on how to proceed with the claim and can help to ensure that the victim receives the maximum amount of compensation.

Seeking Compensation

In both scenarios, the victim should be aware that the process of seeking compensation can be lengthy and complicated. It is important to have patience and to work with a qualified attorney to ensure that all legal options are explored. It is also important to remember that the amount of compensation received will depend on the state in which the accident occurred and the particulars of the case.

It is also important to remember that, in the case of a hit and run accident, the victim may not be able to identify the driver who caused the accident and therefore may not have any legal recourse. In this situation, the victim may be able to receive compensation from their own insurance provider if they have uninsured motorist coverage.

In the case of an uninsured motorist claim, the victim should be aware that the amount of compensation received will depend on the state in which the accident occurred and the particulars of the case. The victim should work with a qualified attorney to ensure that all legal options are explored and that they receive the maximum amount of compensation.

Hit and Run Accident Vs Uninsured Motorist Claim Pros & Cons

Hit and Run Accident Pros:

- Victim can still get compensation from their own insurance company.

- No need to identify the perpetrator.

- No need to deal with the perpetrator’s insurance company.

Hit and Run Accident Cons:

- Victim may not receive full compensation for their damages.

- It can be difficult to receive compensation from the insurance company.

- The process of filing a claim can be complicated.

Uninsured Motorist Claim Pros:

- Victim can receive full compensation for their damages.

- The process of filing a claim is simpler.

- The perpetrator can be identified and held responsible.

Uninsured Motorist Claim Cons:

- The perpetrator may not have enough money to cover the damages.

- The claim may be difficult to collect.

- The process of filing a claim can be more complicated.

Hit and Run Accident Vs Uninsured Motorist Claim

When deciding between a hit and run accident and an uninsured motorist claim, it is important to consider the severity of the accident, the insurance coverage available, and other factors. In the unfortunate case of an accident, the outcome of the claim can have a major impact on the financial and emotional wellbeing of those involved.

Due to the complexity of each situation, it is difficult to determine which is the better option. However, in most cases, an uninsured motorist claim is the more beneficial choice. This is because it allows the injured party to hold the uninsured driver accountable for their actions and seek compensation to cover medical expenses and other damages.

In contrast, a hit and run accident can be extremely difficult to pursue due to the driver’s anonymity. In cases like these, the injured party may be limited to filing a claim with their own insurance company to cover damages. Therefore, an uninsured motorist claim is typically the better option for the injured party.

The following are three reasons why an uninsured motorist claim is the better choice in most cases:

- It allows the injured party to seek compensation for medical expenses and other damages.

- It holds the uninsured driver accountable for their actions.

- It provides a greater chance of success than a hit and run accident.

Frequently Asked Questions

Getting into a hit-and-run accident or an uninsured motorist claim can be a confusing and frustrating experience. This article will provide an overview of what to do in such an event.

What is a hit-and-run accident?

A hit-and-run accident is when a driver causes an accident and then leaves the scene without providing information to the other parties involved. This is illegal in most states and can result in criminal charges. In such cases, a victim can make a claim against their own insurance company for uninsured/underinsured motorist coverage.

What is an uninsured motorist claim?

An uninsured motorist claim is when a person is injured or sustains property damage from an accident caused by a driver who does not have insurance. The victim can then make a claim against their own insurance company for uninsured/underinsured motorist coverage. This coverage can help to cover medical expenses and property damage due to the accident.

What should I do if I’m involved in a hit-and-run accident?

If you are involved in a hit-and-run accident, it’s important to take some steps to ensure that you can make an uninsured motorist claim. First, call the police and report the incident. Make sure to get the license plate number, make, and model of the other vehicle if possible. Then, take pictures of the scene and get contact information from any witnesses. Finally, contact your insurance company to make a claim.

What should I do if I’m involved in an uninsured motorist claim?

If you are involved in an uninsured motorist claim, you should contact your insurance company as soon as possible. You will need to provide them with all the information you can about the other driver, such as their name, address, and contact information. Additionally, you should make sure to take pictures of the scene and get any witness contact information. Your insurance company will then review the claim and determine the amount of coverage you can receive.

What is the difference between a hit-and-run accident and an uninsured motorist claim?

The main difference between a hit-and-run accident and an uninsured motorist claim is that a hit-and-run accident is when a driver causes an accident and then leaves the scene, while an uninsured motorist claim is when a person is injured or sustains property damage from an accident caused by a driver who does not have insurance. In a hit-and-run accident, the victim can make a claim against their own insurance company for uninsured/underinsured motorist coverage. In an uninsured motorist claim, the victim must contact their insurance company to make a claim.

Hit and run accidents and uninsured motorist claims are two of the most difficult and complex situations a motorist can face. Accidents can be costly and the legal ramifications can be even more expensive. It is important to understand the differences between these two types of claims and to know when to contact a legal professional for assistance. With the right knowledge and the right legal representation, you can navigate these complex cases with ease and get the compensation you deserve.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts