Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

In Alaska, accidents are a common occurrence, and they can happen to anyone at any time. That’s why it’s essential to have adequate insurance coverage to protect yourself and your loved ones in the event of an accident. One of the most critical questions you may have is whether Personal Injury Protection (PIP) is required in Alaska.

In this article, we will explore the ins and outs of PIP insurance in Alaska. We will discuss what PIP insurance is, why it’s important, and whether it’s mandatory in Alaska. So, if you’re looking for answers to your PIP insurance questions, keep reading to find out more.

Yes, Personal Injury Protection (PIP) is required in Alaska. The minimum coverage required is $50,000 per person for medical expenses, lost wages, and other related expenses resulting from a car accident. PIP coverage also extends to passengers in your vehicle who don’t have their own PIP insurance. Failure to carry PIP insurance may result in fines and license suspension.

Contents

- Understanding Personal Injury Protection in Alaska

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) in Alaska?

- What expenses are covered by Personal Injury Protection in Alaska?

- Is it possible to waive Personal Injury Protection (PIP) coverage in Alaska?

- What happens if I don’t have Personal Injury Protection (PIP) coverage in Alaska?

- Can I use my Personal Injury Protection (PIP) coverage for injuries sustained in a car accident outside of Alaska?

- What is Personal Injury Protection (PIP)?

Understanding Personal Injury Protection in Alaska

What is Personal Injury Protection?

Personal injury protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident, regardless of who is at fault. PIP is also known as no-fault insurance because it covers your expenses regardless of who caused the accident.

In Alaska, PIP is required by law, and all drivers must carry a minimum of $50,000 in PIP coverage. This coverage is designed to provide you with quick access to medical care and help you recover from your injuries without having to worry about the cost of medical bills or lost wages.

What Does PIP Cover?

PIP covers a wide range of expenses related to a car accident, including medical expenses, lost wages, and other related costs. Specifically, PIP covers:

- Medical expenses: PIP covers the cost of medical care related to your injuries, including hospitalization, surgery, rehabilitation, and other medical expenses.

- Lost wages: If you are unable to work due to your injuries, PIP will cover a portion of your lost wages.

- Death benefits: If you or a passenger in your vehicle is killed in a car accident, PIP will provide death benefits to the surviving family members.

- Funeral expenses: PIP also covers the cost of funeral expenses in the event of a car accident.

The Benefits of PIP

There are many benefits to carrying PIP insurance in Alaska. The primary benefit is that it provides you with quick access to medical care and financial support if you are injured in a car accident. This can be especially helpful if you do not have health insurance or if your health insurance does not cover all of your medical expenses.

Additionally, PIP can help you recover from your injuries more quickly by providing you with the financial support you need to pay for medical care, lost wages, and other related expenses. This can help you get back on your feet faster and return to work and other activities more quickly.

PIP Vs. Other Types of Car Insurance

PIP is just one type of car insurance coverage that you can carry in Alaska. Other types of car insurance include liability insurance, collision insurance, and comprehensive insurance. Each type of insurance covers different types of expenses related to a car accident.

Liability insurance, for example, covers the cost of damages and injuries you cause to other drivers and their vehicles. Collision insurance covers the cost of damages to your vehicle in an accident. Comprehensive insurance covers the cost of damages to your vehicle that are not related to a car accident, such as theft or vandalism.

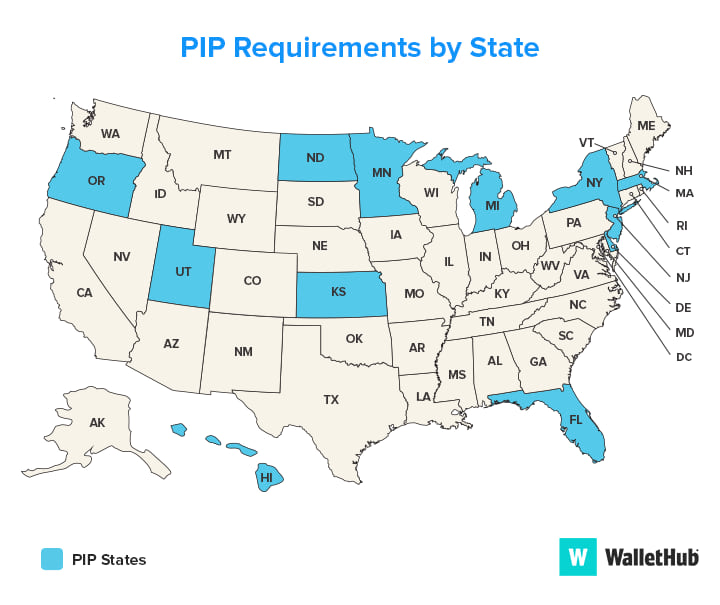

While PIP is not required in every state, it is required in Alaska, and it can provide you with valuable financial support if you are injured in a car accident. If you are not sure what type of car insurance coverage is right for you, it is a good idea to speak with an insurance agent who can help you understand your options and make an informed decision.

Frequently Asked Questions

What is Personal Injury Protection (PIP) in Alaska?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who is at fault.

In Alaska, PIP is mandatory and all drivers are required to have a minimum coverage of $50,000 per person. This coverage can also extend to cover the policyholder’s household members and passengers.

What expenses are covered by Personal Injury Protection in Alaska?

Personal Injury Protection (PIP) in Alaska covers medical expenses, lost wages, and other related expenses that result from a car accident. This can include hospital bills, doctor’s fees, rehabilitation costs, and even funeral expenses if necessary.

Additionally, PIP can also cover lost income if you are unable to work due to the injuries sustained in the accident. This coverage can be extended to include other household members and passengers who are injured in the accident as well.

Is it possible to waive Personal Injury Protection (PIP) coverage in Alaska?

Yes, it is possible to waive Personal Injury Protection (PIP) coverage in Alaska. However, this can only be done if you have health insurance that covers injuries sustained in a car accident.

To waive PIP coverage, you must submit a written request to your insurance company. Keep in mind that if you do waive PIP coverage, you will not be covered for medical expenses or lost wages resulting from a car accident, even if you are not at fault.

What happens if I don’t have Personal Injury Protection (PIP) coverage in Alaska?

If you do not have Personal Injury Protection (PIP) coverage in Alaska, you may be held financially responsible for any medical expenses, lost wages, or other related expenses resulting from a car accident, regardless of who is at fault.

Additionally, driving without the minimum required insurance coverage in Alaska can result in fines, license suspension, and even legal action. It is important to make sure you have adequate insurance coverage to protect yourself and others on the road.

Can I use my Personal Injury Protection (PIP) coverage for injuries sustained in a car accident outside of Alaska?

No, Personal Injury Protection (PIP) coverage in Alaska only covers injuries sustained in a car accident that occurs within the state. If you are involved in a car accident outside of Alaska, your insurance coverage will depend on the laws and requirements of the state where the accident occurred.

It is important to check with your insurance provider to see what coverage you have while driving outside of Alaska and to make sure you have adequate coverage for any potential accidents that may occur.

What is Personal Injury Protection (PIP)?

In conclusion, the answer to the question of whether Personal Injury Protection (PIP) is required in Alaska is a bit complex. While it is not mandatory by law for drivers in the state to have PIP coverage, it is highly recommended.

PIP coverage can provide invaluable protection in the event of a car accident, covering medical expenses and lost wages regardless of who is at fault. Without it, drivers may be left with significant out-of-pocket expenses and financial hardship.

Ultimately, the decision to purchase PIP coverage is up to each individual driver. However, it is important to carefully consider the potential consequences of being involved in an accident without this type of protection. In the end, the peace of mind and financial security provided by PIP coverage may be well worth the investment.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts