Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Car accidents can be a scary and overwhelming experience, but knowing how to contact your insurance company can make the process smoother. After all, insurance is there to help you in these situations, and it’s crucial to know what steps to take to ensure you receive the assistance you need. In this guide, we’ll walk you through the steps to help you contact your insurance company after a car accident and get the support you need to get back on the road.

Whether you’ve been in a minor fender bender or a major collision, the aftermath of a car accident can be stressful. However, knowing how to contact your insurance company can make all the difference in navigating the claims process. We’ll cover everything you need to know, from what information to provide to your insurance company to how they’ll handle your claim. So, let’s dive in and learn how to contact your insurance after a car accident.

If you’ve been involved in a car accident, it’s important to contact your insurance company as soon as possible. Call the number on the back of your insurance card or visit their website to file a claim. Provide the necessary details such as the date, time, and location of the accident, the names and contact information of other drivers involved, and any witnesses. Your insurance company will guide you on the next steps.

Contents

- How to Contact Insurance After a Car Accident

- 1. Contact Your Insurance Company as Soon as Possible

- 2. Provide Accurate and Detailed Information

- 3. Know What Your Insurance Policy Covers

- 4. Follow Up With Your Insurance Company

- 5. Consider Hiring an Attorney

- 6. Be Prepared for the Claims Process

- 7. Know Your Rights

- 8. Understand the Benefits of Working With an Independent Insurance Agent

- 9. Compare Insurance Companies Before Choosing a Policy

- 10. Understand the Pros and Cons of Filing a Claim

- Frequently Asked Questions

- What information should I provide when contacting my insurance company after a car accident?

- When should I contact my insurance company after a car accident?

- What should I expect when I contact my insurance company after a car accident?

- How long does it take to hear back from my insurance company after filing a claim?

- What should I do if I’m having trouble getting in touch with my insurance company?

How to Contact Insurance After a Car Accident

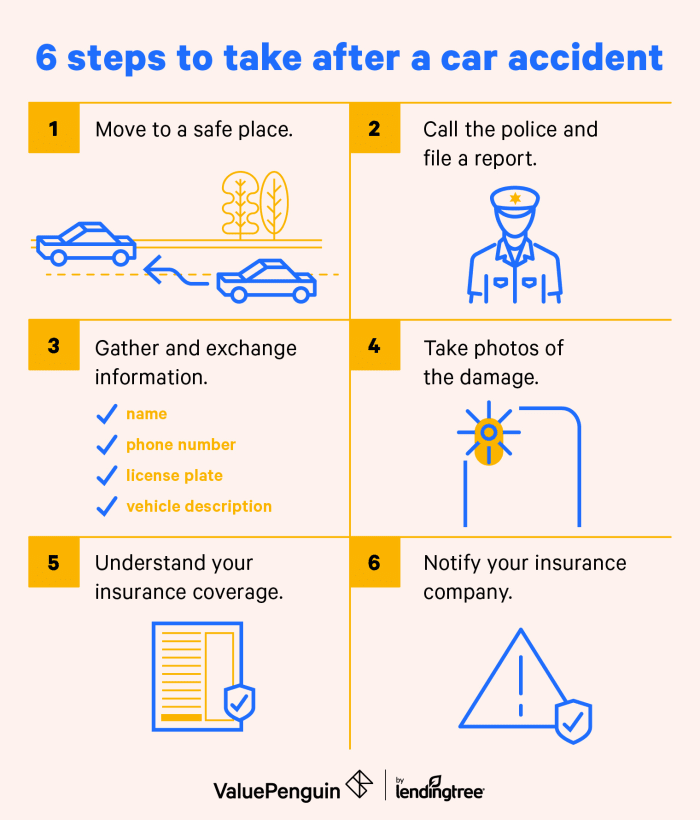

Being involved in a car accident can be a stressful and overwhelming experience. In addition to dealing with any injuries and damages, you also need to contact your insurance company to file a claim. Knowing the proper steps to take when contacting your insurance company can make the process smoother and less stressful. Here’s what you need to know about how to contact insurance after a car accident.

1. Contact Your Insurance Company as Soon as Possible

The first step in contacting your insurance company after a car accident is to do so as soon as possible. Most insurance policies require you to report any accidents within a certain timeframe, typically within 24 hours or by the end of the business day. Failure to report the accident promptly could result in a denial of your claim.

When you contact your insurance company, be prepared to provide them with as much information about the accident as possible. This includes the date, time, and location of the accident, the names and contact information of any other drivers involved, and any police reports or witness statements.

2. Provide Accurate and Detailed Information

When speaking with your insurance company, it’s essential to provide accurate and detailed information about the accident. This includes the extent of any injuries or damages, as well as any other relevant information about the accident.

Be honest and straightforward when speaking with your insurance company. Don’t exaggerate or downplay any injuries or damages, as this could lead to a denial of your claim.

3. Know What Your Insurance Policy Covers

Before contacting your insurance company, it’s important to know what your insurance policy covers. This includes the types of damages and injuries that are covered, as well as any deductibles or limits on your coverage.

Understanding your insurance policy can help you make informed decisions when filing a claim, and can also prevent any surprises or unexpected expenses down the road.

4. Follow Up With Your Insurance Company

After filing a claim with your insurance company, it’s important to follow up with them to ensure that your claim is being processed. This can include checking on the status of your claim, providing any additional information or documentation that is needed, and answering any questions that your insurance company may have.

By staying on top of your claim and following up with your insurance company, you can help ensure that your claim is processed as quickly and smoothly as possible.

5. Consider Hiring an Attorney

If you’ve been involved in a car accident and are struggling to deal with your insurance company, you may want to consider hiring an attorney. An experienced car accident attorney can help you navigate the claims process, negotiate with your insurance company on your behalf, and ensure that you receive the compensation you deserve.

While hiring an attorney can be expensive, it can also be a worthwhile investment if you’re facing significant damages or injuries as a result of the accident.

6. Be Prepared for the Claims Process

The claims process can be a lengthy and complicated process, so it’s important to be prepared for what lies ahead. This includes understanding the timeline for processing your claim, as well as any documentation or information that may be required.

By being prepared and organized, you can help ensure that your claim is processed as smoothly and efficiently as possible.

7. Know Your Rights

As a policyholder, you have certain rights when it comes to filing a claim with your insurance company. This includes the right to a fair and timely claims process, as well as the right to appeal any denials or decisions made by your insurance company.

Knowing your rights can help you advocate for yourself and ensure that you receive the compensation you deserve.

8. Understand the Benefits of Working With an Independent Insurance Agent

One way to make the process of contacting your insurance company after a car accident easier is to work with an independent insurance agent. An independent agent can help you navigate the claims process, answer any questions you may have, and ensure that you receive the best coverage at the best possible price.

Working with an independent agent can also help you save time and money, as they can compare policies and coverage options from multiple insurance companies on your behalf.

9. Compare Insurance Companies Before Choosing a Policy

Before purchasing an insurance policy, it’s important to compare coverage options and prices from multiple insurance companies. This can help you find the best policy for your needs and budget.

When comparing insurance companies, be sure to consider factors such as the types of coverage offered, the cost of premiums, and the reputation of the company.

10. Understand the Pros and Cons of Filing a Claim

Finally, it’s important to understand the pros and cons of filing a claim with your insurance company after a car accident. While filing a claim can help you receive compensation for damages and injuries, it can also result in higher premiums or even policy cancellation.

Before filing a claim, consider the extent of the damages or injuries, as well as the potential impact on your insurance policy and premiums.

In conclusion, knowing how to contact your insurance company after a car accident is an essential part of the claims process. By following these tips and being prepared, you can help ensure that your claim is processed as smoothly and efficiently as possible, and that you receive the compensation you deserve.

Frequently Asked Questions

Getting in touch with your insurance company after a car accident is essential. However, it can be challenging to know what steps to take, which is why we’ve compiled a list of frequently asked questions to help you get started.

What information should I provide when contacting my insurance company after a car accident?

When contacting your insurance company after a car accident, it’s essential to provide as much information as possible. You should provide details such as the date and time of the accident, the location, the names and contact information of any witnesses, and any injuries sustained. You should also have your insurance policy number and driver’s license number on hand.

It’s crucial to be honest and accurate when providing information to your insurance company. Failing to provide accurate information can result in your claim being denied.

When should I contact my insurance company after a car accident?

You should contact your insurance company as soon as possible following a car accident. Even if you’re unsure whether you’ll be making a claim, it’s still important to let your insurance company know about the accident. Your insurance company can provide guidance on the next steps to take and can also assist you in filing a claim if necessary.

It’s important to note that some insurance policies have specific time limits for reporting accidents. Failing to report an accident within the specified time frame may result in your claim being denied.

What should I expect when I contact my insurance company after a car accident?

When you contact your insurance company after a car accident, you’ll likely be asked to provide information about the accident and any injuries sustained. Your insurance company may also ask for copies of any police reports or medical records related to the accident.

Once your insurance company has all the necessary information, they will typically assign an adjuster to your case. The adjuster will work with you to investigate the accident and determine the amount of compensation you’re entitled to under your policy.

How long does it take to hear back from my insurance company after filing a claim?

The amount of time it takes to hear back from your insurance company after filing a claim can vary depending on several factors. In some cases, you may hear back from your insurance company within a few days of filing a claim. In other cases, it may take several weeks or even months to receive a response.

Factors that can impact the time it takes to hear back from your insurance company include the complexity of the case, the availability of information related to the accident, and the workload of the adjuster handling your case.

What should I do if I’m having trouble getting in touch with my insurance company?

If you’re having trouble getting in touch with your insurance company, there are several steps you can take. First, make sure you have the correct contact information for your insurance company. If you’re still having trouble getting through, try contacting your agent or broker for assistance.

If you’re still unable to get in touch with your insurance company, you may need to file a complaint with your state insurance department. Your state insurance department can provide guidance on how to file a complaint and can also assist you in resolving any issues you may be having with your insurance company.

In conclusion, contacting insurance after a car accident may seem daunting, but it is a crucial step towards getting the compensation you deserve. Remember to gather all important information and documents before making the call, and be honest when describing the details of the accident.

It is important to keep in mind that insurance companies are businesses and their main goal is to make a profit. This means that they may try to offer a low settlement or deny your claim altogether. Don’t be afraid to negotiate and seek legal advice if necessary.

Lastly, it is important to prioritize your health and safety after a car accident. Seek medical attention if needed and take the time to recover before dealing with the insurance process. Remember, accidents happen, and it’s important to stay calm and informed throughout the process of contacting insurance.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts