Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

New York is a bustling state with a high number of vehicles on its roads. With this comes an increased risk of car accidents. One of the most significant questions that arise after an accident is whether New York is a no-fault state for car accidents. In this article, we will explore what it means to be a no-fault state, what it entails, and how it affects car accident cases in New York.

If you have been in a car accident in New York, it is crucial to understand the state’s laws and regulations to help you navigate the aftermath. The no-fault system can be complex and confusing, but with the right knowledge, you can protect your rights and get the compensation you deserve. So let’s delve into the world of New York car accident laws and discover whether it is a no-fault state.

Yes, New York is a no-fault state for car accidents. This means that regardless of who caused the accident, each driver’s insurance company is responsible for covering their own expenses and damages. However, there are some exceptions to this rule, such as cases involving serious injuries or deaths. It’s important to consult with an experienced car accident attorney in New York to understand your legal rights and options.

Is New York a No Fault State for Car Accidents?

If you’re involved in a car accident in New York, you may be wondering if the state is a no-fault state. In short, the answer is yes. New York is a no-fault state, which means that if you’re involved in a car accident, you’ll turn to your own insurance company for compensation, regardless of who was at fault for the accident. This system is designed to streamline the claims process and ensure that injured parties receive prompt compensation for their injuries and related expenses.

Understanding No-Fault Insurance

In New York, all drivers are required to carry no-fault insurance, also known as personal injury protection (PIP) insurance. This coverage is designed to provide compensation for medical expenses, lost wages, and other related expenses that you may incur as a result of a car accident, regardless of who was at fault for the accident. Under the no-fault system, you’ll turn to your own insurance company to file a claim, rather than filing a claim with the other driver’s insurance company.

If you’re injured in a car accident, you’ll need to file a claim with your insurance company within 30 days of the accident. Your insurance company will then provide you with a claim number and assign an adjuster to your case. You’ll need to provide your adjuster with all relevant information, such as medical bills and lost wage statements, to ensure that your claim is processed promptly.

The Benefits of No-Fault Insurance

While the no-fault system may seem confusing at first, it offers a number of benefits for drivers in New York. One of the primary benefits of no-fault insurance is that it ensures that injured parties receive prompt compensation for their injuries and related expenses. Under the traditional fault-based system, injured parties often had to wait months or even years to receive compensation for their injuries, which could lead to financial hardship and other difficulties.

Another benefit of no-fault insurance is that it helps to reduce the number of lawsuits related to car accidents. Under the no-fault system, injured parties are typically prohibited from suing the other driver unless their injuries meet certain thresholds, such as a serious injury or permanent disability. This helps to reduce the burden on the court system and ensures that cases are resolved more quickly and efficiently.

No-Fault vs. Traditional Fault-Based Systems

While the no-fault system has its benefits, it’s important to understand how it differs from traditional fault-based systems. In a fault-based system, the driver who is deemed to be at fault for the accident is responsible for paying for the damages and injuries that result from the accident. This can lead to lengthy legal battles and may make it more difficult for injured parties to receive prompt compensation.

Under the no-fault system, however, injured parties are able to receive compensation more quickly and efficiently, without the need for lengthy legal battles. This can help to reduce the stress and financial burden associated with car accidents, allowing injured parties to focus on their recovery and getting back on their feet.

Conclusion

If you’re involved in a car accident in New York, it’s important to understand that the state is a no-fault state. This means that you’ll need to turn to your own insurance company to file a claim for compensation, rather than filing a claim with the other driver’s insurance company. While the no-fault system may seem confusing at first, it offers a number of benefits for drivers in New York, including prompt compensation for injuries and related expenses, as well as a reduction in the number of lawsuits related to car accidents.

Contents

Frequently Asked Questions

Car accidents can be stressful and confusing, especially when it comes to insurance and liability. If you’re a driver in New York, you may be wondering whether the state is a no-fault state for car accidents. Here are some common questions and answers to help you understand the situation.

What is a no-fault state?

A no-fault state is one where drivers are required to carry personal injury protection (PIP) insurance, which covers medical expenses and lost wages in the event of an accident, regardless of who was at fault. In a no-fault state, each driver’s insurance company pays for their own policyholder’s damages, rather than having one driver’s insurance company pay for the damages of the other driver.

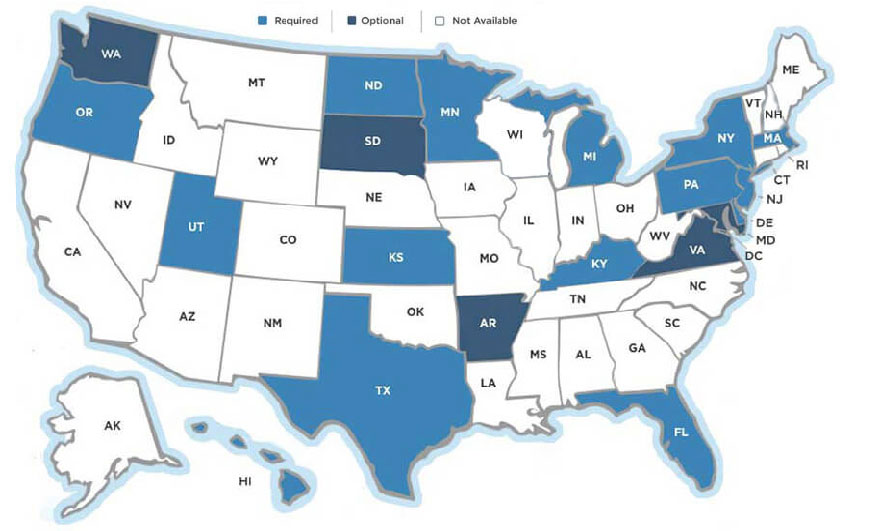

New York is one of several states that has a no-fault insurance system in place for car accidents.

What does no-fault insurance cover?

No-fault insurance covers medical expenses, lost wages, and other related expenses resulting from a car accident. This coverage is available to the policyholder regardless of who was at fault for the accident. In New York, the minimum amount of PIP insurance required is $50,000 per person, per accident.

It’s important to note that no-fault insurance does not cover property damage, such as damage to the vehicles involved in the accident. That is typically covered by liability insurance, which is mandatory in New York and most other states.

Do I still need liability insurance if I have no-fault insurance?

Yes, drivers in New York are required to carry liability insurance in addition to PIP insurance. Liability insurance covers damages or injuries that you may cause to others in an accident where you are at fault. The minimum amount of liability insurance required in New York is $25,000 per person, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

Having both types of insurance coverage can help protect you financially in the event of a car accident, regardless of who was at fault.

Can I still sue for damages if I have no-fault insurance?

Yes, you can still sue for damages in New York even if you have no-fault insurance. However, the circumstances under which you can sue are limited. In most cases, you can only sue for damages that exceed your PIP coverage or for damages that are not covered by PIP insurance, such as pain and suffering.

If you do decide to sue, it’s important to work with an experienced personal injury attorney who can help you navigate the legal process and ensure that you receive the compensation you deserve.

What should I do if I’m involved in a car accident in New York?

If you’re involved in a car accident in New York, there are several steps you should take to protect yourself and your legal rights. First, call 911 and seek medical attention if necessary. Then, exchange information with the other driver, including names, addresses, phone numbers, and insurance information.

Be sure to also take photos of the accident scene, including damage to the vehicles and any injuries sustained. Finally, contact your insurance company as soon as possible to report the accident and begin the claims process.

In conclusion, New York is indeed a no-fault state for car accidents. This means that regardless of who is at fault, each party’s insurance company is responsible for covering their own medical expenses and lost wages. However, it is important to note that there are certain exceptions to this rule, such as cases involving serious injuries or significant property damage. Regardless of the circumstances, it is always important to seek the advice of an experienced personal injury attorney to ensure that your rights are protected and that you receive the compensation you deserve. So, if you find yourself in a car accident in New York, do not hesitate to seek professional legal advice to help you navigate the complexities of the state’s no-fault laws.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts