Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

Montana is a beautiful state known for its stunning natural landscapes and outdoor adventures. However, accidents can happen even in the most picturesque places, and it is important to be prepared for the unexpected. One question many people have when it comes to protecting themselves on the road is whether personal injury protection (PIP) is required in Montana.

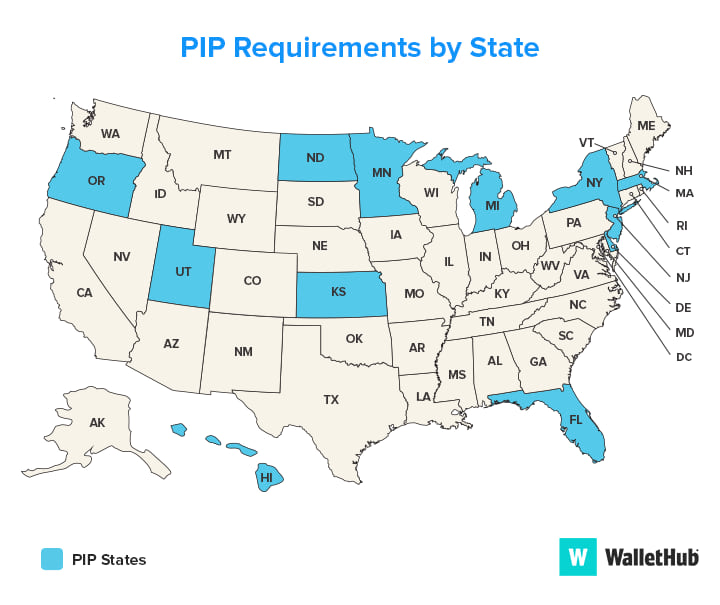

PIP is a type of car insurance that covers medical expenses and other related costs if you are injured in an accident. While some states require drivers to have PIP coverage, Montana does not have a mandatory requirement. However, it is still a good idea to consider adding PIP to your car insurance policy to ensure you have adequate protection in case of an accident.

Yes, Personal Injury Protection (PIP) is required in Montana. All drivers in Montana are required to carry PIP insurance coverage as part of their auto insurance policy. PIP covers medical expenses, lost wages, and other related expenses in case of an accident, regardless of who is at fault. The minimum PIP coverage required in Montana is $25,000 per person, per accident.

Is Personal Injury Protection Required in Montana?

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that provides medical expenses and lost wages to drivers and passengers who are injured in a car accident. PIP is also known as no-fault insurance because it covers the insured regardless of who is at fault for the accident.

In Montana, PIP is not required by law. However, it is an option that drivers can choose to add to their auto insurance policy.

What Does PIP Cover?

PIP covers medical expenses, lost wages, and other related expenses that result from a car accident. Medical expenses may include hospital bills, doctor visits, and physical therapy. Lost wages may include time off work due to the injuries sustained in the accident.

In addition to medical expenses and lost wages, PIP may also cover other related expenses such as transportation costs to and from medical appointments, funeral expenses, and childcare expenses.

Benefits of PIP

One of the main benefits of PIP is that it provides coverage regardless of who is at fault for the accident. This means that even if you are responsible for the accident, you can still receive coverage for medical expenses and lost wages.

Another benefit of PIP is that it can help cover expenses that may not be covered by other types of car insurance, such as liability insurance or collision insurance. This can be especially helpful if you have high medical bills or lost wages due to an accident.

PIP vs. Liability Insurance

Liability insurance is another type of car insurance that is required by law in Montana. Unlike PIP, liability insurance covers damages and injuries that you may cause to other drivers or their property in an accident. It does not cover your own medical expenses or lost wages.

While liability insurance is important, it may not be enough to cover all of your expenses in the event of an accident. Adding PIP to your insurance policy can provide additional coverage for your own medical expenses and lost wages.

How Much PIP Coverage Should You Have?

If you choose to add PIP to your auto insurance policy, you will need to decide how much coverage you want. The amount of coverage you need will depend on your individual circumstances, such as your medical history and employment situation.

Some drivers may only need a small amount of PIP coverage, while others may need more comprehensive coverage. It is important to speak with your insurance agent to determine the amount of coverage that is right for you.

Conclusion

While PIP is not required by law in Montana, it can be a valuable addition to your auto insurance policy. PIP provides coverage for medical expenses and lost wages that result from a car accident, regardless of who is at fault. Adding PIP to your policy can provide additional peace of mind and financial protection in the event of an accident.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) insurance?

- What are the legal requirements for auto insurance in Montana?

- How does PIP insurance differ from medical payments coverage?

- What factors should I consider when choosing PIP coverage in Montana?

- What should I do if I am involved in a car accident in Montana?

- What is Personal Injury Protection (PIP)?

Frequently Asked Questions

Montana is one of the few states in the US that does not require Personal Injury Protection (PIP) insurance. However, it is important to understand the legal requirements and the benefits of having PIP coverage in Montana.

What is Personal Injury Protection (PIP) insurance?

Personal Injury Protection (PIP) insurance is a type of auto insurance that covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who was at fault. In Montana, PIP coverage is optional but highly recommended, as it can provide financial protection and peace of mind in case of an accident.

PIP insurance can cover a range of expenses, such as medical bills, rehabilitation costs, lost wages, and even funeral expenses. It can also provide benefits for household services and child care, which can be crucial if you are unable to perform daily tasks due to injuries sustained in an accident.

What are the legal requirements for auto insurance in Montana?

In Montana, drivers are required to carry liability insurance, which covers damages and injuries you may cause to others in an accident. The minimum liability coverage required by law is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 per accident for property damage.

While PIP insurance is not required in Montana, it can be a beneficial addition to your auto insurance policy. It is important to consult with an insurance agent to determine the best coverage options for your specific needs and budget.

How does PIP insurance differ from medical payments coverage?

Medical payments coverage, also known as MedPay, is another type of optional auto insurance coverage that can be added to your policy. Like PIP insurance, MedPay provides coverage for medical expenses incurred as a result of a car accident, regardless of who was at fault.

The main difference between PIP insurance and MedPay is that PIP coverage typically offers broader protection, including benefits for lost wages and other related expenses. MedPay coverage is typically limited to medical expenses only. However, MedPay coverage can be a more affordable option and may be sufficient for drivers who have health insurance that covers their medical expenses.

What factors should I consider when choosing PIP coverage in Montana?

When choosing PIP coverage in Montana, there are several factors to consider, such as your budget, driving habits, and personal circumstances. It is important to choose a coverage level that provides adequate protection for your needs, but also fits within your budget.

You should also consider your risk factors, such as the likelihood of being involved in an accident or the potential for injuries that could result in lost wages or long-term disability. It is important to work with an experienced insurance agent who can help you assess your risk factors and determine the best coverage options for your situation.

What should I do if I am involved in a car accident in Montana?

If you are involved in a car accident in Montana, it is important to seek medical attention immediately, even if you do not think you are injured. You should also contact your insurance provider as soon as possible to report the accident and begin the claims process.

If you have PIP coverage, your insurance provider can help you file a claim and provide guidance on how to receive benefits for medical expenses, lost wages, and other related expenses. It is important to keep all documentation and records related to the accident, including medical bills and police reports, to support your claim.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is not required in Montana, but it is highly recommended. PIP provides coverage for medical expenses, lost wages, and other related expenses in case of an accident. Without PIP, you could be left with significant financial burdens after an accident.

While Montana does not require PIP, it is important to consider your own personal circumstances and the potential risks you face. Accidents can happen at any time, and having PIP coverage can give you peace of mind and protect you and your family from the financial fallout of an accident.

Ultimately, the decision to purchase PIP coverage in Montana is up to you. However, it is always a good idea to consult with an insurance professional who can help you weigh the pros and cons and make an informed decision based on your individual needs and circumstances.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts