Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

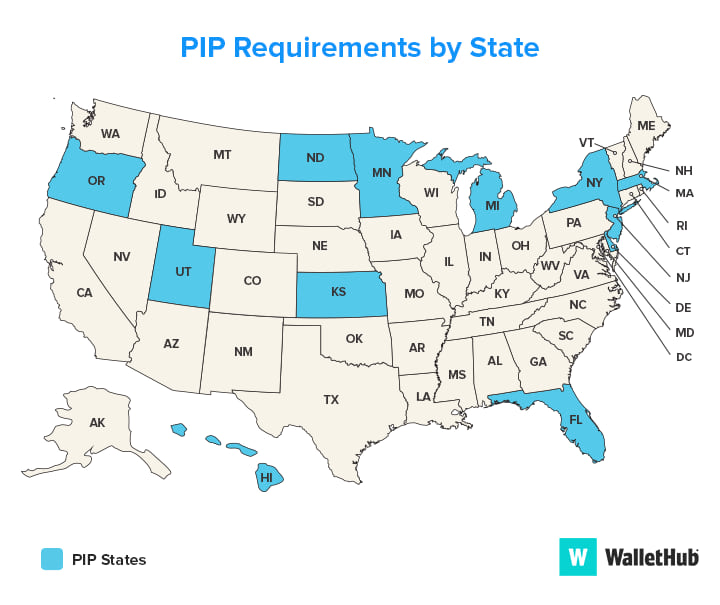

Personal injury protection (PIP) is a type of insurance coverage that pays for medical expenses and lost wages in case of an accident. If you are a resident of Oregon, you may be wondering whether PIP is required by law in the state. In this article, we will explore the answer to this question and provide you with all the information you need to know about PIP in Oregon.

Yes, Personal Injury Protection (PIP) is mandatory in Oregon. It covers medical expenses, lost wages, and other related costs for the driver, passengers, and pedestrians injured in a car accident, regardless of who’s at fault. The minimum PIP coverage required is $15,000 per person per accident. Failure to carry PIP insurance can result in fines, license suspension, and other penalties.

Contents

- Is Personal Injury Protection Required in Oregon?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) in Oregon?

- Who is covered by Personal Injury Protection in Oregon?

- What happens if I don’t have Personal Injury Protection in Oregon?

- Can I waive Personal Injury Protection in Oregon?

- Do I need Personal Injury Protection if I have health insurance?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in Oregon?

Personal Injury Protection (PIP) is a type of car insurance that provides coverage for medical expenses, lost wages, and other expenses resulting from a car accident, regardless of who was at fault. In Oregon, PIP is mandatory for all drivers. However, the minimum coverage requirements may vary based on the insurance company.

What is Personal Injury Protection?

Personal Injury Protection, also known as no-fault insurance, is designed to cover medical expenses and lost wages for you and your passengers in the event of a car accident. PIP covers medical expenses such as hospital bills, doctor visits, and rehabilitation costs. It can also cover lost wages if you are unable to work as a result of your injuries. Additionally, PIP can cover expenses related to household services, such as childcare or cleaning, that you are unable to perform due to your injuries.

Personal Injury Protection can be an important form of insurance coverage for drivers in Oregon, as it provides help in covering unexpected medical expenses and lost wages that may result from a car accident. It is important to consider your individual needs and budget when selecting PIP coverage amounts.

What are the Benefits of Personal Injury Protection?

Personal Injury Protection provides several benefits for drivers involved in car accidents. Here are some of the key benefits:

- No-fault coverage: PIP provides coverage regardless of who was at fault for the accident.

- Medical expense coverage: PIP covers medical expenses related to the accident, including hospital bills, doctor visits, and rehabilitation costs.

- Lost wage coverage: PIP can cover lost wages if you are unable to work as a result of your injuries.

- Household service coverage: PIP can cover expenses related to household services, such as childcare or cleaning, that you are unable to perform due to your injuries.

- Peace of mind: PIP can provide peace of mind knowing that unexpected medical expenses and lost wages are covered in the event of a car accident.

PIP Coverage Requirements in Oregon

In Oregon, PIP is mandatory for all drivers. The minimum coverage requirements vary based on the insurance company, but typically include:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Medical expenses | $15,000 per person, per accident |

| Lost wages | $3,000 per month, for up to 52 weeks |

| Household services | $30 per day, for up to 52 weeks |

It is important to note that these are the minimum coverage amounts, and drivers may choose to purchase additional coverage to meet their individual needs.

PIP vs. Bodily Injury Liability Coverage

While PIP provides coverage for medical expenses and lost wages, Bodily Injury Liability (BIL) coverage provides protection for expenses related to injuries or death of others in an accident. BIL coverage is not required in Oregon, but it is recommended. Here are some key differences between PIP and BIL coverage:

- Coverage: PIP covers medical expenses and lost wages for you and your passengers, while BIL covers expenses related to injuries or death of others in an accident.

- Required coverage: PIP is required in Oregon, while BIL is not.

- Cost: PIP typically costs less than BIL coverage.

- Limitations: PIP has limitations on coverage amounts, while BIL coverage may have higher limits.

Conclusion

Personal Injury Protection is mandatory for all drivers in Oregon, and provides important coverage for medical expenses and lost wages in the event of a car accident. While PIP coverage requirements vary based on the insurance company, it is important to consider your individual needs and budget when selecting coverage amounts. Additionally, drivers may choose to purchase Bodily Injury Liability coverage for additional protection in the event of an accident.

Frequently Asked Questions

Personal Injury Protection is a type of car insurance that covers medical expenses and lost wages in case of an accident. It is mandatory in some states, but is it required in Oregon? Here are some commonly asked questions about Personal Injury Protection in Oregon.

What is Personal Injury Protection (PIP) in Oregon?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in case of an accident. In Oregon, PIP is mandatory and every driver must have a minimum of $15,000 in coverage per person, per accident. PIP also covers expenses related to funeral costs, child care, and housekeeping if the injured person is unable to perform these tasks due to the accident.

PIP is a no-fault insurance, meaning that it is available regardless of who caused the accident. This ensures that injured parties receive prompt medical attention and compensation for their losses, regardless of the outcome of any legal proceedings.

Who is covered by Personal Injury Protection in Oregon?

Personal Injury Protection in Oregon covers the driver and all passengers in the insured vehicle, as well as pedestrians and cyclists who are involved in a car accident. PIP also covers passengers in other vehicles who do not have their own PIP coverage.

However, if you are driving a vehicle that you do not own, such as a rental car, you may not be covered by your own PIP insurance. In this case, you may need to purchase additional coverage from the rental car agency or rely on the PIP coverage of the rental car owner.

What happens if I don’t have Personal Injury Protection in Oregon?

If you do not have Personal Injury Protection in Oregon, you may be subject to fines and penalties. In addition, you will have to pay for your own medical expenses and lost wages if you are injured in a car accident, regardless of who caused the accident.

Furthermore, if you do not have PIP coverage and you are involved in an accident with a driver who is uninsured or underinsured, you may not be able to recover damages for your injuries and losses.

Can I waive Personal Injury Protection in Oregon?

No, you cannot waive Personal Injury Protection in Oregon. PIP is mandatory in the state and every driver must have a minimum of $15,000 in coverage per person, per accident.

However, you may be able to reduce your PIP coverage if you have health insurance that covers car accident injuries. In this case, you can coordinate your PIP coverage with your health insurance to avoid paying for duplicate coverage.

Do I need Personal Injury Protection if I have health insurance?

Yes, you still need Personal Injury Protection in Oregon even if you have health insurance. PIP covers expenses that are not covered by health insurance, such as lost wages, child care, and housekeeping. In addition, PIP is a no-fault insurance, meaning that it is available regardless of who caused the accident.

Having both PIP and health insurance can help ensure that you receive prompt medical attention and compensation for your losses in case of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is required in the state of Oregon. This means that all drivers are required to have a minimum of $15,000 in PIP coverage to help cover medical expenses and lost wages in the event of an accident.

While this may seem like an added expense, PIP coverage can provide crucial financial support in the aftermath of an accident. It can also help ease the burden of medical bills and other expenses, allowing you to focus on your recovery and getting back to your daily life.

Ultimately, it is important to remember that accidents can happen to anyone at any time. By having PIP coverage, you can help ensure that you are prepared for the unexpected and have the resources you need to get back on your feet. So if you’re a driver in Oregon, make sure you have the right coverage to protect yourself and your loved ones on the road.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts