Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Personal injury settlements are awarded to compensate victims for physical and emotional damages suffered as a result of an accident caused by another party’s negligence. While these settlements can provide much-needed financial relief, many individuals are left wondering if they will have to pay taxes on the money they receive.

The short answer is that personal injury settlements are not considered income for tax purposes, but there are exceptions to this rule. In this article, we will explore the nuances of personal injury settlements and how they may impact your tax situation.

A personal injury settlement is generally not considered income for tax purposes. However, there are some exceptions. If the settlement includes compensation for lost wages or punitive damages, it may be taxable. It’s best to consult with a tax professional to determine the tax implications of your specific settlement.

Contents

- Is a Personal Injury Settlement Considered Income?

- Frequently Asked Questions

- What is a personal injury settlement?

- Is a personal injury settlement taxable?

- Can a personal injury settlement affect my government benefits?

- How is a personal injury settlement paid out?

- What should I do if I receive a personal injury settlement?

- Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

Is a Personal Injury Settlement Considered Income?

When you suffer an injury due to someone else’s negligence, you may be entitled to a personal injury settlement. This can help you cover medical bills, lost wages, and other expenses resulting from the incident. However, many people wonder whether a personal injury settlement is considered income and if it is taxable. In this article, we’ll take a closer look at this issue and provide you with all the information you need to know.

What Is a Personal Injury Settlement?

A personal injury settlement is a legal agreement between an injured party and the party responsible for the injury. This agreement outlines the compensation that the injured party will receive for their damages. Personal injury settlements can arise from a variety of incidents, including car accidents, slip and falls, and medical malpractice.

Benefits of a Personal Injury Settlement

A personal injury settlement can provide many benefits to an injured party. These benefits may include:

- Compensation for medical bills

- Reimbursement for lost wages

- Payment for pain and suffering

- Assistance with future medical expenses

Personal Injury Settlement vs. Lawsuit

It’s important to note that a personal injury settlement is not the same as a lawsuit. A lawsuit is a legal case that is heard in court and decided by a judge or jury. A personal injury settlement, on the other hand, is an agreement that is reached outside of court. In many cases, settling a personal injury case can be faster and less expensive than going to court.

Is a Personal Injury Settlement Considered Income?

The short answer is no, a personal injury settlement is not considered income for tax purposes. This means that you do not have to pay federal or state income taxes on the settlement amount. However, there are some exceptions to this rule that you should be aware of.

Exceptions to the Rule

There are some situations where a personal injury settlement may be taxable. For example, if you receive a settlement for lost wages, this amount may be considered taxable income. Additionally, if you receive punitive damages as part of your settlement, this amount may also be taxable.

Benefits of a Non-Taxable Settlement

One of the main benefits of a non-taxable personal injury settlement is that you can keep more of the money that you receive. This can help you cover your expenses and get back on your feet after your injury. Additionally, you do not have to worry about setting aside money for taxes, which can be a relief for many people.

Conclusion

In summary, a personal injury settlement is not considered income for tax purposes. This means that you do not have to pay federal or state income taxes on the settlement amount. However, there are some exceptions to this rule, so it’s important to speak with a tax professional if you have any questions. Overall, a personal injury settlement can provide many benefits to an injured party, including compensation for medical bills, lost wages, and pain and suffering.

Frequently Asked Questions

What is a personal injury settlement?

A personal injury settlement is an agreement between a victim of a personal injury and the party responsible for causing the injury. The settlement is usually a lump sum of money paid to the victim to compensate for their damages, such as medical expenses, lost wages, pain and suffering, and other related costs.

The settlement can be reached through negotiations between the parties or by going to court. Once the settlement is agreed upon, it is a legal binding agreement that ends the case.

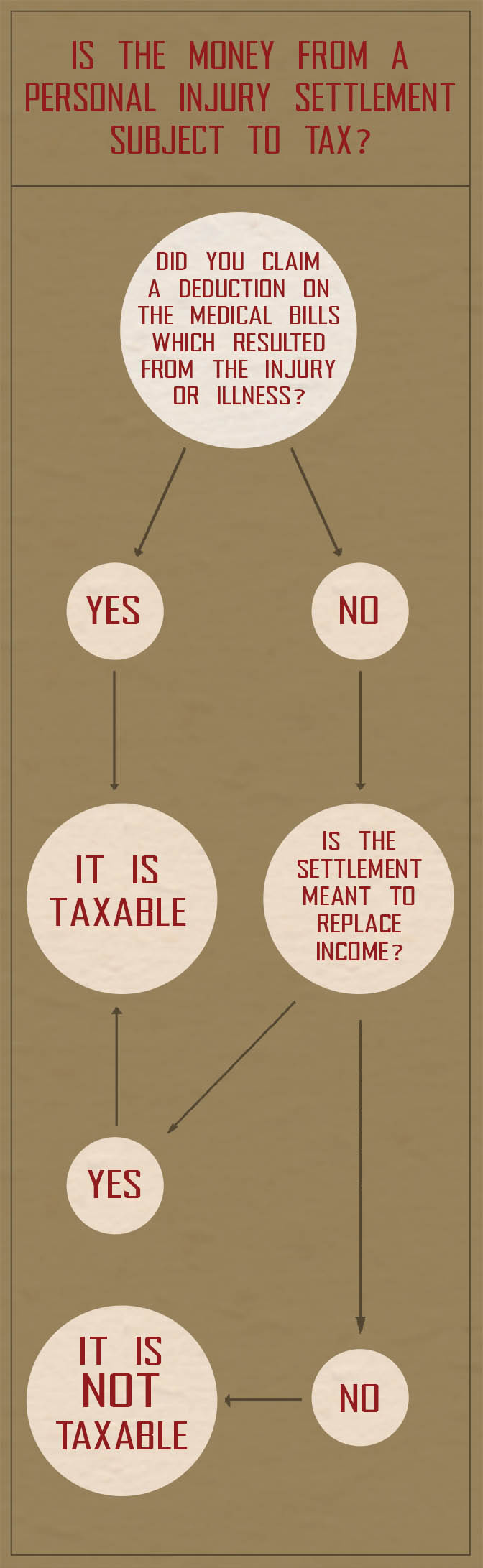

Is a personal injury settlement taxable?

In general, a personal injury settlement is not taxable. The IRS considers compensation for physical injuries and illnesses to be non-taxable. This means that the settlement money you receive for your injuries or illnesses is not considered income and is not subject to federal income tax.

However, there are some exceptions to this rule. If your settlement includes compensation for lost wages or emotional distress, these portions of the settlement may be taxable. It’s important to consult with a tax professional to determine if any part of your settlement is subject to taxes.

Can a personal injury settlement affect my government benefits?

Yes, a personal injury settlement can affect your government benefits. If you receive government benefits such as Medicaid or Social Security Disability Insurance (SSDI), your settlement may impact your eligibility for these benefits.

If your settlement exceeds a certain amount, it may disqualify you from receiving government benefits. It’s important to speak with an attorney or financial advisor who is experienced in personal injury settlements and government benefits to understand how your settlement may affect your benefits.

How is a personal injury settlement paid out?

A personal injury settlement is typically paid out in one lump sum. Once the settlement is agreed upon, the responsible party or their insurance company will issue a check to the victim or their attorney. The check will usually include the full amount of the settlement minus any attorney’s fees or other costs associated with the case.

The victim can then use the settlement money to pay for their medical expenses, lost wages, and other related costs. If the victim has a structured settlement, the settlement will be paid out in regular payments over a period of time.

What should I do if I receive a personal injury settlement?

If you receive a personal injury settlement, it’s important to consult with an attorney or financial advisor who is experienced in personal injury settlements. They can help you understand the terms of the settlement and how it may impact your taxes, government benefits, and other financial matters.

It’s also important to create a plan for how you will use the settlement money. You may need to pay for medical expenses, lost wages, and other related costs. You may also want to use the settlement money to invest in your future, such as paying for education or starting a business. A financial advisor can help you create a plan that makes the most of your settlement money.

Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

In conclusion, a personal injury settlement may or may not be considered taxable income depending on the specific circumstances. Factors such as the type of damages awarded and whether they are compensatory or punitive can affect tax liability. It is important to consult with a qualified tax professional to fully understand the tax implications of a personal injury settlement.

However, it is important to note that even if a personal injury settlement is not considered taxable income, it could still affect eligibility for certain government benefits or impact child support obligations. It is crucial to consider all potential consequences and consult with a legal professional before accepting any settlement offer.

Ultimately, the best course of action is to seek out the advice of both a tax professional and a legal professional to ensure that you fully understand your rights and responsibilities when it comes to personal injury settlements. With the right guidance, you can make informed decisions and protect your financial and legal interests.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts