Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website...Read more

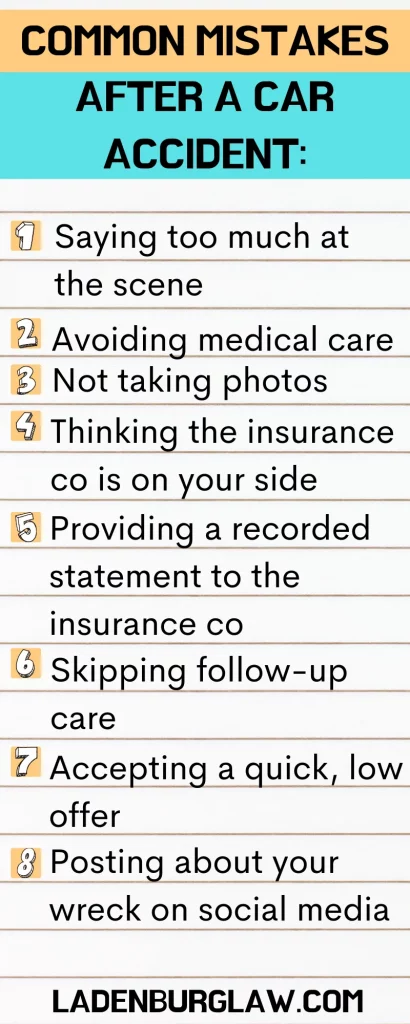

Car accidents are a common occurrence on the roads today, and many drivers find themselves in the unfortunate position of having to deal with insurance companies afterwards. However, navigating the insurance claims process can be a daunting task, especially if you are not familiar with the procedures involved. In this article, we will highlight the top eight mistakes to avoid when dealing with insurance companies after a car accident.

From failing to report the accident promptly to accepting a low settlement offer, there are various pitfalls that can derail your insurance claim. By understanding these mistakes and taking steps to avoid them, you can increase your chances of receiving fair compensation for your losses. So, let’s dive in and explore the top eight mistakes to steer clear of when dealing with insurance companies after a car accident.

Avoid these common mistakes when dealing with insurance companies after a car accident: not reporting the accident immediately, admitting fault, accepting the first settlement offer, not gathering enough evidence, not seeking medical attention, not keeping detailed records, not reviewing insurance policies, and not consulting with a personal injury attorney.

Contents

- Top 8 Mistakes to Avoid When Dealing with Insurance Companies After a Car Accident

- Frequently Asked Questions

- What is the first step to take after being involved in a car accident?

- What should I avoid doing when talking to insurance adjusters?

- Should I accept the insurance company’s first settlement offer?

- What should I do if the insurance company denies my claim?

- How long does the insurance claims process take?

Top 8 Mistakes to Avoid When Dealing with Insurance Companies After a Car Accident

Car accidents can be a traumatic experience, and dealing with insurance companies afterwards can be equally stressful. Insurance companies are in the business of minimizing their payouts, so it is important to be careful about how you communicate with them. Here are the top eight mistakes to avoid when dealing with insurance companies after a car accident.

1. Admitting Fault

One of the biggest mistakes you can make when dealing with an insurance company is admitting fault. Even if you think you may have been at fault, it is important to avoid saying so until all the facts have been gathered. Anything you say to an insurance adjuster can be used against you, so it is best to let them determine fault through their investigation.

2. Not Reporting the Accident Right Away

Another common mistake is not reporting the accident to your insurance company right away. Some people try to handle things on their own and only involve their insurance company if the other party files a claim. However, it is important to report the accident to your insurance company as soon as possible, even if you don’t think you will file a claim. Failing to report the accident right away could result in your claim being denied.

3. Not Collecting Evidence

When you are involved in a car accident, it is important to collect evidence to support your claim. This includes taking photos of the damage to your car, getting the contact information of any witnesses, and obtaining a copy of the police report. Failing to collect evidence could make it difficult to prove your case.

4. Providing Too Much Information

While it is important to be honest with your insurance company, providing too much information could hurt your case. Stick to the facts and avoid speculating about what could have caused the accident. Anything you say could be used against you, so it is best to keep things simple and straightforward.

5. Accepting the First Settlement Offer

Insurance companies often offer a low settlement amount to start with, hoping that you will accept it without question. It is important to remember that the first offer is usually not the best offer. Take the time to negotiate and make sure you are getting a fair settlement.

6. Not Consulting with an Attorney

If you are unsure about how to handle your car accident case, it is important to consult with an attorney. An experienced attorney can help you navigate the complexities of dealing with insurance companies and ensure that you are getting the best possible outcome.

7. Signing a Release Too Soon

Insurance companies may ask you to sign a release in exchange for a settlement offer. It is important to read the release carefully and make sure you understand what you are signing. Once you sign a release, you give up your right to pursue further damages related to the accident.

8. Not Following Your Doctor’s Orders

If you are injured in a car accident, it is important to follow your doctor’s orders. Failing to do so could hurt your case and make it difficult to prove your injuries. It is also important to keep track of all your medical expenses and document any missed time from work.

In conclusion, dealing with insurance companies after a car accident can be challenging. However, by avoiding these common mistakes, you can ensure that you are getting the best possible outcome for your case. Remember to be honest, collect evidence, and consult with an attorney if you are unsure about how to proceed.

Frequently Asked Questions

What is the first step to take after being involved in a car accident?

The first step to take after being involved in a car accident is to call the police. Even if there are no injuries, it’s important to have a police report filed. This report will be important when dealing with insurance companies.

After calling the police, exchange information with the other driver, including insurance information. Take pictures of the accident scene and any damage to vehicles. This evidence will also be important when dealing with insurance companies.

What should I avoid doing when talking to insurance adjusters?

When talking to insurance adjusters, it’s important to avoid admitting fault. Even if you think you may be partially at fault, do not admit fault. Let the insurance companies and police determine fault based on the evidence.

Additionally, avoid giving a recorded statement without first consulting with a personal injury attorney. Insurance adjusters may try to use your statement against you later on in the claims process.

Should I accept the insurance company’s first settlement offer?

You should never accept the insurance company’s first settlement offer without consulting with a personal injury attorney. Insurance companies will often try to settle for less than what you deserve. A personal injury attorney can help you negotiate a fair settlement that covers all of your damages.

Remember, once you accept a settlement offer, you cannot go back and ask for more money. It’s important to make sure the settlement offer is fair and covers all of your damages before accepting.

What should I do if the insurance company denies my claim?

If the insurance company denies your claim, you may need to file a lawsuit to recover damages. Contact a personal injury attorney to discuss your options. Your attorney can help you file a lawsuit and represent you in court if necessary.

Keep in mind that insurance companies may deny claims for a variety of reasons. Your attorney can help you understand the reason for the denial and determine if you have a strong case for a lawsuit.

How long does the insurance claims process take?

The length of the insurance claims process can vary depending on the complexity of the case. Simple cases may be resolved within a few weeks, while more complex cases may take months or even years to resolve.

It’s important to be patient during the claims process and to work closely with your personal injury attorney. Your attorney can help you understand the timeline and keep you updated on any developments in your case.

In conclusion, dealing with insurance companies after a car accident can be a daunting task. However, by avoiding these top eight mistakes, you can increase your chances of getting the compensation you deserve.

Firstly, it’s essential to avoid admitting fault or apologizing for the accident. Secondly, don’t give a recorded statement without legal representation. Lastly, don’t accept a settlement offer without consulting with an attorney.

Remember, insurance companies have their best interests in mind, not yours. It’s crucial to protect yourself by being aware of these mistakes and avoiding them at all costs. By doing so, you can ensure that you receive the compensation you deserve for your injuries, damages, and losses.

Clifford Ector is the innovative force behind ClaimSettlementSpecialists. With a background in Law, his experience and legal acumen have been instrumental in bringing the website to life. Clifford recognized the complexities claimants faced and launched this platform to make the claim settlement process simpler, accessible, and more transparent for everyone. His leadership, expertise, and dedication have made ClaimSettlementSpecialists today’s trusted guide.

More Posts