Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Idaho is known as the “Gem State” for its natural beauty, but unfortunately, accidents can happen anywhere. If you’re a driver in Idaho, you may be wondering if personal injury protection (PIP) is required. PIP can provide important coverage for medical expenses and lost wages in the event of an accident, so it’s important to know whether it’s mandatory in Idaho.

The answer is that Idaho does not require drivers to carry PIP insurance, but it is an option that can provide valuable protection. In this article, we’ll explore the ins and outs of PIP insurance in Idaho, including what it covers, how it works, and whether it’s worth considering for your own auto insurance policy.

Yes, Personal Injury Protection (PIP) is mandatory in Idaho. Every driver is required to have a minimum PIP coverage of $5,000. This coverage will pay for medical expenses and lost wages if you or your passengers are injured in a car accident, regardless of who is at fault.

Contents

- Is Personal Injury Protection Required in Idaho?

- What is Personal Injury Protection (PIP)?

- Is Personal Injury Protection Required in Idaho?

- What are the Benefits of Personal Injury Protection?

- What is the Difference Between Liability Insurance and Personal Injury Protection?

- Should You Consider Personal Injury Protection?

- What are the Pros and Cons of Personal Injury Protection?

- Conclusion

- Frequently Asked Questions

Is Personal Injury Protection Required in Idaho?

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and other related expenses if you or your passengers are injured in a car accident. PIP insurance can cover medical expenses, lost wages, and other expenses, regardless of who was at fault for the accident.

Is Personal Injury Protection Required in Idaho?

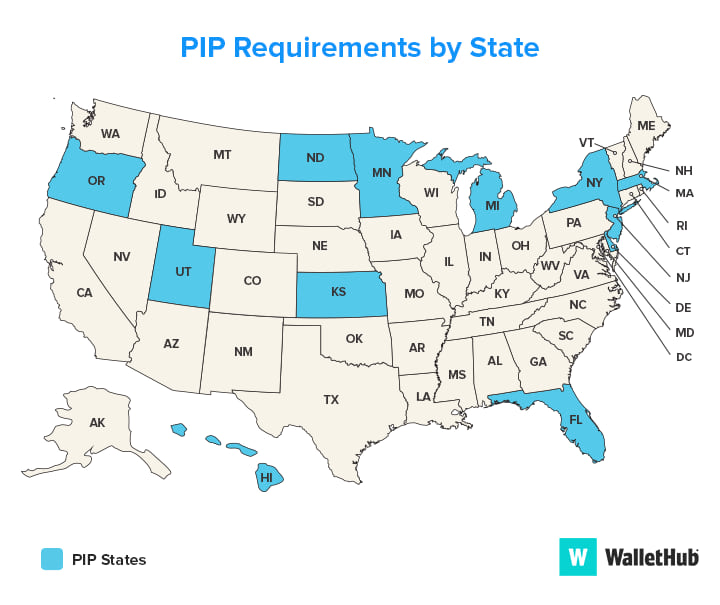

Personal Injury Protection is not a required type of car insurance in Idaho. However, drivers in Idaho are required to carry a minimum amount of liability insurance. Liability insurance covers the costs of damages to other people’s property or injuries that you cause in an accident.

What are the Benefits of Personal Injury Protection?

Personal Injury Protection can provide many benefits in the event of a car accident. Some of the benefits of PIP insurance include:

- Coverage for medical expenses, regardless of who was at fault for the accident

- Lost wages coverage for time missed from work due to injuries sustained in a car accident

- Funeral expenses coverage in the event of a death resulting from a car accident

- Coverage for injuries sustained by passengers in your vehicle

- Protection against lawsuits from other drivers or passengers involved in the accident

What is the Difference Between Liability Insurance and Personal Injury Protection?

Liability insurance and Personal Injury Protection insurance are two different types of car insurance coverage. Liability insurance covers the costs of damages to other people’s property or injuries that you cause in an accident. PIP insurance, on the other hand, covers medical expenses and other related expenses if you or your passengers are injured in a car accident, regardless of who was at fault for the accident.

Should You Consider Personal Injury Protection?

While Personal Injury Protection is not a required type of car insurance in Idaho, it can provide many benefits in the event of a car accident. If you are interested in adding PIP insurance to your car insurance policy, it is important to speak with your insurance provider to determine the best coverage options for your individual needs.

What are the Pros and Cons of Personal Injury Protection?

Pros:

- Coverage for medical expenses, regardless of who was at fault for the accident

- Lost wages coverage for time missed from work due to injuries sustained in a car accident

- Funeral expenses coverage in the event of a death resulting from a car accident

- Coverage for injuries sustained by passengers in your vehicle

- Protection against lawsuits from other drivers or passengers involved in the accident

Cons:

- Additional cost to your car insurance policy

- May not be necessary if you already have health insurance coverage

- May not provide coverage for all types of injuries sustained in a car accident

Conclusion

In conclusion, Personal Injury Protection is not a required type of car insurance in Idaho, but it can provide many benefits in the event of a car accident. If you are interested in adding PIP insurance to your car insurance policy, it is important to speak with your insurance provider to determine the best coverage options for your individual needs.

Frequently Asked Questions

Idaho is a state in the Pacific Northwest region of the United States. It has various laws that govern the use of motor vehicles, including Personal Injury Protection (PIP) requirements. Here are the answers to some frequently asked questions about PIP requirements in Idaho.

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages related to a car accident, regardless of who was at fault. PIP is also known as no-fault insurance because it pays out regardless of who caused the accident. PIP is required in some states, including Idaho.

In Idaho, the minimum PIP coverage is $5,000. This means that if you are injured in a car accident, your PIP coverage will pay up to $5,000 of your medical expenses and lost wages. If your medical expenses and lost wages exceed $5,000, the at-fault driver’s insurance may be responsible for the additional costs.

Who is required to have PIP coverage in Idaho?

In Idaho, all drivers must have PIP coverage. PIP coverage is required by law and cannot be waived. If you are caught driving without PIP coverage, you may face fines and other penalties.

If you are a resident of Idaho and own a car, you must have PIP coverage. If you are a non-resident who is driving in Idaho, you must have PIP coverage if your home state requires it or if you are driving a car that is registered in Idaho.

What does PIP coverage in Idaho cover?

In Idaho, PIP coverage covers medical expenses and lost wages related to a car accident, regardless of who was at fault. PIP coverage also covers expenses such as funeral expenses, rehabilitation expenses, and household services that you may need as a result of your injuries. The minimum PIP coverage in Idaho is $5,000.

If your medical expenses and lost wages exceed $5,000, the at-fault driver’s insurance may be responsible for the additional costs. If the at-fault driver does not have insurance or does not have enough insurance to cover your expenses, you may need to sue the driver to recover your damages.

How much does PIP coverage cost in Idaho?

The cost of PIP coverage in Idaho varies depending on your insurance company, your driving record, and other factors. However, the minimum PIP coverage in Idaho is $5,000, which is relatively low compared to other states. Adding more coverage to your PIP policy may increase your premiums.

If you are looking for PIP coverage in Idaho, it is a good idea to shop around and compare rates from different insurance companies to find the best deal.

What happens if I don’t have PIP coverage in Idaho?

If you are caught driving without PIP coverage in Idaho, you may face fines and other penalties. In addition, if you are injured in a car accident and do not have PIP coverage, you may be responsible for paying your own medical expenses and lost wages.

If you are injured in a car accident that was not your fault and do not have PIP coverage, you may need to sue the at-fault driver to recover your damages. This can be a long and costly process, and there is no guarantee that you will recover all of your damages.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is not required in Idaho, but it is highly recommended. While it may seem like an unnecessary expense, PIP can provide crucial financial assistance in the event of an accident. With medical bills and lost wages piling up, PIP can help cover these costs and prevent you from falling into debt.

Moreover, PIP can also provide coverage for passengers in your vehicle, regardless of who is at fault for the accident. This can provide peace of mind for you and your loved ones, knowing that you are all protected in the event of an accident.

Ultimately, the decision to purchase PIP is up to you. However, considering the potential benefits and the relatively low cost of the coverage, it may be worth the investment for your financial security and peace of mind.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts