Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Hawaii is known for its beautiful beaches, stunning scenery, and laid-back lifestyle. However, accidents can still happen, even in paradise. If you’re involved in a car accident in Hawaii, you may wonder if you’re required to have personal injury protection (PIP) insurance.

In this article, we’ll explore the ins and outs of PIP insurance in Hawaii. We’ll discuss what it is, how it works, and whether it’s mandatory. So, whether you’re a local resident or a visitor to the islands, read on to learn everything you need to know about PIP insurance in Hawaii.

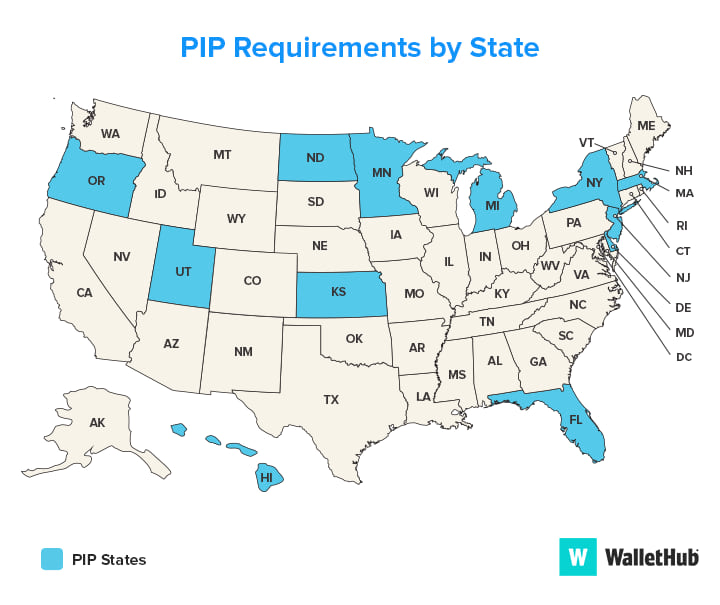

Yes, Personal Injury Protection (PIP) is required in Hawaii. The minimum coverage amount for PIP in Hawaii is $10,000. PIP provides coverage for medical expenses, lost wages, and other related expenses in case of an accident, regardless of who is at fault. It is important to note that Hawaii is a no-fault state, meaning that each driver’s insurance policy pays for their own damages and injuries in an accident.

Is Personal Injury Protection Required in Hawaii?

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages for the driver and passengers involved in an accident, regardless of who is at fault. PIP is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

In Hawaii, PIP is mandatory for all registered vehicles. The minimum coverage required is $10,000 per person, per accident. This means that if you are injured in an accident, your PIP coverage will pay up to $10,000 for your medical expenses and lost wages, regardless of who caused the accident.

What Does PIP Cover?

PIP covers a range of expenses related to injuries sustained in a car accident. This includes:

1. Medical Expenses: PIP coverage will pay for your medical expenses, including hospital bills, doctor’s visits, and medication. If you require ongoing medical treatment, your PIP coverage will continue to pay for your expenses until you reach the policy limit.

2. Lost Wages: If you are unable to work due to your injuries, PIP will cover a portion of your lost wages. This can help you stay financially stable while you recover.

3. Funeral Expenses: If a passenger in your vehicle is killed in an accident, PIP will cover their funeral expenses up to the policy limit.

4. Childcare Expenses: If you are unable to care for your children due to your injuries, PIP will cover the cost of childcare while you recover.

Benefits of PIP

There are several benefits of having PIP coverage, including:

1. Peace of Mind: Knowing that you are covered in the event of an accident can provide peace of mind and reduce stress.

2. No-fault Coverage: PIP is a no-fault insurance, which means that regardless of who caused the accident, you will be covered for your medical expenses and lost wages.

3. Quick Payment: PIP coverage pays out quickly, which means that you can receive the funds you need to cover your expenses without delay.

PIP vs. Bodily Injury Liability

Bodily Injury Liability (BIL) is another type of car insurance that covers injuries sustained by others in an accident that you caused. In Hawaii, BIL is not mandatory, but it is highly recommended.

While PIP covers your own medical expenses and lost wages, BIL covers the medical expenses and lost wages of others involved in the accident that you caused. BIL can also cover legal fees if you are sued for damages.

It is important to note that while PIP is a no-fault insurance, BIL is a fault-based insurance. This means that if you are at fault for the accident, your BIL coverage will pay for the other party’s expenses.

Conclusion

In Hawaii, Personal Injury Protection is mandatory for all registered vehicles. PIP provides coverage for medical expenses, lost wages, funeral expenses, and childcare expenses in the event of an accident, regardless of who caused the accident. While PIP is a no-fault insurance, Bodily Injury Liability is a fault-based insurance that covers injuries sustained by others in an accident that you caused. It is important to have both types of coverage to ensure that you are fully protected in the event of an accident.

Contents

Frequently Asked Questions

Here are some commonly asked questions about personal injury protection in Hawaii:

What is personal injury protection (PIP) coverage?

Personal Injury Protection is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. PIP coverage can also cover funeral expenses and other related costs. It is sometimes referred to as “no-fault” coverage because it pays out regardless of who is at fault for the accident.

In Hawaii, PIP coverage is mandatory and all drivers are required to carry a minimum of $10,000 in PIP coverage.

What does PIP cover in Hawaii?

In Hawaii, PIP coverage can cover medical expenses, lost wages, and other related costs if you or your passengers are injured in a car accident. PIP coverage can also cover funeral expenses if a passenger dies as a result of the accident. The minimum amount of PIP coverage required in Hawaii is $10,000.

It’s important to note that PIP coverage only covers injuries sustained in a car accident. It does not cover damage to your vehicle or other property.

Do I need PIP coverage if I have health insurance?

Yes, you still need PIP coverage even if you have health insurance. PIP coverage is designed to pay for medical expenses and lost wages immediately after an accident, regardless of who is at fault. Health insurance may not cover all of the costs associated with a car accident, such as lost wages or funeral expenses. PIP coverage is mandatory in Hawaii and all drivers are required to carry a minimum of $10,000 in coverage.

It’s important to review your health insurance policy and your PIP coverage to make sure you have adequate coverage in the event of a car accident.

What happens if I don’t have PIP coverage in Hawaii?

If you are caught driving without PIP coverage in Hawaii, you may face fines and other penalties. In addition, if you are injured in a car accident and do not have PIP coverage, you may be responsible for paying for your medical expenses and lost wages out of pocket. It’s important to carry the minimum amount of PIP coverage required by law to protect yourself and your passengers in the event of a car accident.

If you are having trouble finding affordable PIP coverage, you may want to reach out to an insurance agent or broker for assistance.

How much does PIP coverage cost in Hawaii?

The cost of PIP coverage in Hawaii can vary depending on a number of factors, such as your driving record, the type of car you drive, and your age. However, the minimum amount of PIP coverage required by law in Hawaii is $10,000. It’s important to shop around and compare quotes from different insurance providers to find the best coverage at the best price for your needs.

Keep in mind that while PIP coverage is mandatory in Hawaii, you may also want to consider purchasing additional coverage, such as liability insurance or collision coverage, to protect yourself and your vehicle in the event of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is mandatory in Hawaii. It is a type of car insurance coverage that provides medical expenses and income loss benefits, regardless of fault. This means that if you get into an accident, PIP will cover your medical bills and lost wages, up to your policy limits.

While some may argue that PIP increases the cost of car insurance, it is important to remember that it offers invaluable protection in case of an accident. Hawaii’s no-fault insurance system also makes PIP a necessary requirement, as it ensures that all parties involved in an accident receive the necessary medical care and compensation.

Overall, whether you’re a resident or a visitor to Hawaii, having PIP coverage is essential for your safety and financial well-being. Don’t take any chances on the road – make sure you have the proper car insurance coverage and drive with peace of mind.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts