Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Florida is known for its sunny beaches, theme parks, and warm weather. However, with its busy roads and bustling cities, accidents can happen at any time. This begs the question: is personal injury protection (PIP) required in Florida?

PIP is a type of car insurance that covers medical expenses, lost wages, and other related expenses in case of an accident. In this article, we will explore the state’s requirements for PIP coverage and explain why it is important to have it.

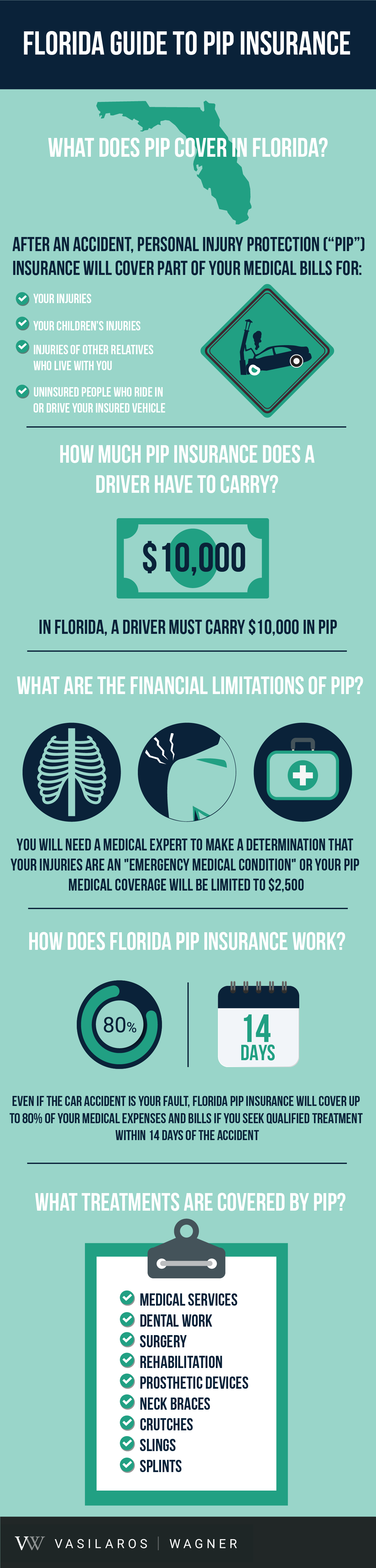

Yes, Personal Injury Protection (PIP) is required in Florida. It is mandatory for all drivers to carry PIP insurance coverage, which provides benefits for medical expenses, lost wages, and other related expenses resulting from a car accident, regardless of who was at fault. The minimum coverage amount for PIP in Florida is $10,000.

Contents

- Is Personal Injury Protection Required in Florida?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) insurance?

- Who is required to have PIP insurance in Florida?

- What happens if a driver does not have PIP insurance in Florida?

- Can a driver waive their PIP insurance in Florida?

- Can a driver purchase additional PIP coverage in Florida?

- Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

Is Personal Injury Protection Required in Florida?

If you live in the state of Florida and own a vehicle, you may be wondering whether or not you need to have personal injury protection (PIP) insurance. PIP insurance is a type of coverage that pays for medical expenses and lost wages if you are injured in a car accident, regardless of who was at fault. In this article, we will explore whether or not PIP is required in Florida and what the benefits of having this type of coverage are.

What is Personal Injury Protection?

Personal injury protection, also known as PIP, is a type of car insurance that is designed to cover medical expenses and lost wages if you or your passengers are injured in a car accident. This type of coverage is often referred to as “no-fault” insurance because it pays out regardless of who was at fault for the accident.

In Florida, PIP insurance is required by law. Every driver is required to carry a minimum of $10,000 in PIP coverage and $10,000 in property damage liability coverage. This means that if you are injured in a car accident, your PIP insurance will pay for your medical expenses and lost wages, up to the limit of your policy.

The Benefits of Personal Injury Protection

There are many benefits to having personal injury protection insurance in Florida. One of the biggest benefits is that it provides coverage regardless of who was at fault for the accident. This means that even if you were at fault for the accident, you can still receive coverage for your medical expenses and lost wages.

Another benefit of PIP insurance is that it provides coverage for a wide range of injuries, including whiplash, broken bones, and traumatic brain injuries. This type of coverage can be especially important if you have a high-deductible health insurance plan or no health insurance at all.

PIP vs. Bodily Injury Liability

While PIP insurance is required in Florida, bodily injury liability insurance is not. Bodily injury liability insurance is designed to cover the medical expenses and lost wages of other drivers and passengers if you are at fault for an accident.

If you are involved in a car accident and you are at fault, your PIP insurance will only cover your own medical expenses and lost wages. If you have bodily injury liability insurance, however, it will cover the medical expenses and lost wages of the other driver and passengers involved in the accident.

The Bottom Line

Personal injury protection insurance is required in Florida and provides coverage for your medical expenses and lost wages if you are injured in a car accident, regardless of who was at fault. While bodily injury liability insurance is not required, it can provide additional coverage if you are at fault for an accident. Ultimately, the decision to purchase PIP and/or bodily injury liability insurance is up to you and depends on your individual needs and budget.

Frequently Asked Questions

Florida is one of the few states in the US that requires drivers to carry Personal Injury Protection (PIP) insurance. Here are some commonly asked questions about PIP insurance in Florida:

What is Personal Injury Protection (PIP) insurance?

Personal Injury Protection (PIP) insurance is a type of car insurance that covers medical expenses and lost wages in case of an accident, regardless of who is at fault. It is also known as no-fault insurance. PIP insurance is required in Florida to ensure that drivers have some coverage for medical expenses and lost wages if they are injured in an accident.

PIP insurance covers up to 80% of medical expenses and 60% of lost wages, up to a limit of $10,000. It can also cover other expenses such as rehabilitation, funeral expenses, and in-home care. PIP insurance is designed to provide quick payment of medical bills and lost wages, without the need to go through a lengthy legal process to determine fault.

Who is required to have PIP insurance in Florida?

In Florida, all drivers are required to carry PIP insurance. This includes both residents and non-residents who operate a vehicle in the state for more than 90 days in a year. The only exception is for drivers who can prove that they have a medical insurance policy that covers auto accidents with a minimum coverage of $10,000.

It is important to note that PIP insurance is not the same as liability insurance, which covers damages to other people’s property or injuries they sustain in an accident caused by the insured driver.

What happens if a driver does not have PIP insurance in Florida?

If a driver is caught without PIP insurance, they may face severe penalties. This includes fines, driver’s license suspension, and even vehicle registration suspension. The penalties for driving without PIP insurance in Florida can be significant, and it is not worth the risk of driving without this required coverage.

Additionally, if a driver is involved in an accident and does not have PIP insurance, they may be responsible for paying their medical bills and lost wages out of pocket, which can be financially devastating.

Can a driver waive their PIP insurance in Florida?

Yes, drivers in Florida can waive their PIP insurance, but only if they meet certain requirements. To waive PIP insurance, a driver must have a medical insurance policy that covers auto accidents with a minimum coverage of $10,000. The driver must also sign a waiver stating that they are waiving their PIP coverage.

It is important to note that waiving PIP insurance can be risky, as medical insurance policies may not cover all the expenses that PIP insurance does. It is recommended that drivers consult with their insurance agent to determine if waiving PIP insurance is the right choice for them.

Can a driver purchase additional PIP coverage in Florida?

Yes, drivers in Florida can purchase additional PIP coverage beyond the minimum required by law. Additional PIP coverage can provide more comprehensive coverage for medical expenses and lost wages, which can be especially important for drivers who may not have adequate health insurance coverage.

It is recommended that drivers consult with their insurance agent to determine if additional PIP coverage is the right choice for them, based on their individual needs and circumstances.

Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

In conclusion, personal injury protection (PIP) is required in Florida. It is a mandatory coverage that all drivers must have in order to legally operate a vehicle in the state. PIP insurance provides coverage for medical expenses and lost wages regardless of who is at fault in an accident.

While some drivers may view PIP as an unnecessary expense, it is important to remember that accidents can happen to anyone at any time. Having PIP insurance can provide peace of mind knowing that you and your passengers are covered in the event of an accident.

In addition, not having PIP insurance can result in penalties and fines if caught driving without it. It is important to ensure that you have the proper coverage to avoid any legal issues and to protect yourself and your loved ones in the event of an accident.

Overall, PIP insurance is a necessary requirement in Florida and provides essential coverage for all drivers. Be sure to check with your insurance provider to ensure that you have the proper coverage and are compliant with state laws.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts