Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

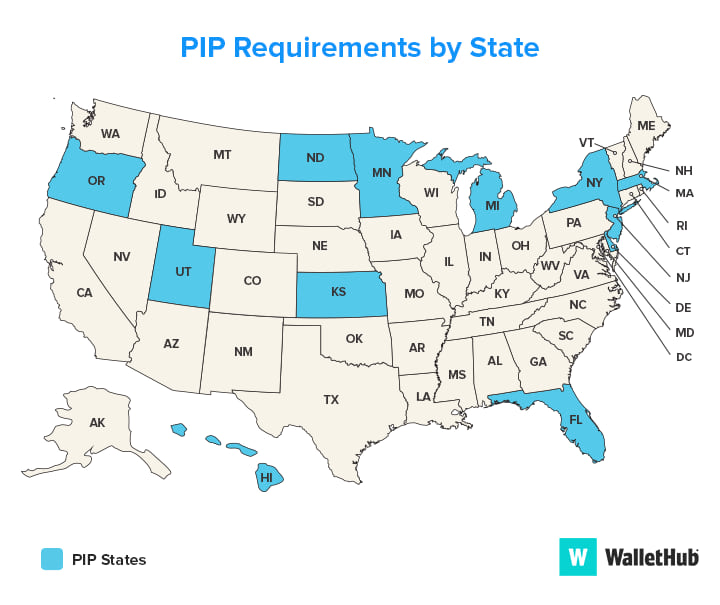

In New Mexico, driving without insurance is illegal. But what about personal injury protection (PIP)? Is it mandatory for drivers to have PIP coverage? This is an important question to consider, as PIP can provide crucial financial support in the event of an accident. Let’s take a closer look at PIP requirements in New Mexico and what they mean for drivers.

While PIP is not required by law in New Mexico, it is highly recommended. PIP can help cover medical expenses, lost wages, and other costs associated with an accident, regardless of who is at fault. Without PIP, these costs could fall solely on the injured party, potentially leading to financial hardship. So while PIP may not be mandatory, it’s certainly worth considering for drivers in New Mexico.

Yes, Personal Injury Protection (PIP) is required in New Mexico. Drivers must carry a minimum of $25,000 in PIP coverage per person, per accident. PIP coverage helps to pay for medical expenses, lost wages, and other related expenses after an accident, regardless of who was at fault.

Contents

- Is Personal Injury Protection Required in New Mexico?

- Frequently Asked Questions

- What is personal injury protection?

- Who is required to have personal injury protection in New Mexico?

- What does personal injury protection cover?

- How much personal injury protection do I need in New Mexico?

- How do I purchase personal injury protection in New Mexico?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in New Mexico?

If you are a driver in New Mexico, you may be wondering if personal injury protection (PIP) is required. PIP is an insurance coverage that pays for medical expenses and other related costs in the event of a car accident. In this article, we’ll explore whether PIP is mandatory in New Mexico and what it covers.

What is Personal Injury Protection?

Personal injury protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you are injured in a car accident. PIP covers you, your passengers, and anyone else who was involved in the accident, regardless of who was at fault.

Benefits of Personal Injury Protection

There are several benefits to having PIP coverage. First, it can help pay for medical expenses that may not be covered by your health insurance. PIP can also cover lost wages if you are unable to work due to your injuries. Additionally, PIP can provide funeral expenses if someone is killed in the accident.

Personal Injury Protection vs. Medical Payments Coverage

While PIP and medical payments coverage may seem similar, there are some key differences. Medical payments coverage only pays for medical expenses, while PIP covers a wider range of expenses, including lost wages and funeral expenses. Additionally, medical payments coverage typically has lower limits than PIP.

Is Personal Injury Protection Required in New Mexico?

Personal injury protection is not required in New Mexico, but it is an optional coverage that you can add to your car insurance policy. However, if you choose not to purchase PIP, you must sign a waiver indicating that you declined the coverage.

What PIP Covers in New Mexico

If you do choose to purchase PIP in New Mexico, it typically covers the following:

- Medical expenses

- Lost wages

- Funeral expenses

- Child care expenses

- Household services

How Much PIP Coverage Do You Need?

The amount of PIP coverage you need depends on your individual situation. If you have health insurance that covers medical expenses, you may not need as much PIP coverage. However, if you do not have health insurance or have a high deductible, you may want to consider purchasing more PIP coverage.

Conclusion

While personal injury protection is not required in New Mexico, it can be a valuable coverage to have in the event of a car accident. PIP can help pay for medical expenses, lost wages, and other related expenses, regardless of who was at fault. If you are considering adding PIP to your car insurance policy, be sure to speak with your insurance agent to determine the amount of coverage that is right for you.

Frequently Asked Questions

Here are some common questions about personal injury protection in New Mexico:

What is personal injury protection?

Personal injury protection, or PIP, is a type of auto insurance coverage that helps pay for medical expenses and other related costs if you’re injured in a car accident. It can also cover lost wages and other expenses, depending on your policy and the circumstances of the accident.

In New Mexico, PIP is optional, but some drivers may be required to carry it if they have certain types of insurance policies or if they’re involved in certain types of accidents.

Who is required to have personal injury protection in New Mexico?

In New Mexico, PIP is not required for all drivers. However, if you have a policy that includes uninsured/underinsured motorist coverage, you may be required to have PIP as well. This is known as “stacking” your coverage.

If you’re involved in an accident with an uninsured or underinsured driver, your PIP coverage can help cover your medical expenses and other costs that aren’t covered by the other driver’s insurance.

What does personal injury protection cover?

Personal injury protection can cover a variety of expenses related to a car accident, including medical bills, lost wages, and other related costs. However, the exact coverage you’ll receive depends on the terms of your policy.

Some PIP policies may have limits on how much they’ll pay out for each type of expense, while others may provide more comprehensive coverage. It’s important to carefully review the terms of your policy to understand what’s covered and how much coverage you have.

How much personal injury protection do I need in New Mexico?

In New Mexico, the minimum amount of PIP coverage you can have is $4,500 per person, per accident. However, you may choose to purchase additional coverage if you’re concerned about the potential costs of a serious accident.

It’s important to remember that PIP is just one type of insurance coverage you may need as a driver. Other types of coverage, such as liability insurance, can help protect you if you’re responsible for causing an accident.

How do I purchase personal injury protection in New Mexico?

If you’re interested in purchasing PIP coverage in New Mexico, you can do so through your auto insurance provider. Many insurance companies offer PIP as an optional add-on to your existing policy.

Be sure to shop around and compare prices and coverage options from different providers to find the policy that’s right for you.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is not required in New Mexico. However, it is highly recommended that drivers opt for this coverage to protect themselves and their passengers in case of an accident.

PIP can cover medical expenses, lost wages, and other related costs, regardless of who was at fault for the accident. Without PIP, drivers may have to rely solely on their health insurance or pay out of pocket for these expenses.

Being involved in an accident can be a traumatic experience, and PIP can provide some peace of mind during such a difficult time. While it may not be required by law, investing in PIP coverage can save drivers from financial stress and allow them to focus on their recovery.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts