Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

When it comes to protecting yourself and your vehicle in the event of an accident, it’s important to understand the difference between Personal Injury Protection (PIP) and Uninsured Motorist (UM) coverage. Both are important types of auto insurance that can help cover medical bills and lost wages, but understanding the distinctions between the two can help you make sure you have the right coverage for your needs. In this article, we’ll explore the differences between PIP and UM coverage and how each can help protect you in the event of an accident.

| Personal Injury Protection | Uninsured Motorist |

|---|---|

| PIP is a type of car insurance coverage that provides you with financial protection if you are injured in a car accident. | UM is a type of car insurance coverage that provides you with financial protection if you are injured in a car accident caused by an uninsured driver. |

| It covers medical expenses and lost wages, regardless of fault. | It covers medical expenses and lost wages, if the other driver is at fault and uninsured. |

| It is a mandatory coverage in some states. | It is a required coverage in most states. |

Chart Comparing: Personal Injury Protection Vs Uninsured Motorist

| Personal Injury Protection | Uninsured Motorist | |

|---|---|---|

| Purpose | A type of car insurance that covers medical expenses and lost wages for an insured individual, regardless of who is at fault in an accident. | A type of car insurance that covers costs of damage or injury to an insured individual that is caused by an uninsured driver. |

| Coverage | Personal Injury Protection covers medical expenses, lost wages, funeral costs, and in some cases, other losses such as childcare costs or services required for daily living. | Uninsured Motorist coverage may provide compensation for medical expenses, property damage, lost wages, and other losses. |

| Eligibility | Personal Injury Protection is available in most states, but is required in some states. | Uninsured Motorist coverage is required in some states. |

| Cost | Personal Injury Protection premiums vary by state and provider, but are typically more expensive than other types of car insurance. | Uninsured Motorist coverage is typically cheaper than other types of car insurance. |

Contents

Personal Injury Protection Vs Uninsured Motorist

Personal Injury Protection (PIP) and Uninsured Motorist (UM) insurance are both important types of coverage that can help protect you in the event of an accident. But what’s the difference between them? This article will explain the difference between PIP and UM coverage, and how they can help you stay protected.

What is Personal Injury Protection (PIP)?

Personal Injury Protection, or PIP, is a type of coverage that will pay for medical expenses and lost wages if you are injured in an accident. It is a form of no-fault insurance, meaning that it will cover your medical bills regardless of who was at fault in the accident. PIP is required in some states, and it can be added to your auto insurance policy if it’s not required by law.

PIP coverage pays for medical expenses, lost wages, and other costs related to the accident. It can also cover the cost of transportation to medical appointments, funeral expenses, and even childcare costs in some cases. It is important to note that PIP coverage does not cover property damage, so you will need to purchase separate coverage for that.

PIP coverage is generally quite affordable, and it can provide an important layer of protection in the event of an accident. It is important to understand the limits of your PIP coverage, so you can make sure you have enough coverage to protect yourself.

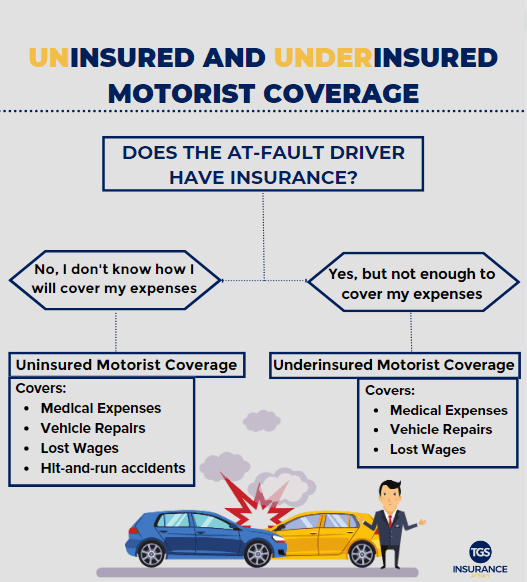

What is Uninsured Motorist Coverage (UM)?

Uninsured Motorist coverage, or UM coverage, is a type of insurance that covers you in the event of an accident with an uninsured driver. If you are injured in an accident with an uninsured driver, UM coverage will pay for medical expenses and lost wages. It is important to note that UM coverage does not cover property damage, so you will need to purchase separate coverage for that.

UM coverage is important because it can provide an important layer of protection in the event of an accident. It is important to understand the limits of your UM coverage, so you can make sure you have enough coverage to protect yourself.

In some states, UM coverage is required by law, and it can be added to your auto insurance policy if it’s not required. UM coverage is generally quite affordable, and it can provide an important layer of protection in the event of an accident.

Personal Injury Protection vs Uninsured Motorist Coverage

Personal Injury Protection (PIP) and Uninsured Motorist (UM) coverage are both important types of coverage that can help protect you in the event of an accident. However, there are some important differences between the two. PIP coverage is a form of no-fault insurance, meaning that it will cover your medical bills regardless of who was at fault in the accident. UM coverage, on the other hand, will cover you in the event of an accident with an uninsured driver. It is important to note that neither PIP nor UM coverage cover property damage, so you will need to purchase separate coverage for that.

PIP and UM coverage are both generally quite affordable, and they can provide an important layer of protection in the event of an accident. It is important to understand the limits of your coverage, so you can make sure you have enough coverage to protect yourself.

Ultimately, both PIP and UM coverage are important types of coverage that can help protect you in the event of an accident. It is important to understand the differences between the two, and make sure you have enough coverage to protect yourself.

How to Choose the Right Coverage

Choosing the right coverage for you will depend on your individual needs and budget. PIP and UM coverage are both important types of coverage, and they can provide an important layer of protection in the event of an accident. It is important to understand the differences between the two, and make sure you have enough coverage to protect yourself.

It is also important to understand the limits of your coverage, so you can make sure you have enough coverage to protect yourself. You should also consider other types of coverage, such as liability coverage, to ensure you are fully covered in the event of an accident.

Choosing the right coverage can be a difficult task, but it is an important one. Be sure to do your research, and talk to an insurance agent to make sure you are getting the right coverage for you.

The Benefits of Having Insurance

Having insurance can provide peace of mind in the event of an accident. It can provide financial protection in the event of an accident, and help cover medical costs, lost wages, and other expenses. Having insurance can also help protect you from lawsuits, and can help cover the costs of repairs to your car if it is damaged in an accident.

Having insurance is an important part of owning a car, and it can provide an important layer of protection in the event of an accident. It is important to understand the different types of coverage, and make sure you have enough coverage to protect yourself.

Ultimately, having insurance can provide peace of mind in the event of an accident. Be sure to do your research, and talk to an insurance agent to make sure you are getting the right coverage for you.

Personal Injury Protection Vs Uninsured Motorist Pros & Cons

Pros of Personal Injury Protection

- Pay for medical expenses and lost wages

- Helps cover medical bills of both drivers and passengers

- It is more comprehensive than Uninsured Motorist Coverage

Cons of Personal Injury Protection

- It does not cover property damage

- If an accident involves a hit-and-run driver, PIP will not cover the costs

- It can be expensive to maintain

Pros of Uninsured Motorist Coverage

- Covers medical expenses and lost wages

- Protection in the event of a hit-and-run

- Cheaper than Personal Injury Protection

Cons of Uninsured Motorist Coverage

- It does not cover property damage

- It is not as comprehensive as Personal Injury Protection

- It may not cover all medical expenses

Personal Injury Protection vs Uninsured Motorist

When it comes to choosing between Personal Injury Protection (PIP) and Uninsured Motorist (UM) insurance coverage, the decision is ultimately up to the insured individual. While both types of coverage provide important protection and financial assistance in the event of a car accident, they differ in the types of expenses they cover and the conditions under which they are provided.

PIP coverage typically covers medical expenses, lost wages, and even funeral costs in the event of an accident. It may also provide coverage for other related costs, such as property damage and liability. In addition, this type of coverage is typically available regardless of who is at fault in the accident. On the other hand, UM coverage typically provides protection for injuries and property damage caused by an uninsured driver, or one who does not have the appropriate level of insurance coverage.

When deciding between PIP and UM coverage, it is important to consider the risks involved in each type of coverage. PIP coverage may provide a more comprehensive level of protection, but it may also be more expensive. UM coverage is typically less expensive, but it may also provide less coverage. Ultimately, the insured individual must decide which type of coverage best suits their needs and budget.

In conclusion, Personal Injury Protection and Uninsured Motorist coverage both provide important protection and financial assistance in the event of an accident. While each type of coverage has its own set of risks and costs, the decision is ultimately up to the insured individual. The following are three reasons why PIP coverage may be the better choice for an insured individual:

- PIP coverage provides a more comprehensive level of protection than UM coverage.

- PIP coverage is typically available regardless of who is at fault in the accident.

- PIP coverage is typically more affordable than UM coverage.

Frequently Asked Questions

Personal Injury Protection (PIP) and Uninsured Motorist (UM) are two types of insurance coverage that help cover medical expenses, lost wages, and other damages related to an automobile crash. PIP is a form of “no-fault” insurance that covers you and your passengers in the event of an accident regardless of who is at fault. Uninsured Motorist coverage provides coverage if you are injured by a driver who does not have insurance or whose insurance limits are insufficient to cover the costs of your damages.

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that helps cover medical expenses, lost wages, and other damages related to an automobile accident. PIP is a form of “no-fault” insurance, which means that it will cover you and your passengers regardless of who is at fault in the accident. PIP is often required in certain states, and can help cover medical bills, lost wages, and other costs associated with an automobile accident.

What is Uninsured Motorist (UM) coverage?

Uninsured Motorist (UM) coverage is a type of insurance coverage that provides protection if you are injured in an automobile accident caused by a driver who does not have insurance, or whose insurance limits are insufficient to cover the costs of your damages. UM coverage will typically cover medical bills, lost wages, and other costs associated with the accident. UM coverage is not required in all states, but it can be a valuable form of protection if you are injured by a driver who does not have adequate insurance.

What is the difference between PIP and UM coverage?

The main difference between PIP and UM coverage is that PIP is a form of “no-fault” insurance, which means it will cover you and your passengers regardless of who is at fault in the accident. On the other hand, UM coverage is a form of insurance that provides protection if you are injured by a driver who does not have insurance, or whose insurance limits are insufficient to cover the costs of your damages.

Do I need both PIP and UM coverage?

PIP coverage is often required in certain states, so if you live in a state that requires PIP coverage, then you will need to purchase it. UM coverage is not required in all states, but it can be a valuable form of protection if you are injured by a driver who does not have adequate insurance. It is important to check with your insurance company to determine what type of coverage is required in your state and what type of coverage is best for you.

What if I have both PIP and UM coverage?

If you have both PIP and UM coverage, then the two policies will work together. PIP coverage will cover your medical bills and lost wages regardless of who is at fault in the accident. However, if the at-fault driver has insufficient insurance coverage, then your UM coverage will kick in to help cover any additional costs. It is important to understand the details of your coverage and how it works with other forms of coverage to ensure you have the protection you need in the event of an accident.

When it comes to personal injury protection and uninsured motorist coverage, the best option for you will depend on the particular risks you are trying to protect yourself against. Personal injury protection can provide financial protection from medical costs in the event of an accident, while uninsured motorist coverage can help to cover damages if you are involved in an accident with an uninsured driver. Ultimately, it is important to do your research and to evaluate your individual needs in order to make the most informed decision.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts